Bootstrapper toolkit empowers entrepreneurs with self-funding strategies, lean operations, and organic growth techniques to maintain full control and minimize debt. Private equity resources offer capital infusion, strategic guidance, and expanded networks, accelerating scalability but often requiring equity dilution. Explore how each funding avenue aligns with your business vision and growth objectives.

Why it is important

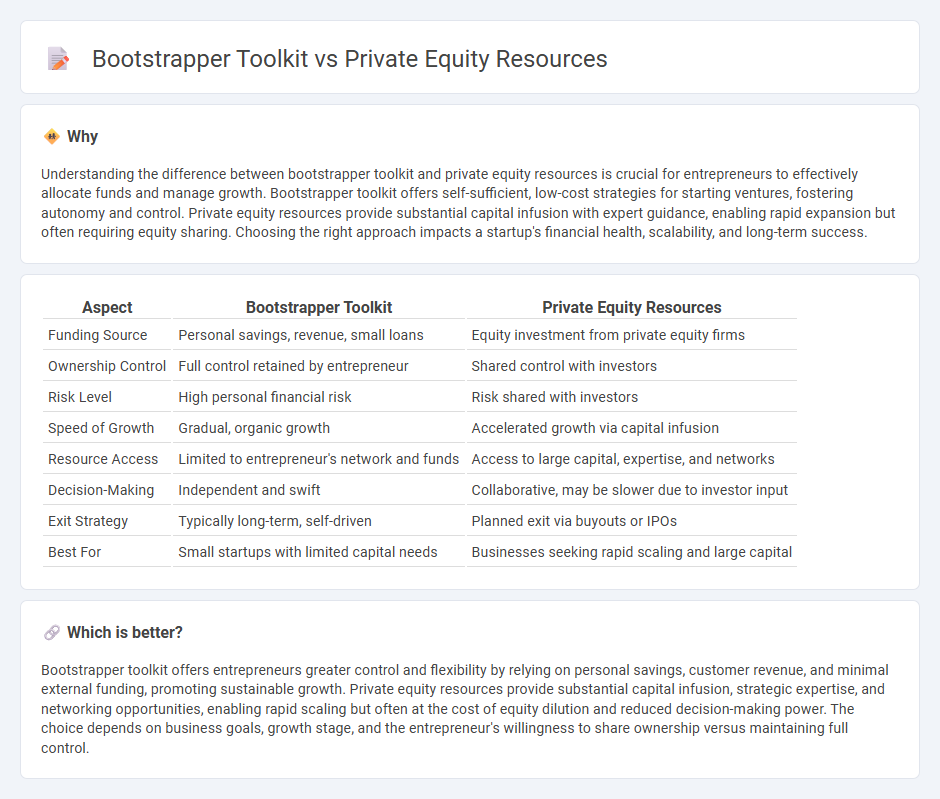

Understanding the difference between bootstrapper toolkit and private equity resources is crucial for entrepreneurs to effectively allocate funds and manage growth. Bootstrapper toolkit offers self-sufficient, low-cost strategies for starting ventures, fostering autonomy and control. Private equity resources provide substantial capital infusion with expert guidance, enabling rapid expansion but often requiring equity sharing. Choosing the right approach impacts a startup's financial health, scalability, and long-term success.

Comparison Table

| Aspect | Bootstrapper Toolkit | Private Equity Resources |

|---|---|---|

| Funding Source | Personal savings, revenue, small loans | Equity investment from private equity firms |

| Ownership Control | Full control retained by entrepreneur | Shared control with investors |

| Risk Level | High personal financial risk | Risk shared with investors |

| Speed of Growth | Gradual, organic growth | Accelerated growth via capital infusion |

| Resource Access | Limited to entrepreneur's network and funds | Access to large capital, expertise, and networks |

| Decision-Making | Independent and swift | Collaborative, may be slower due to investor input |

| Exit Strategy | Typically long-term, self-driven | Planned exit via buyouts or IPOs |

| Best For | Small startups with limited capital needs | Businesses seeking rapid scaling and large capital |

Which is better?

Bootstrapper toolkit offers entrepreneurs greater control and flexibility by relying on personal savings, customer revenue, and minimal external funding, promoting sustainable growth. Private equity resources provide substantial capital infusion, strategic expertise, and networking opportunities, enabling rapid scaling but often at the cost of equity dilution and reduced decision-making power. The choice depends on business goals, growth stage, and the entrepreneur's willingness to share ownership versus maintaining full control.

Connection

Bootstrappers leverage the toolkit of cost-effective strategies, such as lean operations and personal capital, to build ventures without external funding, aligning with private equity resources that focus on injecting capital to scale proven businesses. Private equity firms often scout bootstrapped companies demonstrating strong fundamentals and growth potential for strategic investment and expansion. The intersection lies in bootstrappers preparing sustainable startups that become attractive candidates for private equity funding, facilitating accelerated business growth phases.

Key Terms

Capital investment

Private equity resources provide substantial capital investment through external funding sources, enabling rapid business scaling and access to strategic expertise. Bootstrapper toolkit relies on personal savings and revenue reinvestment, emphasizing lean operations and organic growth without external liabilities. Discover the key differences and strategic implications of each capital investment approach to choose the best fit for your business goals.

Resourcefulness

Resourcefulness defines the stark contrast between private equity resources and the bootstrapper toolkit, with private equity firms leveraging extensive capital, professional networks, and strategic expertise to accelerate growth and mitigate risks. Bootstrappers rely heavily on creativity, lean operations, and adaptability, maximizing limited funds and human resources to validate ideas and sustain businesses. Discover how mastering resourcefulness can optimize your growth strategy and operational efficiency.

Ownership retention

Private equity resources often provide significant capital infusion, professional networks, and strategic guidance, enabling rapid business scaling while typically involving partial ownership dilution. In contrast, the bootstrapper toolkit emphasizes organic growth through reinvested earnings and resourcefulness, prioritizing full ownership retention and control but often limiting the speed of expansion. Discover how choosing between these approaches impacts long-term ownership retention and business autonomy.

Source and External Links

Private Equity: What You Need to Know - KKR - Learn about private equity strategies, how private equity funds operate, and key approaches to improving portfolio companies' performance through management, strategy, and capital structure optimization.

Private Equity Solutions | Asset Management - Commonfund - Overview of CF Private Equity's global private equity investment solutions, focusing on diversified strategies including primaries, secondaries, and co-investments, with customizable portfolios for institutional investors.

Private Equity 101 | Institutional Limited Partners Association - Introduction to private equity as a source of capital and economic growth, explaining its long-term investment nature, active management strategies, and the roles of limited partners and general partners in private equity funds.

dowidth.com

dowidth.com