Entrepreneurship in the digital economy increasingly focuses on digital collectibles and creator coins as innovative assets transforming how creators monetize their work and engage audiences. Digital collectibles, often secured by blockchain technology, provide unique, verifiable ownership of digital art and media, while creator coins enable personalized currencies that fans use to access exclusive content and experiences. Explore how these emerging tools redefine value exchange and entrepreneurial opportunities in the digital age.

Why it is important

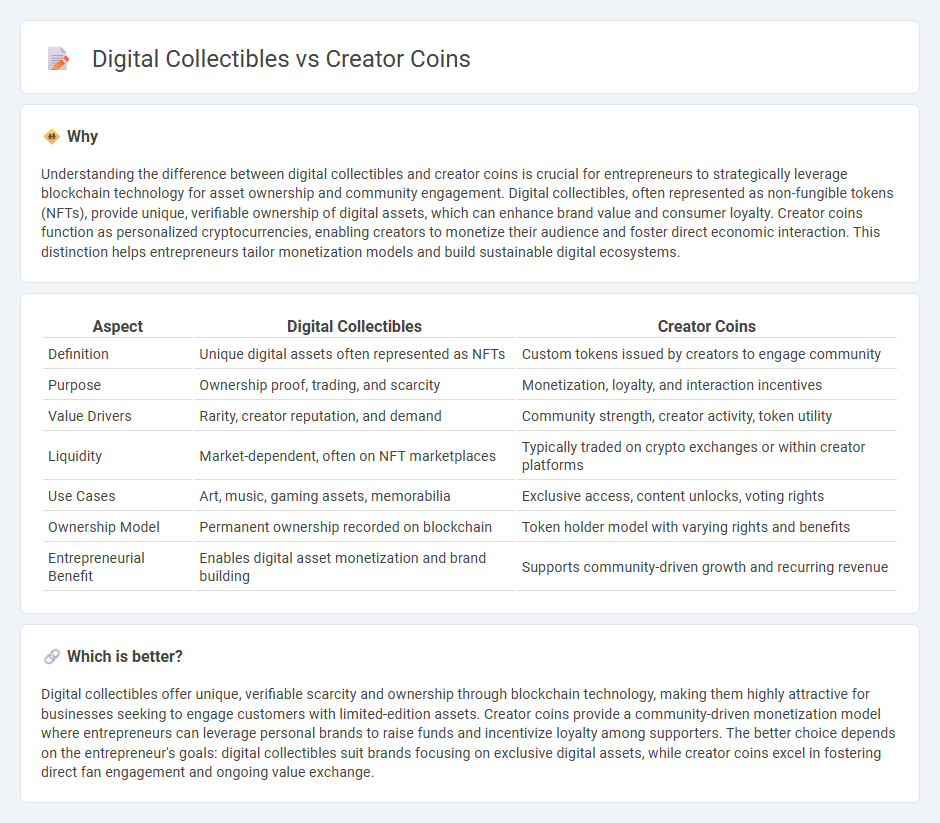

Understanding the difference between digital collectibles and creator coins is crucial for entrepreneurs to strategically leverage blockchain technology for asset ownership and community engagement. Digital collectibles, often represented as non-fungible tokens (NFTs), provide unique, verifiable ownership of digital assets, which can enhance brand value and consumer loyalty. Creator coins function as personalized cryptocurrencies, enabling creators to monetize their audience and foster direct economic interaction. This distinction helps entrepreneurs tailor monetization models and build sustainable digital ecosystems.

Comparison Table

| Aspect | Digital Collectibles | Creator Coins |

|---|---|---|

| Definition | Unique digital assets often represented as NFTs | Custom tokens issued by creators to engage community |

| Purpose | Ownership proof, trading, and scarcity | Monetization, loyalty, and interaction incentives |

| Value Drivers | Rarity, creator reputation, and demand | Community strength, creator activity, token utility |

| Liquidity | Market-dependent, often on NFT marketplaces | Typically traded on crypto exchanges or within creator platforms |

| Use Cases | Art, music, gaming assets, memorabilia | Exclusive access, content unlocks, voting rights |

| Ownership Model | Permanent ownership recorded on blockchain | Token holder model with varying rights and benefits |

| Entrepreneurial Benefit | Enables digital asset monetization and brand building | Supports community-driven growth and recurring revenue |

Which is better?

Digital collectibles offer unique, verifiable scarcity and ownership through blockchain technology, making them highly attractive for businesses seeking to engage customers with limited-edition assets. Creator coins provide a community-driven monetization model where entrepreneurs can leverage personal brands to raise funds and incentivize loyalty among supporters. The better choice depends on the entrepreneur's goals: digital collectibles suit brands focusing on exclusive digital assets, while creator coins excel in fostering direct fan engagement and ongoing value exchange.

Connection

Digital collectibles leverage blockchain technology to establish scarcity and ownership, creating unique assets that can be traded or sold. Creator coins function as personalized cryptocurrencies that empower entrepreneurs and content creators to monetize their audience directly. Both innovations enable new revenue streams and community engagement models, transforming traditional entrepreneurship through decentralized digital economies.

Key Terms

Tokenization

Creator coins leverage tokenization to represent personal brands or individual creators, enabling fans to invest directly in their success through unique, tradable tokens. Digital collectibles, often implemented as non-fungible tokens (NFTs), use tokenization to authenticate ownership and provenance of digital assets such as art, music, or virtual items. Explore how tokenization transforms digital economies by deepening understanding of creator coins and digital collectibles.

Ownership

Creator coins represent a form of digital currency tied directly to an individual's personal brand or creative output, granting holders a unique stake in the creator's community or projects. Digital collectibles, such as NFTs, emphasize verifiable ownership of exclusive digital assets like art, music, or virtual goods, secured by blockchain technology. Explore deeper insights into how these ownership models redefine value in the digital economy.

Monetization

Creator coins enable direct monetization by allowing fans to invest in and support creators with personalized tokens that often fluctuate in value based on the creator's popularity and engagement. Digital collectibles, such as NFTs, generate revenue through one-time purchases, resale royalties, and exclusivity of unique digital assets verified on blockchain platforms. Explore how these two innovative monetization methods empower creators to build sustainable income models in the digital economy.

Source and External Links

Creator Coins Why And How They Work For Business - Creator coins are unique digital currencies tied to creators that foster community engagement, offer exclusive rewards, and create customized economic ecosystems by leveraging blockchain technology, mainly Ethereum, enabling direct creator-fan interactions and incentivized participation.

What are Creator Coins? | Guides - Sanctum docs - Creator Coins on the Solana blockchain are liquid staking tokens linked to individual creators, allowing fans to support creators effortlessly by holding their coins, with staking yields automatically pledged to creators and no lock-in or minimum investment required.

Creator Coins | DeSo * Decentralized Social Media - On the DeSo platform, every profile has a scarce creator coin that can be bought or sold with prices increasing automatically as demand grows, creating a price curve that locks funds into the profile and fosters an on-chain economy directly benefiting creators and their communities.

dowidth.com

dowidth.com