Passive income streams generate revenue with minimal ongoing effort, relying on investments like rental properties or dividend stocks to create steady cash flow. Affiliate income depends on promoting products or services through digital platforms, earning commissions based on sales or leads generated. Explore the differences and strategies behind these income models to enhance your entrepreneurial success.

Why it is important

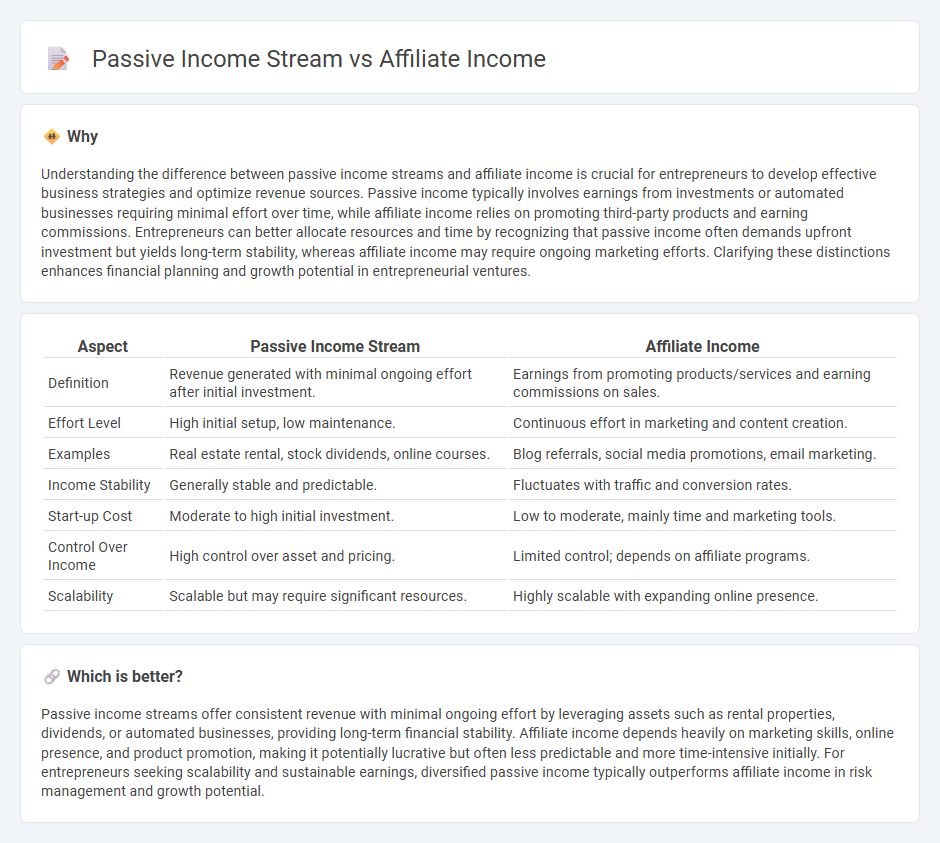

Understanding the difference between passive income streams and affiliate income is crucial for entrepreneurs to develop effective business strategies and optimize revenue sources. Passive income typically involves earnings from investments or automated businesses requiring minimal effort over time, while affiliate income relies on promoting third-party products and earning commissions. Entrepreneurs can better allocate resources and time by recognizing that passive income often demands upfront investment but yields long-term stability, whereas affiliate income may require ongoing marketing efforts. Clarifying these distinctions enhances financial planning and growth potential in entrepreneurial ventures.

Comparison Table

| Aspect | Passive Income Stream | Affiliate Income |

|---|---|---|

| Definition | Revenue generated with minimal ongoing effort after initial investment. | Earnings from promoting products/services and earning commissions on sales. |

| Effort Level | High initial setup, low maintenance. | Continuous effort in marketing and content creation. |

| Examples | Real estate rental, stock dividends, online courses. | Blog referrals, social media promotions, email marketing. |

| Income Stability | Generally stable and predictable. | Fluctuates with traffic and conversion rates. |

| Start-up Cost | Moderate to high initial investment. | Low to moderate, mainly time and marketing tools. |

| Control Over Income | High control over asset and pricing. | Limited control; depends on affiliate programs. |

| Scalability | Scalable but may require significant resources. | Highly scalable with expanding online presence. |

Which is better?

Passive income streams offer consistent revenue with minimal ongoing effort by leveraging assets such as rental properties, dividends, or automated businesses, providing long-term financial stability. Affiliate income depends heavily on marketing skills, online presence, and product promotion, making it potentially lucrative but often less predictable and more time-intensive initially. For entrepreneurs seeking scalability and sustainable earnings, diversified passive income typically outperforms affiliate income in risk management and growth potential.

Connection

Passive income streams often rely on affiliate income as a key component, where entrepreneurs promote products or services to earn commissions without active involvement. This model leverages digital marketing strategies, such as content creation and social media, to generate recurring earnings. Affiliate marketing serves as a scalable and low-risk method for entrepreneurs to build sustainable passive income.

Key Terms

Commission

Affiliate income, derived primarily from commissions earned by promoting products or services, offers a performance-based revenue model that scales with marketing effort and sales volume. Passive income streams, in contrast, often require upfront investment or creation of assets that generate residual earnings over time without continuous active involvement. Explore detailed strategies and compare commission structures to maximize your affiliate marketing profitability and passive income potential.

Residual earnings

Affiliate income is a form of residual earnings generated by promoting products or services and earning commissions on ongoing sales, creating a steady passive income stream. Unlike one-time payouts, residual affiliate income accrues over time as customers continue to purchase, providing long-term financial benefits. Explore how optimizing affiliate marketing strategies can significantly enhance your residual earnings potential.

Automation

Affiliate income relies on automated marketing strategies such as email sequences and content scheduling, allowing commissions to be earned with minimal ongoing effort. Passive income streams encompass diverse automated systems including rental properties with property management or royalties from digital products generating revenue without active involvement. Explore how automation in both affiliate and passive income can maximize financial growth and minimize time investment.

Source and External Links

How much do affiliate marketers make - Hostinger - The average affiliate marketer earns about $8,000 per month, with earnings influenced by experience, niche, and platform; affiliate income is earned through commissions on sales or actions made via unique tracking links.

Affiliate Marketing Guide: All You Need To Know (2025) - Shopify - Affiliate income comes from various payment models including revenue sharing (commission per sale), cost per action, subscription commissions, and hybrid or tiered commissions, depending on the affiliate program's structure.

How Much Can Affiliate Marketers Potentially Earn in 2024? - Affiliate earnings vary widely from $0 to over $100,000 monthly, with most affiliates making between $0 and $80,000 annually, and a small percentage earning six-figure months as super affiliates.

dowidth.com

dowidth.com