Passive income streams generate consistent revenue with minimal ongoing effort, often through dividends, rental properties, or royalties. Equity ownership involves holding shares in a company, offering potential for substantial growth and influence but carrying higher risk and involvement. Explore the advantages and challenges of both to determine the best fit for your entrepreneurial goals.

Why it is important

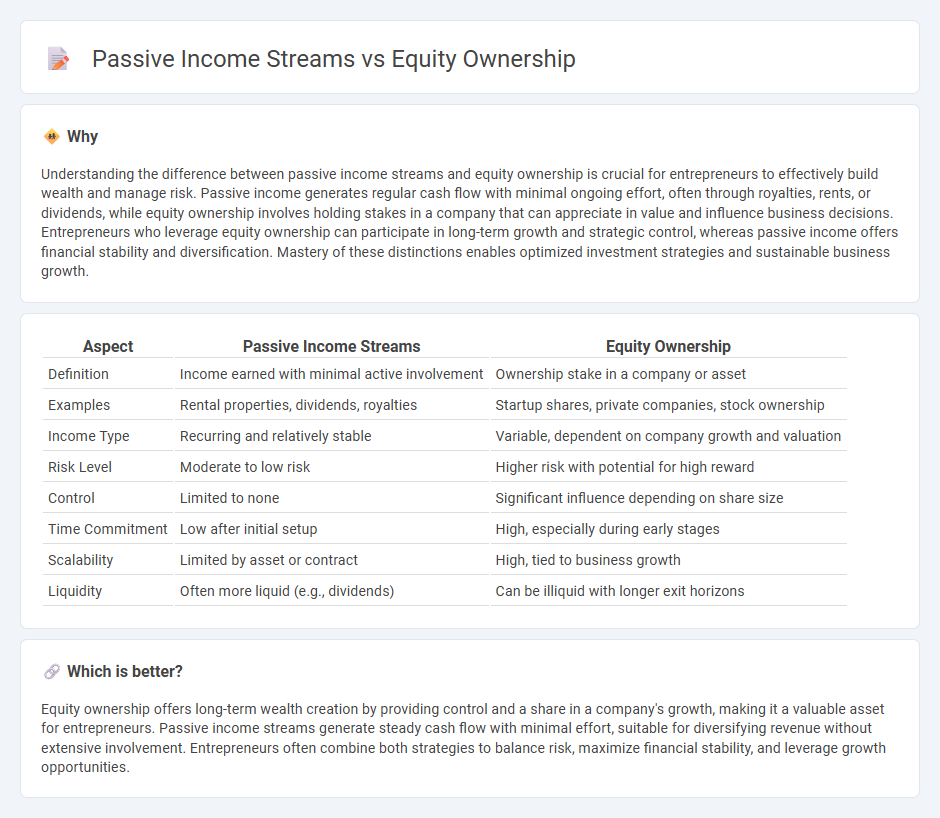

Understanding the difference between passive income streams and equity ownership is crucial for entrepreneurs to effectively build wealth and manage risk. Passive income generates regular cash flow with minimal ongoing effort, often through royalties, rents, or dividends, while equity ownership involves holding stakes in a company that can appreciate in value and influence business decisions. Entrepreneurs who leverage equity ownership can participate in long-term growth and strategic control, whereas passive income offers financial stability and diversification. Mastery of these distinctions enables optimized investment strategies and sustainable business growth.

Comparison Table

| Aspect | Passive Income Streams | Equity Ownership |

|---|---|---|

| Definition | Income earned with minimal active involvement | Ownership stake in a company or asset |

| Examples | Rental properties, dividends, royalties | Startup shares, private companies, stock ownership |

| Income Type | Recurring and relatively stable | Variable, dependent on company growth and valuation |

| Risk Level | Moderate to low risk | Higher risk with potential for high reward |

| Control | Limited to none | Significant influence depending on share size |

| Time Commitment | Low after initial setup | High, especially during early stages |

| Scalability | Limited by asset or contract | High, tied to business growth |

| Liquidity | Often more liquid (e.g., dividends) | Can be illiquid with longer exit horizons |

Which is better?

Equity ownership offers long-term wealth creation by providing control and a share in a company's growth, making it a valuable asset for entrepreneurs. Passive income streams generate steady cash flow with minimal effort, suitable for diversifying revenue without extensive involvement. Entrepreneurs often combine both strategies to balance risk, maximize financial stability, and leverage growth opportunities.

Connection

Passive income streams often arise from equity ownership in businesses, where investors earn dividends or share profits without active involvement. Equity ownership provides a scalable revenue source by granting stakeholders a claim on company earnings and appreciation over time. This connection enables entrepreneurs to build wealth steadily by leveraging ownership stakes to generate ongoing passive income.

Key Terms

Sweat Equity

Sweat equity involves investing time and effort instead of capital to gain ownership in a business, offering potential long-term value appreciation and decision-making power. Unlike passive income streams, which generate earnings with minimal ongoing work through assets like dividends, royalties, or rental income, sweat equity requires active involvement and commitment. Discover how leveraging sweat equity can build substantial business value and personal wealth by exploring further strategies.

Dividend Income

Equity ownership offers a direct stake in a company's growth and potential appreciation, while dividend income provides a steady, passive cash flow from profit distributions. Investors seeking reliable income often prioritize dividend-paying stocks as a key component of passive income streams. Explore detailed strategies on maximizing dividend income to enhance your investment portfolio.

Silent Partner

Equity ownership in a business involves holding shares that represent a stake in the company's assets and profits, often requiring active management or involvement. Passive income streams, such as those earned by a Silent Partner, generate earnings without day-to-day operational responsibilities, allowing investors to benefit from profits while minimizing time commitment. Explore the advantages and potential risks of Silent Partner roles to optimize your investment strategy.

Source and External Links

Owning Equity: Definition and Examples - Equity ownership means having a financial interest in a company, often represented by shares such as common stock, preferred stock, treasury stock, or retained earnings, which together define the ownership percentage and rights in the business.

Owner's Equity: Definition and How to Calculate It - Owner's equity is the owner's share of a business's net assets after liabilities, reflecting the residual claim on assets once debts are paid.

What Is Equity in Business: Definition, Types, and How To ... - Equity represents an ownership stake in a business that can be split among owners or investors and grows through reinvested profits or outside investments; equity owners benefit from dividends and capital gains when shares are sold or the company is acquired.

dowidth.com

dowidth.com