Side Hustle Stack empowers entrepreneurs to launch profitable side businesses with low upfront costs and flexible time commitments, leveraging practical tools and community support. Venture capital involves securing significant funding from investors to scale high-growth startups rapidly, focusing on long-term market disruption and substantial equity stakes. Explore how each approach fits your entrepreneurial goals and growth strategies.

Why it is important

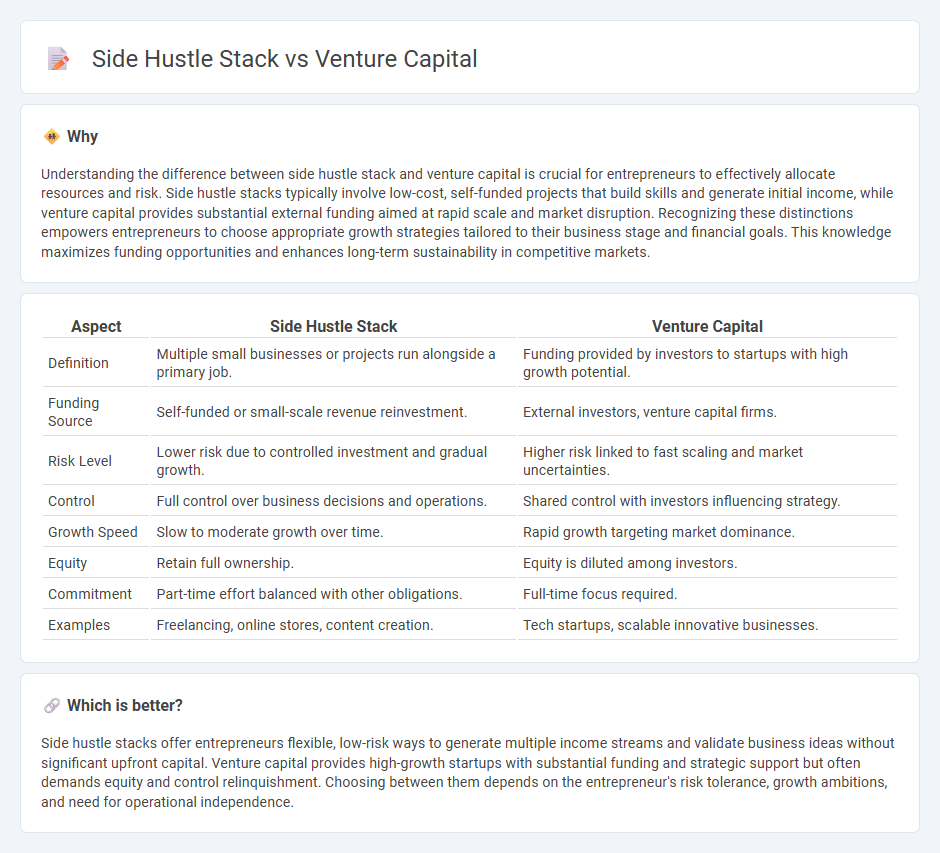

Understanding the difference between side hustle stack and venture capital is crucial for entrepreneurs to effectively allocate resources and risk. Side hustle stacks typically involve low-cost, self-funded projects that build skills and generate initial income, while venture capital provides substantial external funding aimed at rapid scale and market disruption. Recognizing these distinctions empowers entrepreneurs to choose appropriate growth strategies tailored to their business stage and financial goals. This knowledge maximizes funding opportunities and enhances long-term sustainability in competitive markets.

Comparison Table

| Aspect | Side Hustle Stack | Venture Capital |

|---|---|---|

| Definition | Multiple small businesses or projects run alongside a primary job. | Funding provided by investors to startups with high growth potential. |

| Funding Source | Self-funded or small-scale revenue reinvestment. | External investors, venture capital firms. |

| Risk Level | Lower risk due to controlled investment and gradual growth. | Higher risk linked to fast scaling and market uncertainties. |

| Control | Full control over business decisions and operations. | Shared control with investors influencing strategy. |

| Growth Speed | Slow to moderate growth over time. | Rapid growth targeting market dominance. |

| Equity | Retain full ownership. | Equity is diluted among investors. |

| Commitment | Part-time effort balanced with other obligations. | Full-time focus required. |

| Examples | Freelancing, online stores, content creation. | Tech startups, scalable innovative businesses. |

Which is better?

Side hustle stacks offer entrepreneurs flexible, low-risk ways to generate multiple income streams and validate business ideas without significant upfront capital. Venture capital provides high-growth startups with substantial funding and strategic support but often demands equity and control relinquishment. Choosing between them depends on the entrepreneur's risk tolerance, growth ambitions, and need for operational independence.

Connection

Side Hustle Stack offers entrepreneurs access to a curated collection of tools and platforms essential for growing side businesses, which can increase their appeal to venture capital by demonstrating viable revenue streams and market traction. Venture capitalists often look for evidence of scalable business models and early customer validation, both of which can be facilitated through resources found on Side Hustle Stack. This connection helps startups bridge the gap between initial hustle and securing substantial venture funding for expansion.

Key Terms

Equity Financing

Venture capital offers substantial equity financing by providing startups with significant funding in exchange for ownership stakes, accelerating growth and scaling potential. Side hustle stacks typically rely on limited personal savings or small loans, postponing equity financing until the venture reaches a more mature stage. Explore how equity financing impacts control, growth, and investor relationships in both models to make informed decisions.

Bootstrapping

Bootstrapping emphasizes growing a startup using personal savings and revenue without external funding, contrasting with venture capital which entails raising significant funds from investors in exchange for equity. Side hustle stacks often rely on bootstrapping principles to build profitable projects independently while maintaining low financial risk and operational control. Discover effective strategies to maximize your bootstrap approach and optimize growth without venture capital involvement.

Scalability

Venture capital-backed startups prioritize rapid scalability through substantial funding injections, enabling accelerated market penetration and expansion. Side hustles typically rely on organic growth, minimizing initial costs but limiting immediate scalability potential. Explore deeper insights into how scalability strategies differ between venture capital ventures and side hustles.

Source and External Links

What is Venture Capital? - Venture capital is a form of financing that helps turn innovative ideas into high-growth companies by providing risk capital, strategic guidance, and long-term equity investments, often supporting startups that traditional financing cannot fund.

What is Venture Capital? - Venture capital provides funding to startups working on novel technologies with high potential and risk, taking equity stakes and aiming for big returns through exits like IPOs or acquisitions over a long investment horizon.

Fund your business | U.S. Small Business Administration - Venture capital invests in high-growth companies in exchange for equity and often board control, providing funding in stages after due diligence and growth milestone achievements.

dowidth.com

dowidth.com