Entrepreneurs seeking capital now explore alternative funding platforms such as crowdfunding, angel investing, and venture capital alongside Initial Coin Offerings (ICOs), which leverage blockchain technology to raise funds through digital tokens. Alternative platforms offer regulated environments and proven investor protections, while ICOs provide rapid access to global investors but face regulatory uncertainties. Discover how these funding methods shape entrepreneurial success and risks in the evolving startup landscape.

Why it is important

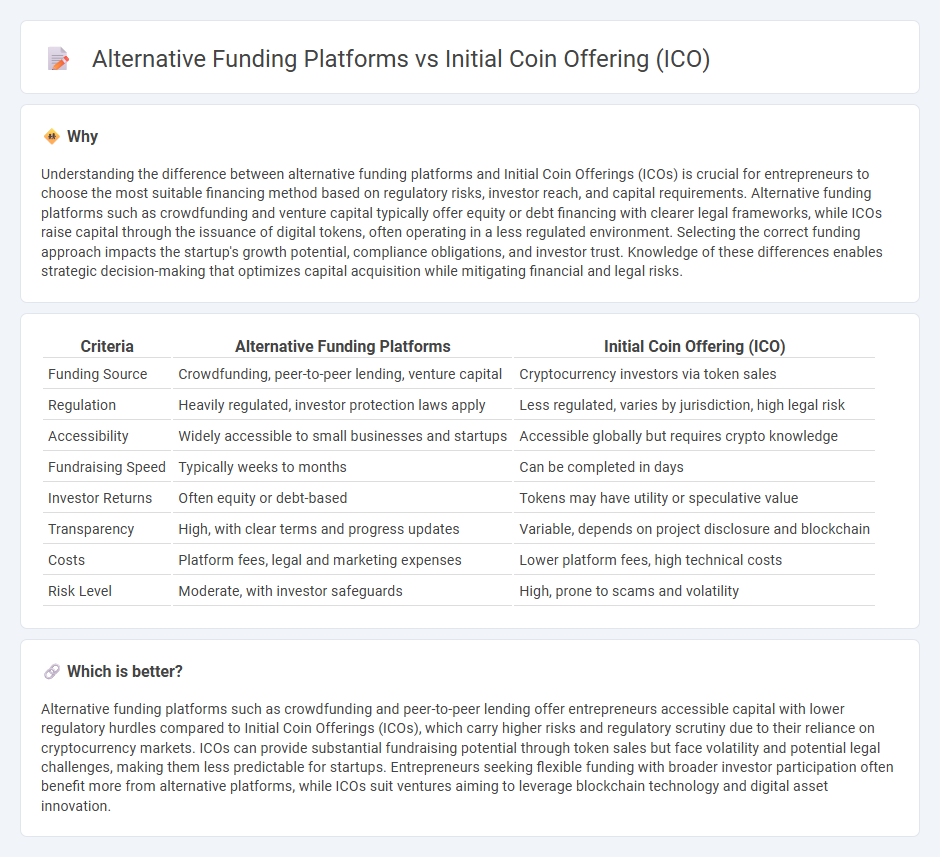

Understanding the difference between alternative funding platforms and Initial Coin Offerings (ICOs) is crucial for entrepreneurs to choose the most suitable financing method based on regulatory risks, investor reach, and capital requirements. Alternative funding platforms such as crowdfunding and venture capital typically offer equity or debt financing with clearer legal frameworks, while ICOs raise capital through the issuance of digital tokens, often operating in a less regulated environment. Selecting the correct funding approach impacts the startup's growth potential, compliance obligations, and investor trust. Knowledge of these differences enables strategic decision-making that optimizes capital acquisition while mitigating financial and legal risks.

Comparison Table

| Criteria | Alternative Funding Platforms | Initial Coin Offering (ICO) |

|---|---|---|

| Funding Source | Crowdfunding, peer-to-peer lending, venture capital | Cryptocurrency investors via token sales |

| Regulation | Heavily regulated, investor protection laws apply | Less regulated, varies by jurisdiction, high legal risk |

| Accessibility | Widely accessible to small businesses and startups | Accessible globally but requires crypto knowledge |

| Fundraising Speed | Typically weeks to months | Can be completed in days |

| Investor Returns | Often equity or debt-based | Tokens may have utility or speculative value |

| Transparency | High, with clear terms and progress updates | Variable, depends on project disclosure and blockchain |

| Costs | Platform fees, legal and marketing expenses | Lower platform fees, high technical costs |

| Risk Level | Moderate, with investor safeguards | High, prone to scams and volatility |

Which is better?

Alternative funding platforms such as crowdfunding and peer-to-peer lending offer entrepreneurs accessible capital with lower regulatory hurdles compared to Initial Coin Offerings (ICOs), which carry higher risks and regulatory scrutiny due to their reliance on cryptocurrency markets. ICOs can provide substantial fundraising potential through token sales but face volatility and potential legal challenges, making them less predictable for startups. Entrepreneurs seeking flexible funding with broader investor participation often benefit more from alternative platforms, while ICOs suit ventures aiming to leverage blockchain technology and digital asset innovation.

Connection

Alternative funding platforms and Initial Coin Offerings (ICOs) intersect by enabling entrepreneurs to raise capital through decentralized, blockchain-based methods outside traditional financial institutions. ICOs act as a form of crowdsourcing where startups issue tokens in exchange for investment, directly leveraging these platforms to access a global pool of investors. This integration accelerates liquidity and democratizes funding opportunities, transforming how new ventures secure early-stage financing.

Key Terms

Tokenization

Initial Coin Offerings (ICOs) revolutionize fundraising by enabling startups to issue tokens directly to investors, bypassing traditional intermediaries and providing immediate liquidity options on various cryptocurrency exchanges. Alternative funding platforms like equity crowdfunding and venture capital often require lengthy approval processes and offer less flexibility in asset transferability compared to tokenized assets. Explore the benefits and evolving landscape of tokenization to understand its impact on modern investment strategies.

Crowdfunding

Initial Coin Offering (ICO) enables blockchain startups to raise capital by issuing tokens, providing liquidity and access to a global investor base without traditional intermediaries. Crowdfunding platforms, such as Kickstarter and Indiegogo, allow businesses to gather small investments or pre-orders from a large audience, emphasizing community support and product validation rather than blockchain asset issuance. Explore the differences in risk, regulation, and investor engagement between ICOs and crowdfunding to choose the ideal funding strategy.

Regulatory Compliance

Initial Coin Offerings (ICOs) face stringent regulatory scrutiny from authorities such as the SEC and FCA, requiring comprehensive disclosure and adherence to securities laws to protect investors and ensure market integrity. Alternative funding platforms like equity crowdfunding, venture capital, and Initial Exchange Offerings (IEOs) often provide clearer compliance frameworks and investor protections under established legal regimes, facilitating smoother regulatory approval. Explore detailed comparisons of legal requirements and compliance strategies to determine the optimal funding approach for your project.

Source and External Links

What are Initial Coin Offerings (ICOs) and how do they work? - An ICO is a fundraising method in the cryptocurrency industry where new tokens are issued to investors to raise capital for projects, functioning similarly to an IPO but with less regulation and various possible token structures.

Initial Coin Offering (ICO) - Definition, Examples, Types - ICOs involve a company creating and promoting blockchain-based tokens to raise capital, where tokens typically represent utility or access to a product rather than equity, and are built on existing blockchain platforms.

What Are ICOs and How Do They Work? - SGR Law - ICOs are a form of crowdfunding through selling digital tokens that provide investors access to project features, distinct from IPOs primarily due to their lack of regulatory oversight and legal disclosure requirements.

dowidth.com

dowidth.com