Acquihire involves acquiring a company primarily for its talented employees, enabling rapid team integration and innovation acceleration. Strategic alliances focus on collaborative partnerships between businesses to leverage complementary strengths without full ownership transfer. Explore key differences and benefits to determine the best approach for your entrepreneurial growth.

Why it is important

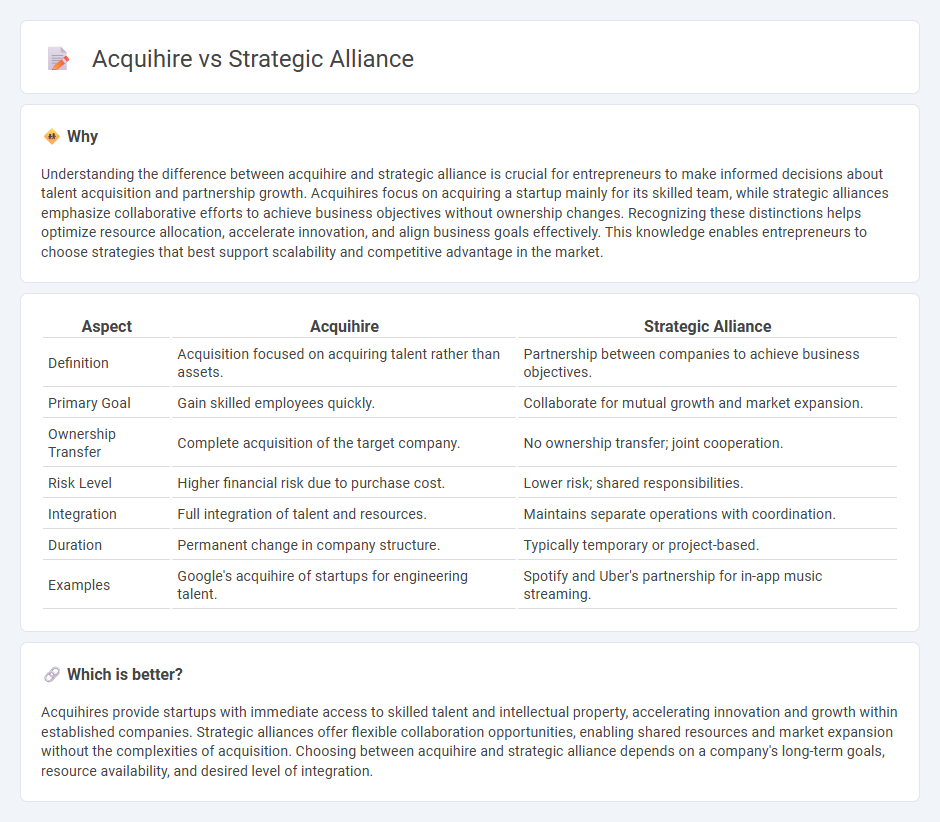

Understanding the difference between acquihire and strategic alliance is crucial for entrepreneurs to make informed decisions about talent acquisition and partnership growth. Acquihires focus on acquiring a startup mainly for its skilled team, while strategic alliances emphasize collaborative efforts to achieve business objectives without ownership changes. Recognizing these distinctions helps optimize resource allocation, accelerate innovation, and align business goals effectively. This knowledge enables entrepreneurs to choose strategies that best support scalability and competitive advantage in the market.

Comparison Table

| Aspect | Acquihire | Strategic Alliance |

|---|---|---|

| Definition | Acquisition focused on acquiring talent rather than assets. | Partnership between companies to achieve business objectives. |

| Primary Goal | Gain skilled employees quickly. | Collaborate for mutual growth and market expansion. |

| Ownership Transfer | Complete acquisition of the target company. | No ownership transfer; joint cooperation. |

| Risk Level | Higher financial risk due to purchase cost. | Lower risk; shared responsibilities. |

| Integration | Full integration of talent and resources. | Maintains separate operations with coordination. |

| Duration | Permanent change in company structure. | Typically temporary or project-based. |

| Examples | Google's acquihire of startups for engineering talent. | Spotify and Uber's partnership for in-app music streaming. |

Which is better?

Acquihires provide startups with immediate access to skilled talent and intellectual property, accelerating innovation and growth within established companies. Strategic alliances offer flexible collaboration opportunities, enabling shared resources and market expansion without the complexities of acquisition. Choosing between acquihire and strategic alliance depends on a company's long-term goals, resource availability, and desired level of integration.

Connection

Acquihire and strategic alliance are connected as both involve collaboration between companies to achieve growth and innovation. Acquihires focus on acquiring talent and skills by purchasing startups, while strategic alliances emphasize forming partnerships to leverage resources and market opportunities. Both strategies help businesses quickly scale capabilities and gain competitive advantages in dynamic industries.

Key Terms

**Strategic Alliance:**

Strategic alliance involves two or more companies collaborating to achieve shared objectives while remaining independent entities, often focusing on resource sharing, market expansion, or joint innovation. Unlike an acquihire, which centers on acquiring talent through company purchase, strategic alliances emphasize mutual benefits without full ownership transfer. Explore detailed comparisons and case studies to understand the optimal approach for your business needs.

Partnership

Strategic alliances emphasize long-term collaboration between companies to leverage complementary strengths and achieve mutual growth, often involving joint ventures or co-development projects. Acquihires prioritize talent acquisition by purchasing a startup primarily to integrate its team, focusing less on ongoing partnership and more on human capital. Discover how these distinct approaches impact business growth and innovation strategies.

Resource Sharing

Strategic alliances emphasize resource sharing by combining complementary assets, expertise, and market access without ownership transfer, fostering collaboration to achieve mutual goals. Acquihires focus on acquiring talent through company purchase, integrating skilled teams into the acquirer's operations, often prioritizing human capital over physical resources. Explore how resource-sharing strategies vary to enhance growth by learning more about their distinct approaches.

Source and External Links

Strategic alliance - Wikipedia - A strategic alliance is an agreement between two or more independent organizations to pursue agreed objectives together, sharing resources like technology, expertise, or capital, while remaining independent entities.

The Five Factors of a Strategic Alliance - Ivey Business Journal - A strategic alliance is defined by criteria such as being critical to core business goals, sustaining competitive advantage, blocking competitors, creating strategic options, or mitigating business risks.

Types and Benefits of Strategic Alliances - Corporate Finance Institute - Strategic alliances are cooperative agreements among independent companies which can take forms such as joint ventures, equity alliances, or non-equity alliances to share resources and capabilities for mutual benefit.

dowidth.com

dowidth.com