Tokenized real estate enables fractional ownership of properties through blockchain technology, allowing investors to buy and trade digital shares with increased liquidity and lower entry costs compared to traditional direct property ownership. Direct property ownership involves full control and responsibility over a physical asset, including maintenance, taxes, and tenant management, but offers tangible asset security and potential long-term appreciation. Explore the advantages and challenges of both models to determine the best investment strategy for your portfolio.

Why it is important

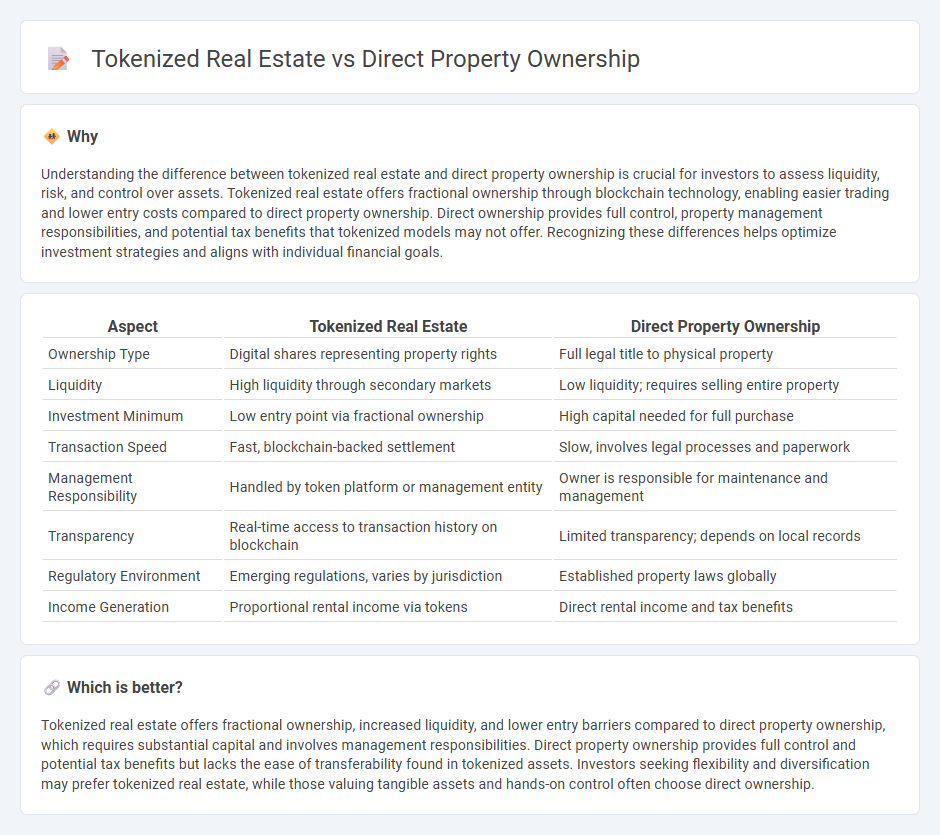

Understanding the difference between tokenized real estate and direct property ownership is crucial for investors to assess liquidity, risk, and control over assets. Tokenized real estate offers fractional ownership through blockchain technology, enabling easier trading and lower entry costs compared to direct property ownership. Direct ownership provides full control, property management responsibilities, and potential tax benefits that tokenized models may not offer. Recognizing these differences helps optimize investment strategies and aligns with individual financial goals.

Comparison Table

| Aspect | Tokenized Real Estate | Direct Property Ownership |

|---|---|---|

| Ownership Type | Digital shares representing property rights | Full legal title to physical property |

| Liquidity | High liquidity through secondary markets | Low liquidity; requires selling entire property |

| Investment Minimum | Low entry point via fractional ownership | High capital needed for full purchase |

| Transaction Speed | Fast, blockchain-backed settlement | Slow, involves legal processes and paperwork |

| Management Responsibility | Handled by token platform or management entity | Owner is responsible for maintenance and management |

| Transparency | Real-time access to transaction history on blockchain | Limited transparency; depends on local records |

| Regulatory Environment | Emerging regulations, varies by jurisdiction | Established property laws globally |

| Income Generation | Proportional rental income via tokens | Direct rental income and tax benefits |

Which is better?

Tokenized real estate offers fractional ownership, increased liquidity, and lower entry barriers compared to direct property ownership, which requires substantial capital and involves management responsibilities. Direct property ownership provides full control and potential tax benefits but lacks the ease of transferability found in tokenized assets. Investors seeking flexibility and diversification may prefer tokenized real estate, while those valuing tangible assets and hands-on control often choose direct ownership.

Connection

Tokenized real estate transforms direct property ownership by allowing investors to acquire fractional shares of physical properties through blockchain-based tokens, increasing liquidity and accessibility in the real estate market. This connection enables seamless transfer and trading of property interests without traditional intermediaries, reducing transaction costs and improving transparency. Investors benefit from diversified portfolios and real-time asset management while maintaining legal rights tied to direct ownership.

Key Terms

Title Deed

Direct property ownership involves holding a physical title deed that grants legal rights and control over a specific real estate asset, ensuring clear proof of ownership and the ability to leverage the property for financing or sale. Tokenized real estate transforms ownership into digital tokens recorded on a blockchain, offering fractional ownership, increased liquidity, and faster, more transparent transactions without the need for traditional title deeds. Discover how title deeds function differently across these ownership models and the implications for investors and legal frameworks.

Blockchain

Direct property ownership involves purchasing physical real estate assets, entailing legal documentation, maintenance costs, and limited liquidity. Tokenized real estate leverages blockchain technology to fractionalize property ownership into digital tokens, enhancing transparency, reducing transaction times, and enabling broader investor access. Explore how blockchain revolutionizes real estate markets by increasing efficiency and democratizing investment opportunities.

Fractional Ownership

Direct property ownership involves holding the full legal title to real estate, offering complete control and traditional benefits such as rental income and capital appreciation. Tokenized real estate allows investors to purchase fractional ownership through blockchain-based tokens, increasing liquidity and accessibility to high-value properties. Explore how fractional ownership via tokenization transforms real estate investment opportunities and risk management.

Source and External Links

The Different Types of Property Ownership - This article discusses direct ownership of real estate assets, including the benefits and drawbacks of owning a physical property.

Property Ownership: Shares vs. Direct Purchase - This blog compares the benefits and drawbacks of direct property purchase versus acquiring shares in a property company.

What Is a Direct Property Investment? - This article defines direct property investing as purchasing, owning, renting, managing, and selling property for profit and returns.

dowidth.com

dowidth.com