Pitch deck design visually communicates a startup's value proposition, market opportunity, and growth potential to attract investors. A term sheet outlines the key financial terms and conditions of the investment agreement, serving as a legal foundation for negotiation. Explore the crucial differences to enhance your fundraising strategy effectively.

Why it is important

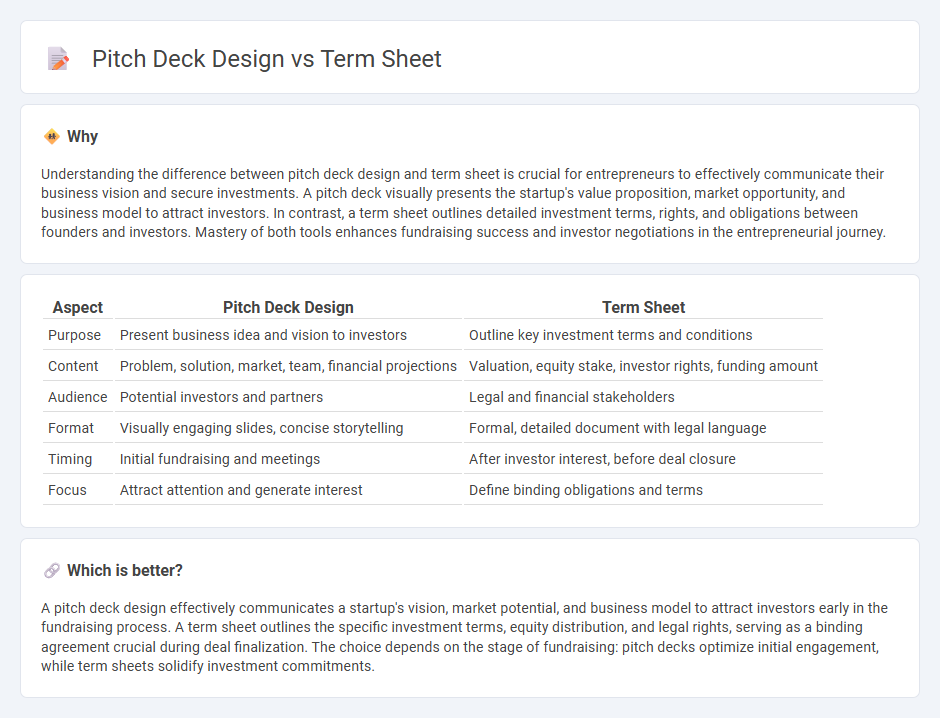

Understanding the difference between pitch deck design and term sheet is crucial for entrepreneurs to effectively communicate their business vision and secure investments. A pitch deck visually presents the startup's value proposition, market opportunity, and business model to attract investors. In contrast, a term sheet outlines detailed investment terms, rights, and obligations between founders and investors. Mastery of both tools enhances fundraising success and investor negotiations in the entrepreneurial journey.

Comparison Table

| Aspect | Pitch Deck Design | Term Sheet |

|---|---|---|

| Purpose | Present business idea and vision to investors | Outline key investment terms and conditions |

| Content | Problem, solution, market, team, financial projections | Valuation, equity stake, investor rights, funding amount |

| Audience | Potential investors and partners | Legal and financial stakeholders |

| Format | Visually engaging slides, concise storytelling | Formal, detailed document with legal language |

| Timing | Initial fundraising and meetings | After investor interest, before deal closure |

| Focus | Attract attention and generate interest | Define binding obligations and terms |

Which is better?

A pitch deck design effectively communicates a startup's vision, market potential, and business model to attract investors early in the fundraising process. A term sheet outlines the specific investment terms, equity distribution, and legal rights, serving as a binding agreement crucial during deal finalization. The choice depends on the stage of fundraising: pitch decks optimize initial engagement, while term sheets solidify investment commitments.

Connection

Pitch deck design directly influences investor perceptions by clearly presenting a startup's value proposition, market potential, and financial outlook, which sets the foundation for negotiating a term sheet. A well-crafted pitch deck highlights key deal terms such as valuation, funding amount, and equity offered, aligning expectations between founders and investors. This alignment facilitates smoother term sheet discussions, accelerating the investment process and ensuring mutually beneficial agreements.

Key Terms

Valuation

Term sheets emphasize detailed valuation metrics, including pre-money and post-money values, equity percentages, and investor rights to clearly define investment terms. Pitch decks highlight valuation more broadly to attract interest, often showcasing market opportunity, growth potential, and comparable company metrics to justify the proposed valuation. Explore best practices to optimize valuation presentation in both term sheets and pitch decks.

Equity

A term sheet outlines the key financial and legal terms of an equity investment, detailing ownership percentages, valuation, and investor rights, crucial for securing funding. A pitch deck design visually highlights the equity proposition, emphasizing market opportunity, business model, and growth potential to attract investors. Explore in-depth strategies to optimize both term sheets and pitch decks for successful equity negotiations.

Visual storytelling

Term sheets prioritize clarity and concise legal terms, emphasizing structured layouts with bullet points and tables for quick understanding of investment conditions. Pitch deck design centers on visual storytelling, using compelling graphics, charts, and narratives to engage investors emotionally and illustrate business potential dynamically. Explore detailed strategies to optimize both formats for impactful investor communication.

Source and External Links

What is a term sheet? A how-to guide for first-time startup ... - A term sheet is a mostly non-binding document outlining the terms and conditions under which venture capitalists will invest in a startup, covering deal structure, investment details, governance, liquidation preferences, voting rights, and more.

Term sheet - Wikipedia - A term sheet is a bullet-point document summarizing the material terms and conditions of a potential business agreement, often non-binding, and serving as the basis for future negotiations and definitive agreements.

What is a Term Sheet? Key terms explained - A Term Sheet is a non-legally binding summary of key deal terms in a funding round, serving as an important negotiation tool between founders and investors prior to final legal agreements.

dowidth.com

dowidth.com