Sweat equity marketplaces enable entrepreneurs to exchange their time and skills for ownership stakes in startups, fostering collaboration without immediate financial investment. Equity crowdfunding allows a broad base of investors to financially support startups in exchange for equity, democratizing access to capital. Discover how these innovative funding models can accelerate your entrepreneurial journey.

Why it is important

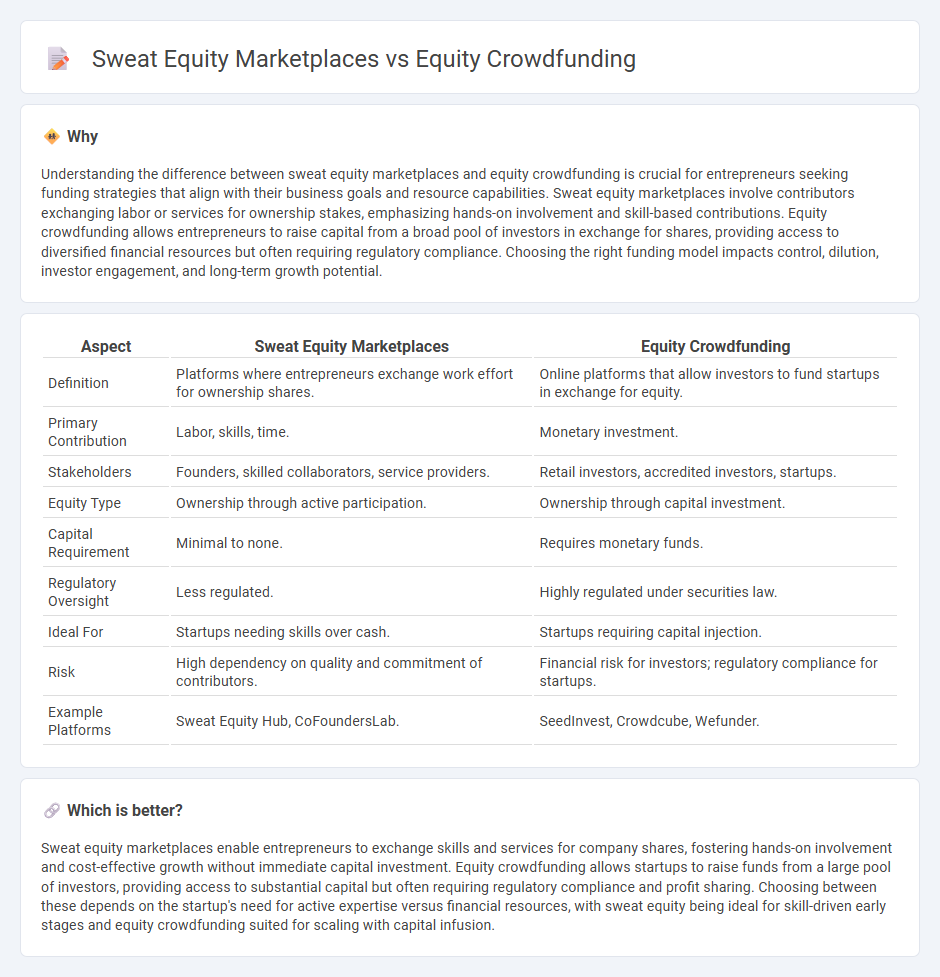

Understanding the difference between sweat equity marketplaces and equity crowdfunding is crucial for entrepreneurs seeking funding strategies that align with their business goals and resource capabilities. Sweat equity marketplaces involve contributors exchanging labor or services for ownership stakes, emphasizing hands-on involvement and skill-based contributions. Equity crowdfunding allows entrepreneurs to raise capital from a broad pool of investors in exchange for shares, providing access to diversified financial resources but often requiring regulatory compliance. Choosing the right funding model impacts control, dilution, investor engagement, and long-term growth potential.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Equity Crowdfunding |

|---|---|---|

| Definition | Platforms where entrepreneurs exchange work effort for ownership shares. | Online platforms that allow investors to fund startups in exchange for equity. |

| Primary Contribution | Labor, skills, time. | Monetary investment. |

| Stakeholders | Founders, skilled collaborators, service providers. | Retail investors, accredited investors, startups. |

| Equity Type | Ownership through active participation. | Ownership through capital investment. |

| Capital Requirement | Minimal to none. | Requires monetary funds. |

| Regulatory Oversight | Less regulated. | Highly regulated under securities law. |

| Ideal For | Startups needing skills over cash. | Startups requiring capital injection. |

| Risk | High dependency on quality and commitment of contributors. | Financial risk for investors; regulatory compliance for startups. |

| Example Platforms | Sweat Equity Hub, CoFoundersLab. | SeedInvest, Crowdcube, Wefunder. |

Which is better?

Sweat equity marketplaces enable entrepreneurs to exchange skills and services for company shares, fostering hands-on involvement and cost-effective growth without immediate capital investment. Equity crowdfunding allows startups to raise funds from a large pool of investors, providing access to substantial capital but often requiring regulatory compliance and profit sharing. Choosing between these depends on the startup's need for active expertise versus financial resources, with sweat equity being ideal for skill-driven early stages and equity crowdfunding suited for scaling with capital infusion.

Connection

Sweat equity marketplaces enable entrepreneurs to invest their skills and time in startups in exchange for ownership shares, aligning incentives between founders and contributors. Equity crowdfunding platforms complement this by providing a means to raise capital from a large pool of investors, democratizing access to funding. Both mechanisms empower startups to leverage community resources and accelerate growth without relying solely on traditional venture capital.

Key Terms

Ownership Stake

Equity crowdfunding platforms enable investors to acquire ownership stakes by purchasing shares in startups or growing companies, often through regulated online portals. Sweat equity marketplaces, on the other hand, allow contributors to earn ownership by exchanging their skills, time, or services for equity rather than cash investment. Explore how these distinct models impact ownership distribution and investor roles in emerging ventures.

Capital Contribution

Equity crowdfunding platforms enable investors to provide capital contributions in exchange for ownership stakes, facilitating fundraising for startups through collective monetary investments. Sweat equity marketplaces allow founders and contributors to exchange services, skills, or time, translating non-monetary efforts into equity shares without direct cash input. Explore the differences and benefits of these capital contribution models to optimize your startup funding strategy.

Value Exchange

Equity crowdfunding platforms enable startups to raise capital by offering shares in exchange for financial investment, facilitating a direct value exchange between investors and entrepreneurs. Sweat equity marketplaces focus on trading labor, skills, or services for ownership stakes, allowing contributors to invest time and expertise instead of cash. Explore the unique benefits and mechanisms of both models to understand how they optimize value exchange in early-stage ventures.

Source and External Links

Equity Crowdfunding - Definition, Pros, Cons, Regulations - Equity crowdfunding is a method for startups and early-stage companies to raise capital by offering securities to many investors, each receiving a proportional equity stake, typically facilitated via online platforms like Wefunder and StartEngine.

Equity crowdfunding - Wikipedia - Equity crowdfunding allows a broad group of investors to fund startups and small businesses online in exchange for equity ownership, bridging capital markets and subject to financial regulation.

Equity Crowdfunding: What It Is and How to Get It - NerdWallet - Legally permitted in the U.S. under SEC rules, equity crowdfunding enables companies to raise up to $5 million annually from accredited and non-accredited investors without incurring debt, but requires compliance with securities regulations and fiduciary duties.

dowidth.com

dowidth.com