Escrow crowdfunding involves pooling funds from multiple investors into a secure, third-party account to finance real estate projects, ensuring transparency and protection for all parties. Commercial property management focuses on the operational oversight, leasing, maintenance, and tenant relations of income-generating properties. Discover how each strategy can impact your real estate investment portfolio by exploring their key differences and benefits.

Why it is important

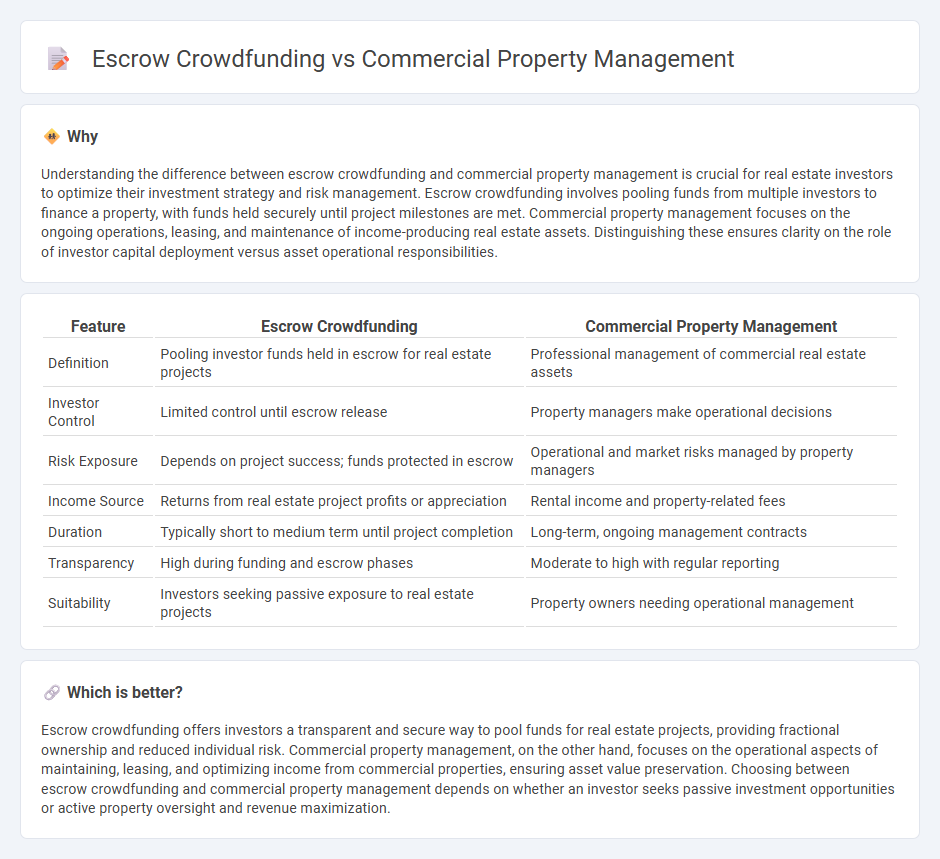

Understanding the difference between escrow crowdfunding and commercial property management is crucial for real estate investors to optimize their investment strategy and risk management. Escrow crowdfunding involves pooling funds from multiple investors to finance a property, with funds held securely until project milestones are met. Commercial property management focuses on the ongoing operations, leasing, and maintenance of income-producing real estate assets. Distinguishing these ensures clarity on the role of investor capital deployment versus asset operational responsibilities.

Comparison Table

| Feature | Escrow Crowdfunding | Commercial Property Management |

|---|---|---|

| Definition | Pooling investor funds held in escrow for real estate projects | Professional management of commercial real estate assets |

| Investor Control | Limited control until escrow release | Property managers make operational decisions |

| Risk Exposure | Depends on project success; funds protected in escrow | Operational and market risks managed by property managers |

| Income Source | Returns from real estate project profits or appreciation | Rental income and property-related fees |

| Duration | Typically short to medium term until project completion | Long-term, ongoing management contracts |

| Transparency | High during funding and escrow phases | Moderate to high with regular reporting |

| Suitability | Investors seeking passive exposure to real estate projects | Property owners needing operational management |

Which is better?

Escrow crowdfunding offers investors a transparent and secure way to pool funds for real estate projects, providing fractional ownership and reduced individual risk. Commercial property management, on the other hand, focuses on the operational aspects of maintaining, leasing, and optimizing income from commercial properties, ensuring asset value preservation. Choosing between escrow crowdfunding and commercial property management depends on whether an investor seeks passive investment opportunities or active property oversight and revenue maximization.

Connection

Escrow crowdfunding streamlines the investment process in commercial real estate by securely holding funds until project milestones are met, ensuring transparency and trust among investors and property managers. Commercial property management relies on escrow funds to handle maintenance, tenant improvements, and operational expenses efficiently, safeguarding both investor and stakeholder interests. This integration enhances capital flow management and improves overall project accountability in real estate ventures.

Key Terms

**Commercial Property Management:**

Commercial property management involves overseeing day-to-day operations, tenant relations, and maintenance of commercial real estate assets to maximize return on investment. Key responsibilities include lease administration, rent collection, property inspections, and coordinating repairs or improvements. Explore how professional management enhances asset value and investor confidence in commercial properties.

Lease Administration

Lease administration in commercial property management involves tracking lease terms, rent payments, and tenant obligations to ensure compliance and optimize asset value. In escrow crowdfunding, lease administration is less direct, focusing instead on safeguarding investor funds until property acquisition or development milestones are met. Explore the differences in lease administration approaches to enhance your investment strategy.

Maintenance Operations

Commercial property management involves overseeing maintenance operations to ensure tenant satisfaction, efficient facility functioning, and regulatory compliance through scheduled inspections and prompt repairs. Escrow crowdfunding platforms typically do not manage physical property maintenance, as their focus lies in pooling investor funds and securing transactions through escrow accounts rather than hands-on property upkeep. Explore how each approach impacts maintenance strategies and operational responsibilities in the real estate investment sector.

Source and External Links

What is Commercial Property Management? - Commercial property management involves the administration, operation, and oversight of properties like office buildings and retail spaces, focusing on maximizing value and profitability.

What Does a Commercial Property Manager Do in California? - Commercial property managers in California handle tasks such as maintenance planning, tenant relations, and lease management, navigating strict environmental and regulatory standards.

Northern California Commercial Property Management - Capital Rivers provides comprehensive property management services, including maintenance, tenant communications, and financial management, specializing in retail, office, and industrial properties.

dowidth.com

dowidth.com