Passive income streams generate revenue with minimal ongoing effort, often through investments, rental properties, or royalties, providing financial stability without active management. Scalable income streams, common in entrepreneurship, increase revenue exponentially by leveraging technology, digital products, or services that can grow without proportional increases in costs or labor. Discover how to balance these income approaches to maximize entrepreneurial success.

Why it is important

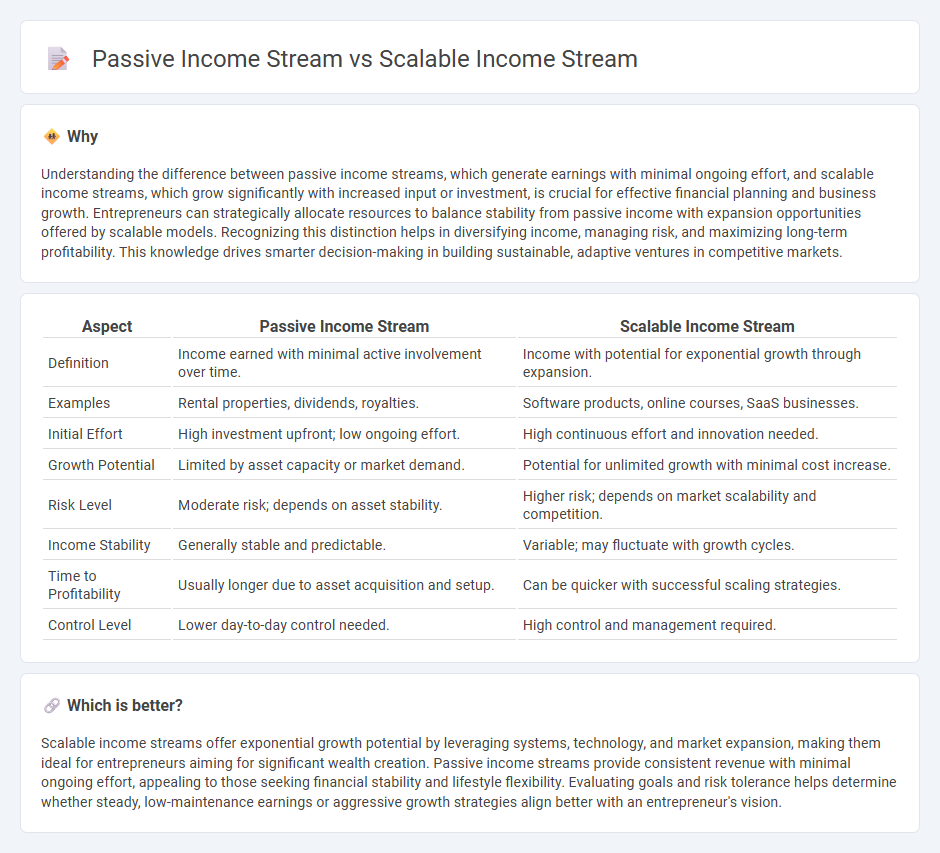

Understanding the difference between passive income streams, which generate earnings with minimal ongoing effort, and scalable income streams, which grow significantly with increased input or investment, is crucial for effective financial planning and business growth. Entrepreneurs can strategically allocate resources to balance stability from passive income with expansion opportunities offered by scalable models. Recognizing this distinction helps in diversifying income, managing risk, and maximizing long-term profitability. This knowledge drives smarter decision-making in building sustainable, adaptive ventures in competitive markets.

Comparison Table

| Aspect | Passive Income Stream | Scalable Income Stream |

|---|---|---|

| Definition | Income earned with minimal active involvement over time. | Income with potential for exponential growth through expansion. |

| Examples | Rental properties, dividends, royalties. | Software products, online courses, SaaS businesses. |

| Initial Effort | High investment upfront; low ongoing effort. | High continuous effort and innovation needed. |

| Growth Potential | Limited by asset capacity or market demand. | Potential for unlimited growth with minimal cost increase. |

| Risk Level | Moderate risk; depends on asset stability. | Higher risk; depends on market scalability and competition. |

| Income Stability | Generally stable and predictable. | Variable; may fluctuate with growth cycles. |

| Time to Profitability | Usually longer due to asset acquisition and setup. | Can be quicker with successful scaling strategies. |

| Control Level | Lower day-to-day control needed. | High control and management required. |

Which is better?

Scalable income streams offer exponential growth potential by leveraging systems, technology, and market expansion, making them ideal for entrepreneurs aiming for significant wealth creation. Passive income streams provide consistent revenue with minimal ongoing effort, appealing to those seeking financial stability and lifestyle flexibility. Evaluating goals and risk tolerance helps determine whether steady, low-maintenance earnings or aggressive growth strategies align better with an entrepreneur's vision.

Connection

Passive income streams generate revenue with minimal ongoing effort, enabling entrepreneurs to focus on developing scalable income streams that grow exponentially without a linear increase in labor or resources. Scalable income models, such as digital products or subscription services, leverage automation and technology to expand market reach and maximize profitability. Entrepreneurs use passive income to reinvest in scalable ventures, creating a synergistic cycle that enhances financial stability and business growth.

Key Terms

Revenue Growth

A scalable income stream allows revenue growth by increasing output without a proportional rise in costs, enabling higher profit margins as sales expand. Passive income streams generate earnings with minimal ongoing effort but often exhibit limited scalability due to fixed payout structures or resource constraints. Explore detailed strategies to maximize income growth through scalable revenue models.

Automation

A scalable income stream leverages automation to increase revenue without a proportional increase in effort or time, enabling growth beyond fixed limits. Passive income streams may generate revenue with minimal ongoing effort but often lack the built-in scalability that automation provides for exponential expansion. Explore how integrating advanced automation can transform your income strategy and maximize scalability.

Time Investment

A scalable income stream requires an upfront investment of significant time and effort to build systems or products that can grow without a proportional increase in workload, while a passive income stream involves minimal ongoing time investment after the initial setup. Scalable income often leverages technology, automation, or outsourcing to expand revenue potential with limited additional time commitment. Explore strategies to optimize your time investment and maximize income potential.

Source and External Links

Scale Your One-Person Business - Michael Lim - Scalable income involves creating products or services where the cost of creation is fixed and revenue potential is unlimited, allowing income growth without trading time directly for money, unlike traditional jobs tied to fixed hourly output.

How to create multiple streams of income: 10 ideas for financial growth - Examples of scalable income streams include selling digital products or investing in rental properties, where products or assets generate ongoing revenue with minimal ongoing effort after initial setup.

36 Passive Income Ideas To Make Money in 2025 - Shopify - Passive income streams like blogging allow scalable earnings by creating content once and monetizing it repeatedly through ads, affiliate marketing, and product sales, growing income without proportional time increases.

dowidth.com

dowidth.com