Alternative funding platforms offer diverse financial options beyond traditional equity crowdfunding, including debt financing, revenue-based funding, and peer-to-peer lending, enabling entrepreneurs to maintain greater control over their businesses. Equity crowdfunding involves selling shares of a company to a wide pool of investors, providing capital and potential brand ambassadors while diluting ownership stakes. Explore the differences between alternative funding platforms and equity crowdfunding to determine the best strategy for your entrepreneurial venture.

Why it is important

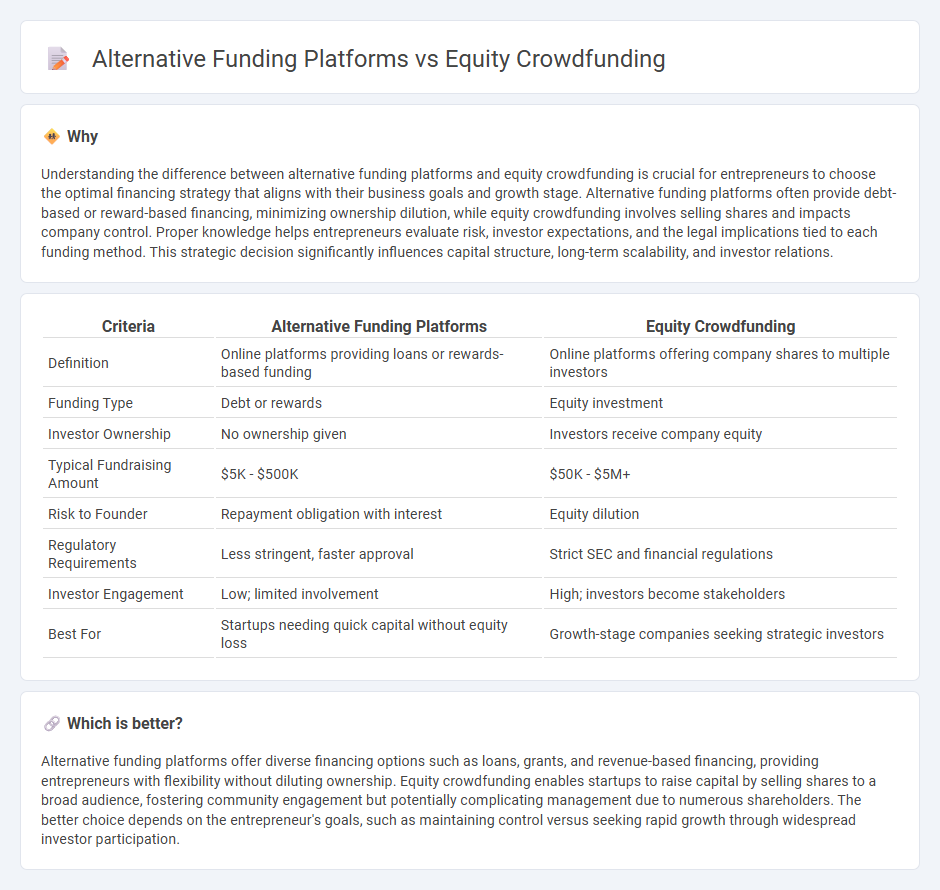

Understanding the difference between alternative funding platforms and equity crowdfunding is crucial for entrepreneurs to choose the optimal financing strategy that aligns with their business goals and growth stage. Alternative funding platforms often provide debt-based or reward-based financing, minimizing ownership dilution, while equity crowdfunding involves selling shares and impacts company control. Proper knowledge helps entrepreneurs evaluate risk, investor expectations, and the legal implications tied to each funding method. This strategic decision significantly influences capital structure, long-term scalability, and investor relations.

Comparison Table

| Criteria | Alternative Funding Platforms | Equity Crowdfunding |

|---|---|---|

| Definition | Online platforms providing loans or rewards-based funding | Online platforms offering company shares to multiple investors |

| Funding Type | Debt or rewards | Equity investment |

| Investor Ownership | No ownership given | Investors receive company equity |

| Typical Fundraising Amount | $5K - $500K | $50K - $5M+ |

| Risk to Founder | Repayment obligation with interest | Equity dilution |

| Regulatory Requirements | Less stringent, faster approval | Strict SEC and financial regulations |

| Investor Engagement | Low; limited involvement | High; investors become stakeholders |

| Best For | Startups needing quick capital without equity loss | Growth-stage companies seeking strategic investors |

Which is better?

Alternative funding platforms offer diverse financing options such as loans, grants, and revenue-based financing, providing entrepreneurs with flexibility without diluting ownership. Equity crowdfunding enables startups to raise capital by selling shares to a broad audience, fostering community engagement but potentially complicating management due to numerous shareholders. The better choice depends on the entrepreneur's goals, such as maintaining control versus seeking rapid growth through widespread investor participation.

Connection

Alternative funding platforms and equity crowdfunding are interconnected by providing startups and small businesses access to capital through online networks that connect entrepreneurs with a broad base of investors. These platforms facilitate equity crowdfunding, allowing investors to acquire ownership stakes in early-stage companies in exchange for funding. The synergy between alternative funding platforms and equity crowdfunding democratizes investment opportunities and accelerates business growth by bypassing traditional financial institutions.

Key Terms

Ownership Shares

Equity crowdfunding allows investors to acquire actual ownership shares in a company, which can lead to dividends and capital gains as the business grows. Alternative funding platforms, such as rewards-based crowdfunding or peer-to-peer lending, typically do not offer equity stakes but instead provide non-ownership returns like products, interest, or loans. Explore detailed comparisons to understand how ownership shares impact investor rights and company control in different funding models.

Investor Pool

Equity crowdfunding platforms attract a diverse investor pool, including retail investors seeking startup equity and early-stage growth opportunities. Alternative funding platforms often target institutional investors or specialized niches with stricter entry criteria and higher capital requirements. Explore the unique investor dynamics and benefits of each platform to make informed funding decisions.

Regulatory Compliance

Equity crowdfunding platforms operate under stringent regulatory frameworks such as the JOBS Act in the United States, which mandates investor protections, disclosure requirements, and fundraising limits to ensure transparency and reduce fraud. Alternative funding platforms like peer-to-peer lending and rewards-based crowdfunding face different compliance standards that often vary by jurisdiction and may include consumer protection laws and financial licensing regulations. Explore the complexities of regulatory compliance across diverse funding platforms to make informed investment decisions.

Source and External Links

Equity Crowdfunding - Definition, Pros, Cons, Regulations - Equity crowdfunding is a method where startups and early-stage companies offer securities to investors online in exchange for capital, allowing many investors to gain equity stakes proportional to their investment through specialized platforms like Wefunder and StartEngine.

Equity Crowdfunding - Is It For You? - Cooley GO - Equity crowdfunding raises capital by soliciting small investments from many people, including via internet or social media, where investors receive ownership shares, differing from donation or rewards crowdfunding which provide no company equity.

Equity crowdfunding - Wikipedia - Equity crowdfunding involves the online offering of private company securities to a broad group of investors who fund startups or small businesses in exchange for equity ownership, often regulated as part of capital markets.

dowidth.com

dowidth.com