Build to rent developments offer purpose-built residential properties designed for long-term leasing, providing modern amenities and professional management. Buy to let involves purchasing existing properties to rent out, typically requiring more individual landlord oversight and maintenance. Explore the differences to determine the best investment strategy for your real estate goals.

Why it is important

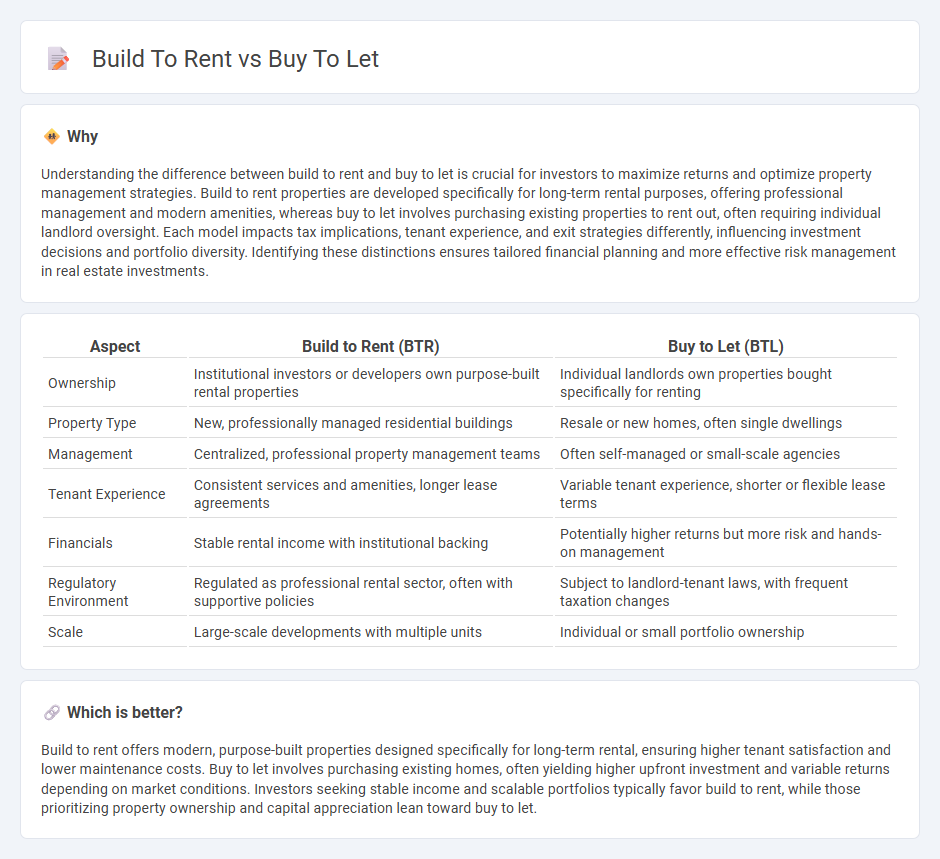

Understanding the difference between build to rent and buy to let is crucial for investors to maximize returns and optimize property management strategies. Build to rent properties are developed specifically for long-term rental purposes, offering professional management and modern amenities, whereas buy to let involves purchasing existing properties to rent out, often requiring individual landlord oversight. Each model impacts tax implications, tenant experience, and exit strategies differently, influencing investment decisions and portfolio diversity. Identifying these distinctions ensures tailored financial planning and more effective risk management in real estate investments.

Comparison Table

| Aspect | Build to Rent (BTR) | Buy to Let (BTL) |

|---|---|---|

| Ownership | Institutional investors or developers own purpose-built rental properties | Individual landlords own properties bought specifically for renting |

| Property Type | New, professionally managed residential buildings | Resale or new homes, often single dwellings |

| Management | Centralized, professional property management teams | Often self-managed or small-scale agencies |

| Tenant Experience | Consistent services and amenities, longer lease agreements | Variable tenant experience, shorter or flexible lease terms |

| Financials | Stable rental income with institutional backing | Potentially higher returns but more risk and hands-on management |

| Regulatory Environment | Regulated as professional rental sector, often with supportive policies | Subject to landlord-tenant laws, with frequent taxation changes |

| Scale | Large-scale developments with multiple units | Individual or small portfolio ownership |

Which is better?

Build to rent offers modern, purpose-built properties designed specifically for long-term rental, ensuring higher tenant satisfaction and lower maintenance costs. Buy to let involves purchasing existing homes, often yielding higher upfront investment and variable returns depending on market conditions. Investors seeking stable income and scalable portfolios typically favor build to rent, while those prioritizing property ownership and capital appreciation lean toward buy to let.

Connection

Build to rent and buy to let both focus on generating rental income from residential properties, but build to rent involves purpose-built developments designed exclusively for rental purposes, while buy to let typically refers to purchasing existing properties to lease out. Investors in build to rent benefit from economies of scale and professional management, enhancing tenant experience and long-term asset value. Both strategies address rental housing demand, yet build to rent offers more predictable returns due to modern infrastructures and built-in amenities.

Key Terms

Ownership Structure

Buy to let properties typically involve individual or small-scale investors owning single units, enabling direct control and income from rental yields, whereas build to rent schemes often feature institutional ownership with large-scale portfolios managed professionally to optimize tenant experience and operational efficiency. Ownership structures in build to rent commonly use special purpose vehicles (SPVs) or real estate investment trusts (REITs), providing tax advantages and facilitating large capital deployment. Explore the advantages of each model's ownership structure to determine the best investment strategy for your goals.

Rental Yield

Rental yield is a key metric in Buy to Let (BTL) and Build to Rent (BTR) investments, with BTR often offering higher yields due to purpose-built properties and professional management attracting stable tenant demand. BTL properties may provide diverse portfolio options but can face higher maintenance costs and variable tenant turnover impacting yields. Explore detailed comparisons of rental yields to make informed investment decisions.

Management Responsibility

Buy-to-let properties typically require landlords to manage tenant relations, maintenance requests, and rent collection, often leading to significant time and resource commitments. Build-to-rent developments are professionally managed by dedicated property management teams, ensuring streamlined operations and enhanced tenant satisfaction. Explore the key differences in management responsibility to choose the best investment strategy for your goals.

Source and External Links

What is a buy to let mortgage? - Lloyds Bank - A Buy to Let mortgage is a loan to buy a property intended to be rented out rather than lived in, usually requiring a larger deposit (20-40%) and often structured as interest-only, with repayments covered by rental income.

Buy to Let Mortgages | Find our best rates - NatWest - Buy to Let mortgages are designed for purchasing or remortgaging rental properties, usually needing a bigger deposit and higher interest rates than residential mortgages due to increased risk.

Buy-to-let explained: how to become a landlord - Zoopla - Buy-to-let involves buying property to rent to tenants, generating rental income to cover mortgage payments; these mortgages require at least 25% deposit and lending decisions are based on projected rental yields.

dowidth.com

dowidth.com