Passive income streams generate revenue with minimal active involvement, such as dividends, royalties, or online business earnings, offering entrepreneurs financial flexibility and scalability. Rental income from real estate provides a steady cash flow by leasing property, but requires property management and maintenance efforts. Explore the advantages and challenges of these income sources to determine which best fits your entrepreneurial goals.

Why it is important

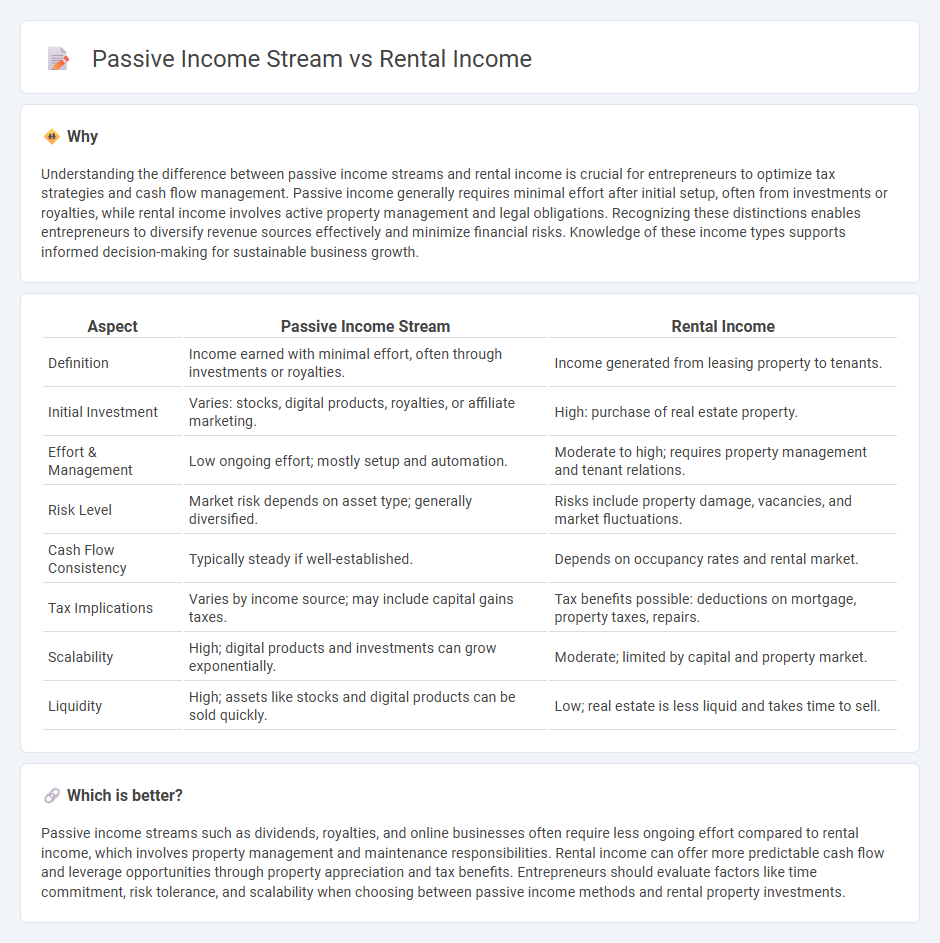

Understanding the difference between passive income streams and rental income is crucial for entrepreneurs to optimize tax strategies and cash flow management. Passive income generally requires minimal effort after initial setup, often from investments or royalties, while rental income involves active property management and legal obligations. Recognizing these distinctions enables entrepreneurs to diversify revenue sources effectively and minimize financial risks. Knowledge of these income types supports informed decision-making for sustainable business growth.

Comparison Table

| Aspect | Passive Income Stream | Rental Income |

|---|---|---|

| Definition | Income earned with minimal effort, often through investments or royalties. | Income generated from leasing property to tenants. |

| Initial Investment | Varies: stocks, digital products, royalties, or affiliate marketing. | High: purchase of real estate property. |

| Effort & Management | Low ongoing effort; mostly setup and automation. | Moderate to high; requires property management and tenant relations. |

| Risk Level | Market risk depends on asset type; generally diversified. | Risks include property damage, vacancies, and market fluctuations. |

| Cash Flow Consistency | Typically steady if well-established. | Depends on occupancy rates and rental market. |

| Tax Implications | Varies by income source; may include capital gains taxes. | Tax benefits possible: deductions on mortgage, property taxes, repairs. |

| Scalability | High; digital products and investments can grow exponentially. | Moderate; limited by capital and property market. |

| Liquidity | High; assets like stocks and digital products can be sold quickly. | Low; real estate is less liquid and takes time to sell. |

Which is better?

Passive income streams such as dividends, royalties, and online businesses often require less ongoing effort compared to rental income, which involves property management and maintenance responsibilities. Rental income can offer more predictable cash flow and leverage opportunities through property appreciation and tax benefits. Entrepreneurs should evaluate factors like time commitment, risk tolerance, and scalability when choosing between passive income methods and rental property investments.

Connection

Passive income streams often include rental income, as property leasing provides a steady cash flow with minimal active involvement. Entrepreneurs leverage rental income to diversify revenue sources and build financial stability without daily operational demands. This connection enhances wealth-building strategies by combining real estate investment with entrepreneurial financial planning.

Key Terms

Cash Flow

Rental income represents a consistent cash flow generated from leasing residential or commercial properties, often requiring active management to maintain occupancy and property condition. Passive income streams, including dividends, royalties, or peer-to-peer lending, typically demand less day-to-day involvement but may present variable cash flow depending on market conditions. Explore strategies to optimize cash flow and balance between rental and passive income sources to maximize financial stability.

Asset Utilization

Rental income represents a direct asset utilization strategy where property owners actively generate cash flow by leasing real estate, maximizing the value of physical assets. Passive income streams often involve diversified investments such as stocks or bonds, which require minimal ongoing management yet still leverage financial assets for growth. Explore how optimizing asset utilization enhances both rental income and passive income opportunities.

Scalability

Rental income offers a scalable passive income stream by leveraging property value appreciation and rental demand growth across multiple real estate assets. Unlike many passive income sources, rental properties can be refinanced or expanded with additional units, enhancing earning potential without proportionally increasing active involvement. Explore strategies to maximize scalability and optimize rental income as a sustainable passive income stream.

Source and External Links

Tips on rental real estate income, deductions and recordkeeping - IRS - All rental income must be reported on your tax return and includes normal rent, advance rent, and security deposits kept due to tenant noncompliance, with expenses generally deductible from rental income.

Rental Income Taxes Explained: 6 Key Questions, Answered - Rental income is usually unearned income, calculated by subtracting property-related expenses from total rent received, and special rules apply if the property is rented fewer than 15 days or used personally.

What is rental income and how do I report it? - TaxSlayer Support - Rental income includes cash or fair market value of services or property received, typically reported on Schedule E, with special rules for short-term rentals under 15 days and handling of security deposits.

dowidth.com

dowidth.com