Exit as a service offers entrepreneurs a streamlined, technology-driven solution to monetize their ventures quickly, contrasting with strategic partnerships that focus on long-term collaboration and resource sharing to scale business operations. Data shows that exit as a service platforms can expedite transactions by up to 40%, while strategic partnerships often drive sustained growth through combined expertise and market access. Explore these models in-depth to determine the optimal path for your entrepreneurial journey.

Why it is important

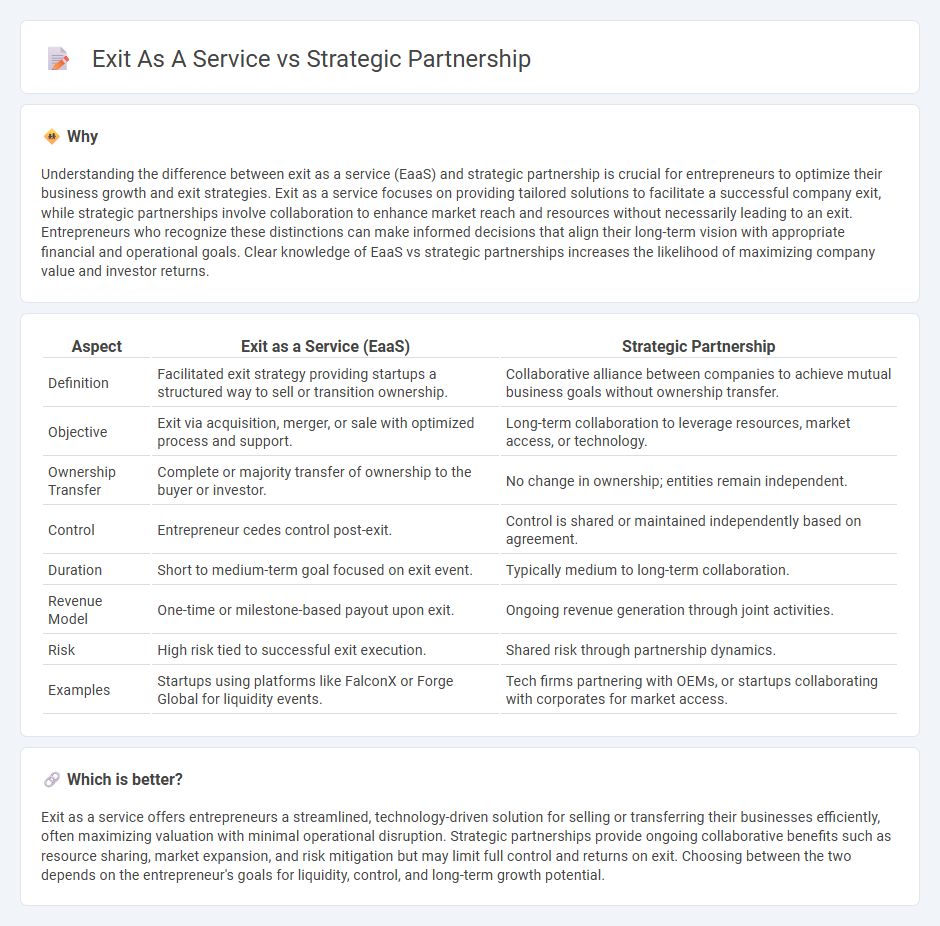

Understanding the difference between exit as a service (EaaS) and strategic partnership is crucial for entrepreneurs to optimize their business growth and exit strategies. Exit as a service focuses on providing tailored solutions to facilitate a successful company exit, while strategic partnerships involve collaboration to enhance market reach and resources without necessarily leading to an exit. Entrepreneurs who recognize these distinctions can make informed decisions that align their long-term vision with appropriate financial and operational goals. Clear knowledge of EaaS vs strategic partnerships increases the likelihood of maximizing company value and investor returns.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Strategic Partnership |

|---|---|---|

| Definition | Facilitated exit strategy providing startups a structured way to sell or transition ownership. | Collaborative alliance between companies to achieve mutual business goals without ownership transfer. |

| Objective | Exit via acquisition, merger, or sale with optimized process and support. | Long-term collaboration to leverage resources, market access, or technology. |

| Ownership Transfer | Complete or majority transfer of ownership to the buyer or investor. | No change in ownership; entities remain independent. |

| Control | Entrepreneur cedes control post-exit. | Control is shared or maintained independently based on agreement. |

| Duration | Short to medium-term goal focused on exit event. | Typically medium to long-term collaboration. |

| Revenue Model | One-time or milestone-based payout upon exit. | Ongoing revenue generation through joint activities. |

| Risk | High risk tied to successful exit execution. | Shared risk through partnership dynamics. |

| Examples | Startups using platforms like FalconX or Forge Global for liquidity events. | Tech firms partnering with OEMs, or startups collaborating with corporates for market access. |

Which is better?

Exit as a service offers entrepreneurs a streamlined, technology-driven solution for selling or transferring their businesses efficiently, often maximizing valuation with minimal operational disruption. Strategic partnerships provide ongoing collaborative benefits such as resource sharing, market expansion, and risk mitigation but may limit full control and returns on exit. Choosing between the two depends on the entrepreneur's goals for liquidity, control, and long-term growth potential.

Connection

Exit as a Service (EaaS) streamlines the process of business transition by providing startups and investors with structured plans for selling or merging ventures, ensuring maximum value realization. Strategic partnerships enhance the effectiveness of EaaS by leveraging combined resources, market access, and expertise, thus increasing the attractiveness and valuation of a startup to potential buyers. This symbiotic relationship accelerates growth, optimizes exit timing, and facilitates smoother handovers in entrepreneurial ecosystems.

Key Terms

**Strategic Partnership:**

Strategic partnerships involve collaboration between companies to leverage shared resources, expertise, and market presence for mutual growth and innovation. These alliances often enhance competitive advantage by combining strengths and expanding reach without the need for ownership changes or financial exits. Discover how strategic partnerships can drive sustainable business success and long-term value creation.

Synergy

Strategic partnerships leverage complementary strengths between companies to create synergy that drives innovation and market expansion, enhancing long-term competitive advantage. Exit as a Service focuses on optimizing the sale or transition process, enabling founders to maximize value and efficiently exit their business with expert guidance. Explore which approach aligns best with your goals to unlock the full potential of your venture.

Collaboration

Strategic partnerships emphasize long-term collaboration between companies to leverage shared resources, innovation, and market reach, fostering mutual growth and competitive advantage. Exit as a Service offers a streamlined process for business owners to sell or transition their company efficiently without extensive internal management, focusing on maximizing value during exit. Explore how collaboration goals shape the choice between forming strategic alliances or opting for exit solutions tailored to business needs.

Source and External Links

How strategic partnering can fuel better business growth - Strategic partnerships enable businesses to access new markets, share resources, spur innovation, mitigate risks, and improve competitive position by combining complementary strengths for effective and efficient goal achievement.

Strategic Partnerships Definition & Meaning - PartnerStack - Strategic partnerships are collaborations between businesses with complementary products or services, working together to share resources, expertise, customer bases, and achieve shared business objectives for mutual growth and brand trust.

Strategic partnership - Wikipedia - A strategic partnership is a business relationship usually formalized by contracts, where companies leverage their assets or expertise to enhance each other's business, focusing on trust and long-term "win-win" benefits without forming a legal partnership entity.

dowidth.com

dowidth.com