Real estate crowdfunding enables individual investors to pool funds online for property investments with lower capital requirements, while real estate syndication involves a group of investors combining resources under a syndicator who manages the investment and operations. Crowdfunding platforms often provide more accessibility and liquidity, whereas syndications typically require higher minimum investments and offer a more hands-on management approach. Explore our detailed comparison to understand which real estate investment strategy best suits your financial goals.

Why it is important

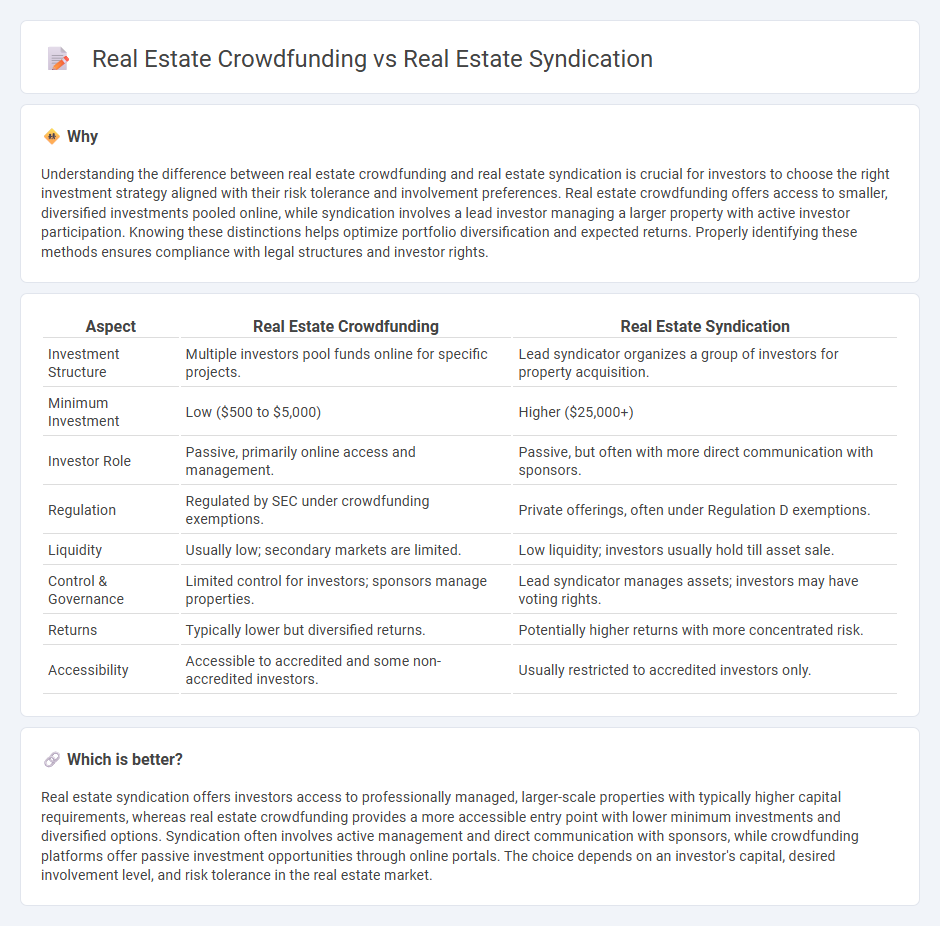

Understanding the difference between real estate crowdfunding and real estate syndication is crucial for investors to choose the right investment strategy aligned with their risk tolerance and involvement preferences. Real estate crowdfunding offers access to smaller, diversified investments pooled online, while syndication involves a lead investor managing a larger property with active investor participation. Knowing these distinctions helps optimize portfolio diversification and expected returns. Properly identifying these methods ensures compliance with legal structures and investor rights.

Comparison Table

| Aspect | Real Estate Crowdfunding | Real Estate Syndication |

|---|---|---|

| Investment Structure | Multiple investors pool funds online for specific projects. | Lead syndicator organizes a group of investors for property acquisition. |

| Minimum Investment | Low ($500 to $5,000) | Higher ($25,000+) |

| Investor Role | Passive, primarily online access and management. | Passive, but often with more direct communication with sponsors. |

| Regulation | Regulated by SEC under crowdfunding exemptions. | Private offerings, often under Regulation D exemptions. |

| Liquidity | Usually low; secondary markets are limited. | Low liquidity; investors usually hold till asset sale. |

| Control & Governance | Limited control for investors; sponsors manage properties. | Lead syndicator manages assets; investors may have voting rights. |

| Returns | Typically lower but diversified returns. | Potentially higher returns with more concentrated risk. |

| Accessibility | Accessible to accredited and some non-accredited investors. | Usually restricted to accredited investors only. |

Which is better?

Real estate syndication offers investors access to professionally managed, larger-scale properties with typically higher capital requirements, whereas real estate crowdfunding provides a more accessible entry point with lower minimum investments and diversified options. Syndication often involves active management and direct communication with sponsors, while crowdfunding platforms offer passive investment opportunities through online portals. The choice depends on an investor's capital, desired involvement level, and risk tolerance in the real estate market.

Connection

Real estate crowdfunding and real estate syndication both enable multiple investors to pool resources for property acquisition, increasing access to larger real estate deals. Crowdfunding platforms utilize online technology to gather small investments from numerous individuals, while syndication typically involves a group of accredited investors led by a syndicator or sponsor managing the investment. These collaborative investment models democratize real estate ownership by reducing individual capital requirements and sharing risks and returns among participants.

Key Terms

Ownership Structure

Real estate syndication typically involves a group of investors pooling capital to purchase properties, with a clear ownership structure often defined by general and limited partners, where general partners manage the property and limited partners provide funding. In contrast, real estate crowdfunding allows multiple investors to participate through an online platform, often receiving fractional shares without active management roles, which simplifies ownership but may dilute control. Explore the nuances of these ownership structures to determine which investment model aligns with your goals.

Capital Raising Method

Real estate syndication raises capital through private partnerships where a syndicator pools funds from a limited number of accredited investors to acquire large properties. Real estate crowdfunding leverages online platforms to attract numerous small investors, often including non-accredited individuals, enabling diversified investment in real estate projects. Explore how these capital raising methods impact investor accessibility and deal structure.

Investor Involvement

Real estate syndication typically involves a smaller group of accredited investors who actively contribute to decision-making and management, while real estate crowdfunding opens access to a larger pool of investors with minimal involvement, often limited to funding and passive oversight. Syndication offers higher control and potential influence on property operations, whereas crowdfunding prioritizes ease of investment and diversification with lower commitment. Explore further to understand which investor involvement model aligns best with your financial goals.

Source and External Links

Real Estate Syndicates and Investment Trusts - This document discusses real estate syndication as a method of pooling capital for real estate investments, often facilitated by real estate licensees.

Introduction to Real Estate Syndication - This guide introduces real estate syndication as a vehicle for pooling investor capital to purchase, rehabilitate, own, operate, and sell properties.

Real Estate Syndication - This article explains real estate syndication as a form of crowdfunding for residential or commercial real estate investments, involving sponsors and limited partner investors.

dowidth.com

dowidth.com