Bootstrapper toolkits empower entrepreneurs to launch ventures using minimal personal resources, promoting financial independence and creative problem-solving. Small business loan services provide access to external capital, enabling faster growth and larger-scale operations through structured financing options. Explore the benefits and challenges of both approaches to determine the best funding strategy for your entrepreneurial journey.

Why it is important

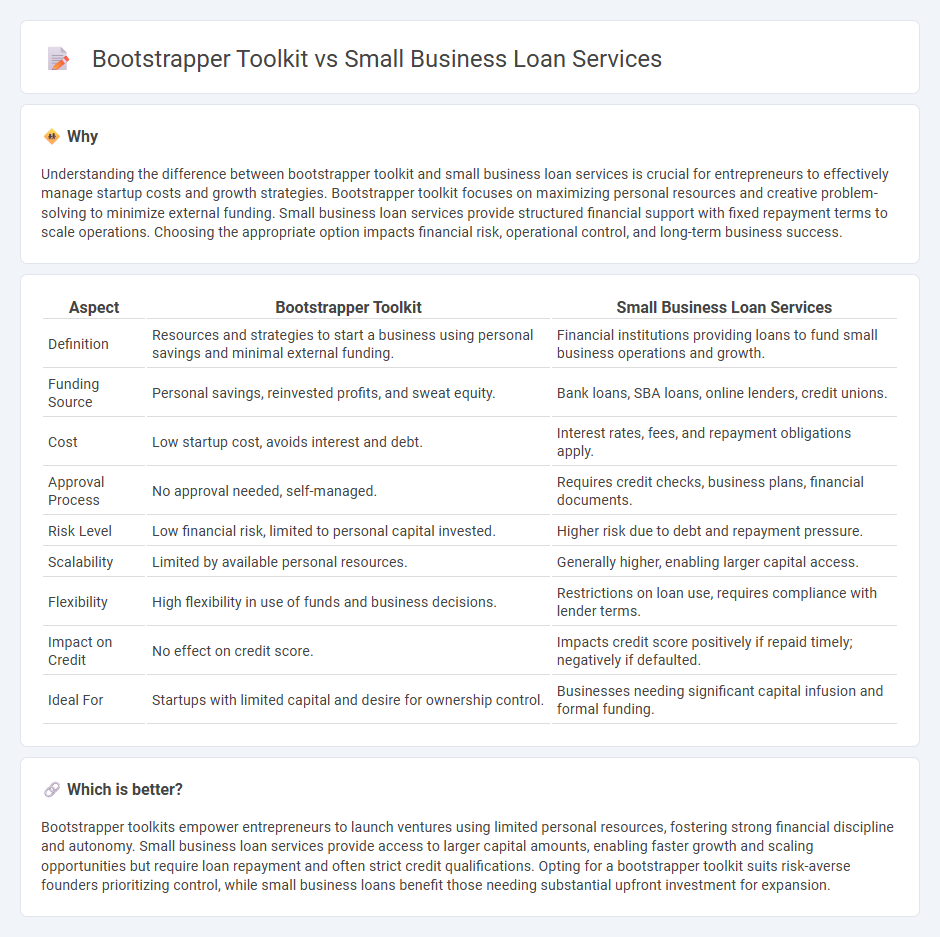

Understanding the difference between bootstrapper toolkit and small business loan services is crucial for entrepreneurs to effectively manage startup costs and growth strategies. Bootstrapper toolkit focuses on maximizing personal resources and creative problem-solving to minimize external funding. Small business loan services provide structured financial support with fixed repayment terms to scale operations. Choosing the appropriate option impacts financial risk, operational control, and long-term business success.

Comparison Table

| Aspect | Bootstrapper Toolkit | Small Business Loan Services |

|---|---|---|

| Definition | Resources and strategies to start a business using personal savings and minimal external funding. | Financial institutions providing loans to fund small business operations and growth. |

| Funding Source | Personal savings, reinvested profits, and sweat equity. | Bank loans, SBA loans, online lenders, credit unions. |

| Cost | Low startup cost, avoids interest and debt. | Interest rates, fees, and repayment obligations apply. |

| Approval Process | No approval needed, self-managed. | Requires credit checks, business plans, financial documents. |

| Risk Level | Low financial risk, limited to personal capital invested. | Higher risk due to debt and repayment pressure. |

| Scalability | Limited by available personal resources. | Generally higher, enabling larger capital access. |

| Flexibility | High flexibility in use of funds and business decisions. | Restrictions on loan use, requires compliance with lender terms. |

| Impact on Credit | No effect on credit score. | Impacts credit score positively if repaid timely; negatively if defaulted. |

| Ideal For | Startups with limited capital and desire for ownership control. | Businesses needing significant capital infusion and formal funding. |

Which is better?

Bootstrapper toolkits empower entrepreneurs to launch ventures using limited personal resources, fostering strong financial discipline and autonomy. Small business loan services provide access to larger capital amounts, enabling faster growth and scaling opportunities but require loan repayment and often strict credit qualifications. Opting for a bootstrapper toolkit suits risk-averse founders prioritizing control, while small business loans benefit those needing substantial upfront investment for expansion.

Connection

Bootstrapper toolkits empower entrepreneurs to launch ventures using minimal personal resources, fostering financial discipline and resourcefulness. Small business loan services provide essential external funding that complements bootstrapped efforts, enabling scalability and operational expansion beyond initial constraints. The strategic integration of bootstrapper toolkits with loan services enhances startup sustainability and growth potential in competitive markets.

Key Terms

Capital access

Small business loan services provide external capital through banks, credit unions, or online lenders, facilitating cash flow for growth, inventory, or equipment. Bootstrapper toolkits emphasize internal funding by optimizing cash management, reducing costs, and leveraging personal savings, maintaining full ownership without debt. Explore detailed strategies to decide which capital access method suits your business needs best.

Self-funding

Self-funding through a bootstrapper toolkit allows entrepreneurs to maintain complete control over their business finances without incurring debt, leveraging personal savings, revenue, and resourcefulness to fuel growth. Small business loan services provide external capital injections with structured repayment plans, often requiring credit checks, collateral, and interest payments that can impact cash flow. Discover how choosing between these financing methods influences your business's financial health and growth strategy.

Financial management

Small business loan services offer external capital essential for growth, providing access to substantial funds that enable operational expansion and inventory acquisition. The bootstrapper toolkit emphasizes self-reliance and resource management, encouraging entrepreneurs to optimize cash flow, minimize expenses, and leverage internal assets without incurring debt. Discover effective financial management strategies by exploring how each approach can enhance your business stability and scalability.

Source and External Links

Loans | U.S. Small Business Administration - The SBA provides various types of guaranteed loans through approved lenders, including the 7(a) program, CDC/504 loans, and microloans to help small businesses get funding with lower risk for lenders.

Small Business Loans and Lines of Credit | Wells Fargo - Wells Fargo offers small business loans, business credit cards, SBA loans, and secured/unsecured lines of credit tailored to growth needs with loan amounts ranging from $5,000 up to $15 million.

Best Small Business Loans: $1k - $5M | LendingTree - LendingTree aggregates loan options from traditional banks, credit unions, and online lenders, featuring options like Fundbox, which is well-suited for startups with minimal operating history and offers quick funding.

dowidth.com

dowidth.com