Exit as a service offers entrepreneurs a structured and scalable solution to transition ownership without the complexities of mergers, focusing on efficiency and controlled asset transfer. Unlike mergers, which often involve blending organizational structures and cultures, exit as a service emphasizes clear, transactional exits that preserve the founder's vision and value. Explore the nuances between these exit strategies to determine the optimal path for your business's future.

Why it is important

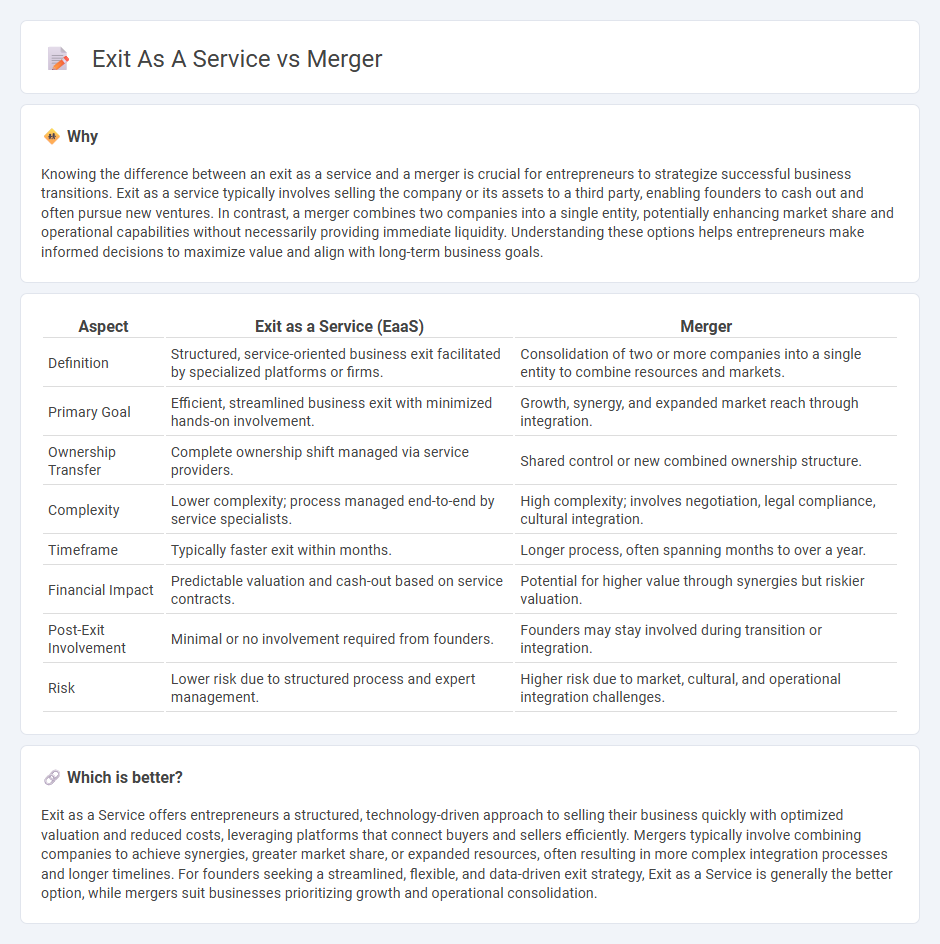

Knowing the difference between an exit as a service and a merger is crucial for entrepreneurs to strategize successful business transitions. Exit as a service typically involves selling the company or its assets to a third party, enabling founders to cash out and often pursue new ventures. In contrast, a merger combines two companies into a single entity, potentially enhancing market share and operational capabilities without necessarily providing immediate liquidity. Understanding these options helps entrepreneurs make informed decisions to maximize value and align with long-term business goals.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Merger |

|---|---|---|

| Definition | Structured, service-oriented business exit facilitated by specialized platforms or firms. | Consolidation of two or more companies into a single entity to combine resources and markets. |

| Primary Goal | Efficient, streamlined business exit with minimized hands-on involvement. | Growth, synergy, and expanded market reach through integration. |

| Ownership Transfer | Complete ownership shift managed via service providers. | Shared control or new combined ownership structure. |

| Complexity | Lower complexity; process managed end-to-end by service specialists. | High complexity; involves negotiation, legal compliance, cultural integration. |

| Timeframe | Typically faster exit within months. | Longer process, often spanning months to over a year. |

| Financial Impact | Predictable valuation and cash-out based on service contracts. | Potential for higher value through synergies but riskier valuation. |

| Post-Exit Involvement | Minimal or no involvement required from founders. | Founders may stay involved during transition or integration. |

| Risk | Lower risk due to structured process and expert management. | Higher risk due to market, cultural, and operational integration challenges. |

Which is better?

Exit as a Service offers entrepreneurs a structured, technology-driven approach to selling their business quickly with optimized valuation and reduced costs, leveraging platforms that connect buyers and sellers efficiently. Mergers typically involve combining companies to achieve synergies, greater market share, or expanded resources, often resulting in more complex integration processes and longer timelines. For founders seeking a streamlined, flexible, and data-driven exit strategy, Exit as a Service is generally the better option, while mergers suit businesses prioritizing growth and operational consolidation.

Connection

Exit as a Service (EaaS) facilitates startups in planning and executing strategic exits, often through mergers, by providing expert guidance on valuation, negotiation, and integration processes. Mergers serve as a common exit strategy where two companies combine resources to maximize growth potential and shareholder value. The synergy between EaaS and mergers streamlines the transition, ensuring optimized deal structures and smoother operational integration for entrepreneurs.

Key Terms

Acquisition

Merger and exit as a service both revolve around acquisition strategies but differ in scope and objectives, with mergers focusing on integrating companies to create synergies and exit as a service aiming to maximize shareholder value through strategic sales. Mergers often involve combining assets, operations, and cultures to achieve long-term growth, while exit as a service emphasizes facilitating a smooth transition for owners seeking liquidity or strategic repositioning. Explore how these approaches impact acquisition success and business transformation.

Valuation

Merger as a service often involves combining companies to create a larger entity, potentially increasing overall valuation through synergy realization and market expansion. Exit as a service focuses on streamlining the process for founders or investors to sell their stakes, aiming to maximize valuation by targeting the right buyers and optimizing deal structures. Explore more about how each approach impacts valuation dynamics and strategic financial outcomes.

Intellectual Property Transfer

Intellectual property transfer in mergers typically involves the consolidation of patents, trademarks, and proprietary technology under a unified entity, enhancing market value and competitive advantage. An exit-as-a-service strategy often structures IP transfer to maximize financial return while minimizing operational disruptions and maintaining innovation continuity. Explore detailed comparisons to understand which option best protects and leverages your intellectual property assets.

Source and External Links

Merger - Overview, Types, Advantages and Disadvantages - A merger is a corporate strategy combining two companies of similar size into a single legal entity to operate jointly, often to increase market share and efficiency through various types such as horizontal, vertical, and conglomerate mergers.

Mergers and acquisitions - Mergers and acquisitions (M&A) are transactions where companies consolidate ownership, with mergers being legal consolidations of two entities into one, often regulated by antitrust laws to prevent market monopolies.

Merge and acquire businesses - Mergers involve combining two businesses into a new legal entity, which is different from acquisitions where one company absorbs another without forming a new company, and thorough valuation and legal agreements are essential in the process.

dowidth.com

dowidth.com