Embedded finance integrates financial services directly into non-financial platforms, streamlining transactions and enhancing customer experiences within apps and websites. Digital wallets store payment information securely, enabling quick, contactless payments via smartphones or other devices. Explore how these financial innovations are transforming entrepreneurship and business models today.

Why it is important

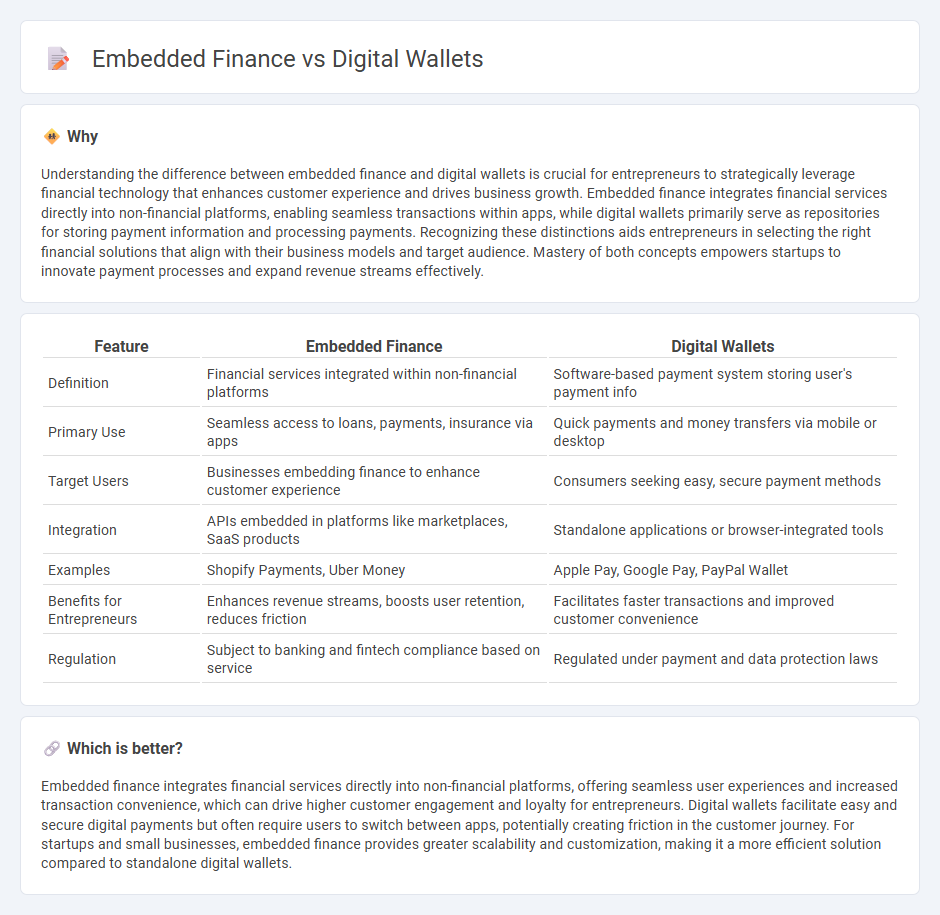

Understanding the difference between embedded finance and digital wallets is crucial for entrepreneurs to strategically leverage financial technology that enhances customer experience and drives business growth. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions within apps, while digital wallets primarily serve as repositories for storing payment information and processing payments. Recognizing these distinctions aids entrepreneurs in selecting the right financial solutions that align with their business models and target audience. Mastery of both concepts empowers startups to innovate payment processes and expand revenue streams effectively.

Comparison Table

| Feature | Embedded Finance | Digital Wallets |

|---|---|---|

| Definition | Financial services integrated within non-financial platforms | Software-based payment system storing user's payment info |

| Primary Use | Seamless access to loans, payments, insurance via apps | Quick payments and money transfers via mobile or desktop |

| Target Users | Businesses embedding finance to enhance customer experience | Consumers seeking easy, secure payment methods |

| Integration | APIs embedded in platforms like marketplaces, SaaS products | Standalone applications or browser-integrated tools |

| Examples | Shopify Payments, Uber Money | Apple Pay, Google Pay, PayPal Wallet |

| Benefits for Entrepreneurs | Enhances revenue streams, boosts user retention, reduces friction | Facilitates faster transactions and improved customer convenience |

| Regulation | Subject to banking and fintech compliance based on service | Regulated under payment and data protection laws |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, offering seamless user experiences and increased transaction convenience, which can drive higher customer engagement and loyalty for entrepreneurs. Digital wallets facilitate easy and secure digital payments but often require users to switch between apps, potentially creating friction in the customer journey. For startups and small businesses, embedded finance provides greater scalability and customization, making it a more efficient solution compared to standalone digital wallets.

Connection

Embedded finance integrates financial services into non-financial platforms, enabling entrepreneurs to offer seamless payment solutions through digital wallets. Digital wallets facilitate instant transactions and enhance customer experience by storing payment information securely within apps or websites. This synergy supports business growth by streamlining cash flow management and expanding access to financial products.

Key Terms

Payment Gateway

Digital wallets streamline transactions by securely storing payment information and enabling instant payments across various platforms, enhancing user convenience. Embedded finance integrates payment gateways directly into non-financial apps, providing seamless checkout experiences and expanding merchant capabilities. Explore how these payment solutions transform digital commerce and optimize customer engagement.

API Integration

API integration is crucial for both digital wallets and embedded finance, enabling seamless transaction processing and real-time data exchange across platforms. Digital wallets leverage APIs to securely connect with payment gateways and financial institutions, enhancing user convenience and transaction speed. Explore how advanced API integration transforms financial services and drives innovation in digital wallets and embedded finance.

User Authentication

Digital wallets employ multi-factor authentication methods such as biometrics and OTPs to ensure secure user access, while embedded finance integrates authentication seamlessly within third-party platforms, enhancing user experience without compromising security. Both systems leverage advanced encryption and AI-driven fraud detection to protect sensitive financial data during transactions. Explore how evolving authentication technologies are shaping the future of secure financial services.

Source and External Links

15 Types of Digital Wallets: Comprehensive Guide - Discusses the two main types of digital wallets: centralized wallets managed by institutions like PayPal and Venmo, and decentralized wallets used for cryptocurrencies that offer user autonomy and privacy.

What is a digital wallet and how do they work? - Defines digital wallets as electronic versions of physical wallets that store payment methods and documents, enabling easy contactless payments via smartphone apps like Apple Pay and Google Wallet.

Digital Wallets: Everything You Need to Know - Explains the security benefits of digital wallets, such as encryption and fingerprint authentication, and how they facilitate online and in-store payments while protecting user data with virtual card numbers.

dowidth.com

dowidth.com