Micro private equity focuses on investing smaller amounts of capital into established small businesses with proven revenue streams, aiming for steady growth and profitability. Startup accelerators provide intensive mentorship, resources, and seed funding to early-stage startups, accelerating their development and market entry. Explore the distinct advantages of micro private equity and startup accelerators to determine which pathway aligns best with your entrepreneurial goals.

Why it is important

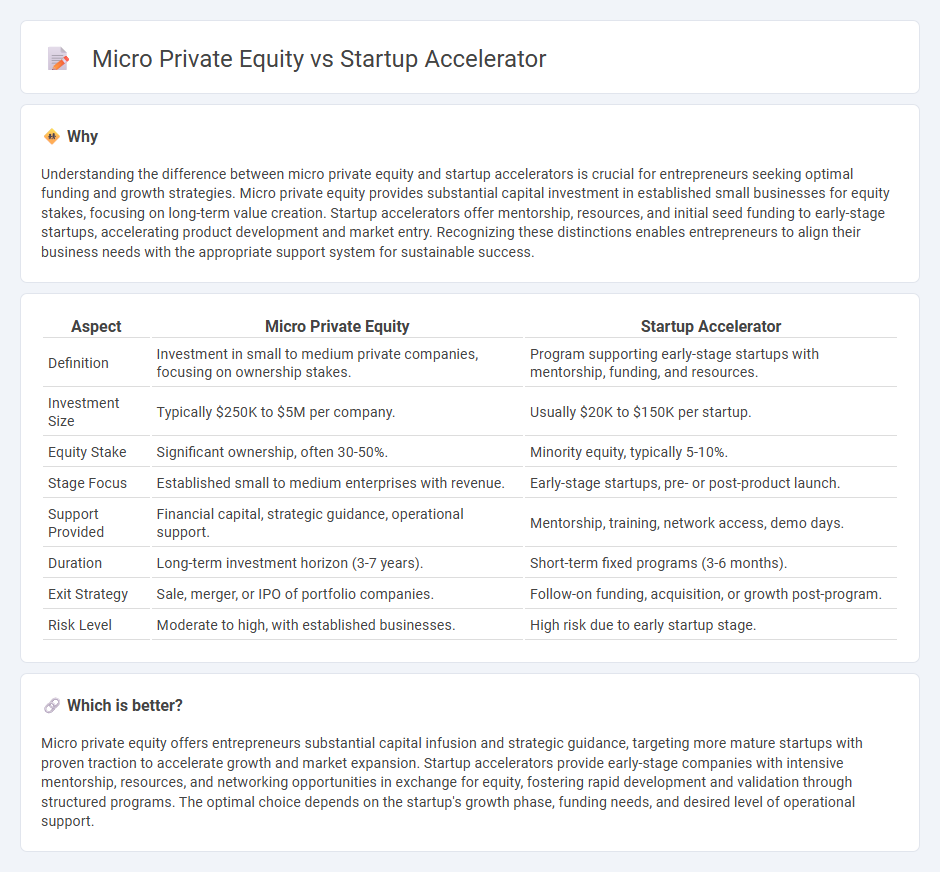

Understanding the difference between micro private equity and startup accelerators is crucial for entrepreneurs seeking optimal funding and growth strategies. Micro private equity provides substantial capital investment in established small businesses for equity stakes, focusing on long-term value creation. Startup accelerators offer mentorship, resources, and initial seed funding to early-stage startups, accelerating product development and market entry. Recognizing these distinctions enables entrepreneurs to align their business needs with the appropriate support system for sustainable success.

Comparison Table

| Aspect | Micro Private Equity | Startup Accelerator |

|---|---|---|

| Definition | Investment in small to medium private companies, focusing on ownership stakes. | Program supporting early-stage startups with mentorship, funding, and resources. |

| Investment Size | Typically $250K to $5M per company. | Usually $20K to $150K per startup. |

| Equity Stake | Significant ownership, often 30-50%. | Minority equity, typically 5-10%. |

| Stage Focus | Established small to medium enterprises with revenue. | Early-stage startups, pre- or post-product launch. |

| Support Provided | Financial capital, strategic guidance, operational support. | Mentorship, training, network access, demo days. |

| Duration | Long-term investment horizon (3-7 years). | Short-term fixed programs (3-6 months). |

| Exit Strategy | Sale, merger, or IPO of portfolio companies. | Follow-on funding, acquisition, or growth post-program. |

| Risk Level | Moderate to high, with established businesses. | High risk due to early startup stage. |

Which is better?

Micro private equity offers entrepreneurs substantial capital infusion and strategic guidance, targeting more mature startups with proven traction to accelerate growth and market expansion. Startup accelerators provide early-stage companies with intensive mentorship, resources, and networking opportunities in exchange for equity, fostering rapid development and validation through structured programs. The optimal choice depends on the startup's growth phase, funding needs, and desired level of operational support.

Connection

Micro private equity and startup accelerators both fuel early-stage business growth by providing capital and strategic support. Micro private equity firms invest in promising startups, leveraging startup accelerator programs to identify scalable ventures with high growth potential. This synergy enhances market validation, resource access, and operational expertise critical for scaling innovative startups efficiently.

Key Terms

**Startup Accelerator:**

Startup accelerators provide early-stage companies with mentorship, seed funding, and a defined program to rapidly scale business models, often culminating in a demo day to attract investors. These accelerators emphasize intensive support within a fixed timeframe, fostering innovation and market validation. Discover how startup accelerators can drive your venture growth and investment readiness.

Cohort-based Program

Startup accelerators offer cohort-based programs designed to rapidly scale early-stage companies through mentorship, networking, and seed funding within a fixed timeframe, typically three to six months. In contrast, micro private equity focuses on acquiring and scaling mature small businesses with a longer investment horizon and hands-on operational involvement. Explore how each model's approach to cohort dynamics impacts growth strategies and investor returns.

Mentorship

Startup accelerators provide intensive mentorship programs aimed at early-stage companies, offering guidance on product development, market fit, and scaling strategies. Micro private equity firms focus on operational improvements and strategic growth through seasoned industry experts, often targeting more mature small businesses with proven revenue streams. Explore the distinct mentorship approaches and benefits each offers to better understand which suits your business goals.

Source and External Links

Startup accelerator - Wikipedia - Startup accelerators are fixed-term, cohort-based programs offering mentorship, seed investment (typically $20,000-$50,000), intensive training usually lasting around 3 months, and end with a demo day for startup pitches to investors; they emphasize rapid growth for small teams and competitive application processes.

32 Best Startup Accelerators 2025 - Leading accelerators like Y Combinator and Techstars provide funding, mentorship, and extensive networks to high-growth startups, with Y Combinator investing around $500,000 on standard terms and supporting companies like Airbnb and Coinbase.

Techstars: Building the World's Most Powerful Network for Founders - Techstars offers a 3-month mentorship-driven accelerator program with capital investment and a global network, supporting over 10,600 founders with a strong track record of companies raising capital post-program.

dowidth.com

dowidth.com