Exit-ready startups focus on rapid growth and innovation with clear plans for acquisition or IPO, targeting scalable markets and high investor returns. Small and medium enterprises (SMEs) emphasize steady cash flow, local market presence, and long-term business sustainability with modest growth expectations. Discover key differences in strategies and goals by exploring exit-ready startups versus SMEs.

Why it is important

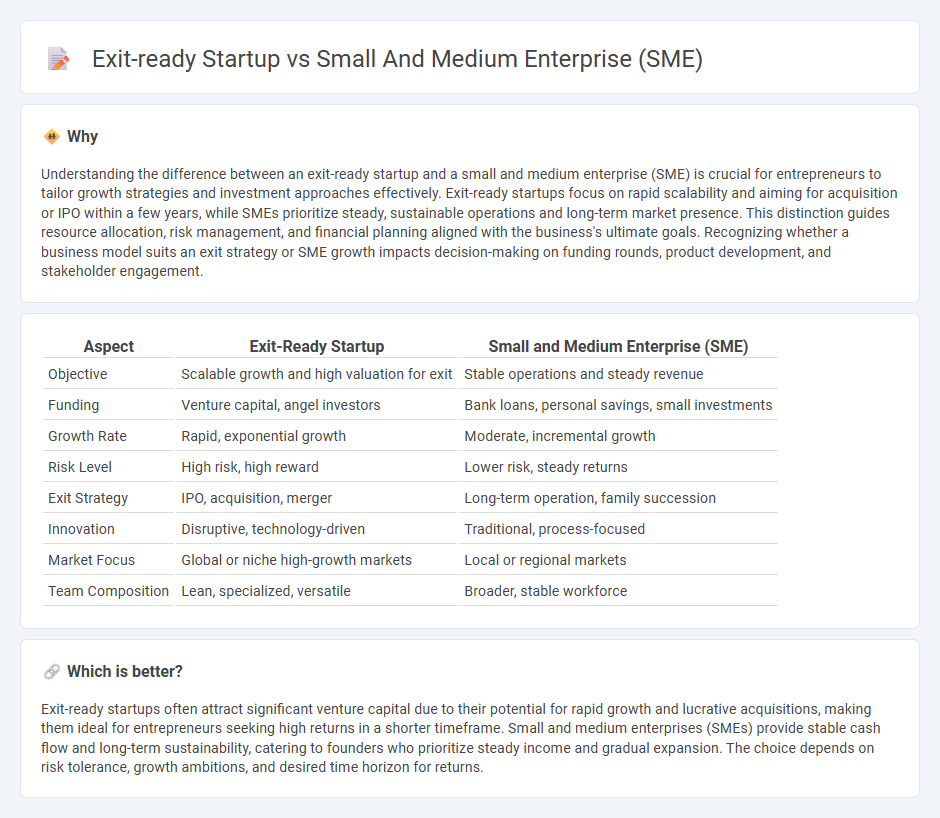

Understanding the difference between an exit-ready startup and a small and medium enterprise (SME) is crucial for entrepreneurs to tailor growth strategies and investment approaches effectively. Exit-ready startups focus on rapid scalability and aiming for acquisition or IPO within a few years, while SMEs prioritize steady, sustainable operations and long-term market presence. This distinction guides resource allocation, risk management, and financial planning aligned with the business's ultimate goals. Recognizing whether a business model suits an exit strategy or SME growth impacts decision-making on funding rounds, product development, and stakeholder engagement.

Comparison Table

| Aspect | Exit-Ready Startup | Small and Medium Enterprise (SME) |

|---|---|---|

| Objective | Scalable growth and high valuation for exit | Stable operations and steady revenue |

| Funding | Venture capital, angel investors | Bank loans, personal savings, small investments |

| Growth Rate | Rapid, exponential growth | Moderate, incremental growth |

| Risk Level | High risk, high reward | Lower risk, steady returns |

| Exit Strategy | IPO, acquisition, merger | Long-term operation, family succession |

| Innovation | Disruptive, technology-driven | Traditional, process-focused |

| Market Focus | Global or niche high-growth markets | Local or regional markets |

| Team Composition | Lean, specialized, versatile | Broader, stable workforce |

Which is better?

Exit-ready startups often attract significant venture capital due to their potential for rapid growth and lucrative acquisitions, making them ideal for entrepreneurs seeking high returns in a shorter timeframe. Small and medium enterprises (SMEs) provide stable cash flow and long-term sustainability, catering to founders who prioritize steady income and gradual expansion. The choice depends on risk tolerance, growth ambitions, and desired time horizon for returns.

Connection

Exit-ready startups and small and medium enterprises (SMEs) share a strategic focus on scalable business models and robust financial health to attract investors for successful exits. Both prioritize comprehensive market validation, streamlined operations, and strong growth trajectories to maximize valuation during acquisition or IPO processes. Effective exit planning integrates these elements, ensuring SMEs transition smoothly into exit-ready entities with heightened appeal to potential buyers.

Key Terms

Growth Potential

Small and medium enterprises (SMEs) typically demonstrate steady and sustainable growth with established customer bases and predictable revenue streams, whereas exit-ready startups prioritize rapid scalability and high growth potential to attract investors and achieve lucrative exits. Startups often emphasize innovation, disruptive technology, and market expansion opportunities to maximize valuation before exit events such as acquisitions or IPOs. Explore detailed strategies and metrics that differentiate SMEs from exit-ready startups in terms of growth potential to optimize your business approach.

Scalability

Small and medium enterprises (SMEs) typically focus on steady growth and sustaining market presence, with scalability often limited by resources and operational models. Exit-ready startups prioritize rapid scalability and investor appeal, leveraging innovative technology and aggressive market expansion to attract acquisition or initial public offering opportunities. Discover how scalability strategies differ fundamentally between SMEs and exit-ready startups to optimize business growth and exit potential.

Exit Strategy

A small and medium enterprise (SME) typically prioritizes steady growth and long-term sustainability, focusing on operational efficiency and market expansion. An exit-ready startup, conversely, centers its strategy on rapid scalability with clear plans for acquisition, merger, or initial public offering (IPO) to maximize investor returns. Discover how distinct exit strategies shape the future trajectory of SMEs versus startups.

Source and External Links

Small and medium enterprises - SMEs are businesses with personnel and revenue below specific limits, making up 90% of global companies and over 50% of employment; they drive innovation and competition but face significant financing gaps, especially for women-owned firms.

Small & medium-sized enterprises - SMEs are independent firms with employee thresholds varying by country (commonly up to 250 employees), accounting for over 95% of firms worldwide and being key sources of job creation, economic growth, and social integration.

SMEs: what are they and what are their characteristics? - The European Commission defines SMEs as companies with no more than 250 employees and annual turnover no greater than 50 million euros, subdividing them into micro, small, and medium enterprises based on size and financial metrics.

dowidth.com

dowidth.com