Entrepreneurship offers diverse avenues for generating revenue, notably through passive income streams and side hustles, each having unique benefits and operational demands. Passive income streams, such as rental properties or dividend stocks, provide ongoing earnings with minimal active involvement, while side hustles require consistent effort but can rapidly enhance skill sets and immediate cash flow. Explore how these approaches can complement your entrepreneurial journey and unlock financial freedom.

Why it is important

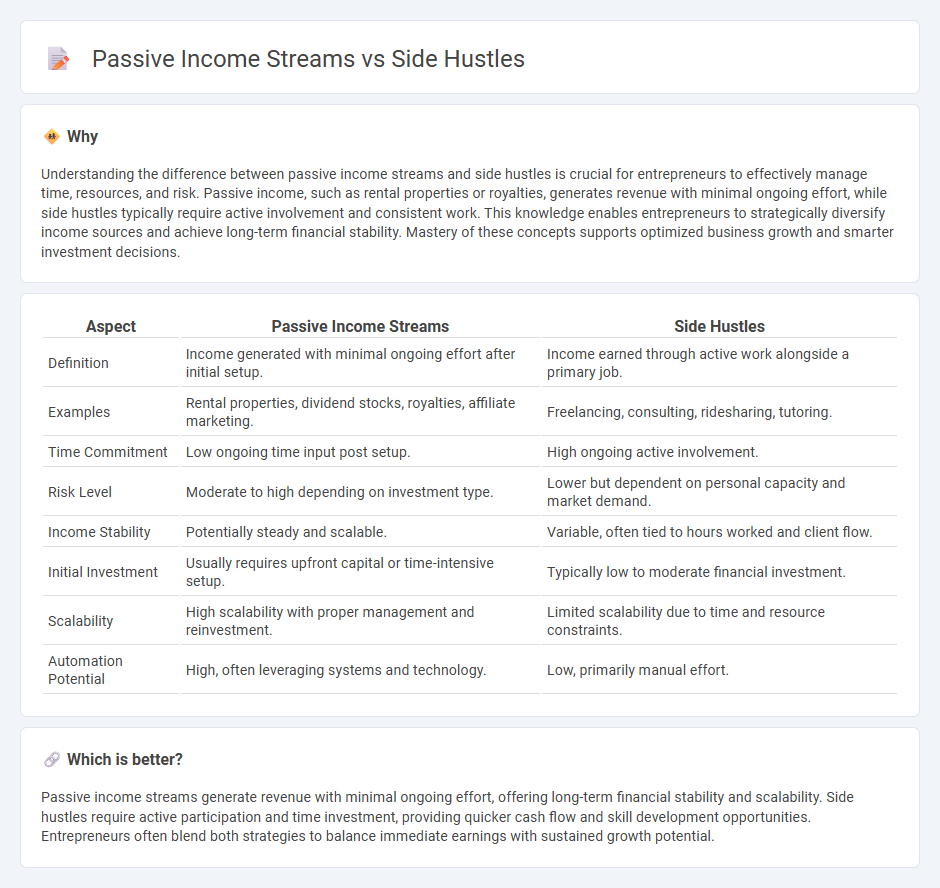

Understanding the difference between passive income streams and side hustles is crucial for entrepreneurs to effectively manage time, resources, and risk. Passive income, such as rental properties or royalties, generates revenue with minimal ongoing effort, while side hustles typically require active involvement and consistent work. This knowledge enables entrepreneurs to strategically diversify income sources and achieve long-term financial stability. Mastery of these concepts supports optimized business growth and smarter investment decisions.

Comparison Table

| Aspect | Passive Income Streams | Side Hustles |

|---|---|---|

| Definition | Income generated with minimal ongoing effort after initial setup. | Income earned through active work alongside a primary job. |

| Examples | Rental properties, dividend stocks, royalties, affiliate marketing. | Freelancing, consulting, ridesharing, tutoring. |

| Time Commitment | Low ongoing time input post setup. | High ongoing active involvement. |

| Risk Level | Moderate to high depending on investment type. | Lower but dependent on personal capacity and market demand. |

| Income Stability | Potentially steady and scalable. | Variable, often tied to hours worked and client flow. |

| Initial Investment | Usually requires upfront capital or time-intensive setup. | Typically low to moderate financial investment. |

| Scalability | High scalability with proper management and reinvestment. | Limited scalability due to time and resource constraints. |

| Automation Potential | High, often leveraging systems and technology. | Low, primarily manual effort. |

Which is better?

Passive income streams generate revenue with minimal ongoing effort, offering long-term financial stability and scalability. Side hustles require active participation and time investment, providing quicker cash flow and skill development opportunities. Entrepreneurs often blend both strategies to balance immediate earnings with sustained growth potential.

Connection

Passive income streams and side hustles are interconnected pathways to financial independence, where side hustles often serve as active ventures that can be scaled or systematized into passive income sources. Entrepreneurs leverage skills, digital platforms, and automation tools to transition time-intensive projects into ongoing revenue with minimal daily involvement. This strategic shift maximizes earning potential while diversifying income, mitigating risks associated with traditional employment.

Key Terms

Active Involvement

Side hustles require active involvement, often demanding consistent time and effort alongside a primary job, making them suitable for those seeking immediate supplemental income. Passive income streams generate revenue with minimal ongoing effort after initial setup, leveraging investments in assets like rental properties, royalties, or online businesses. Explore detailed strategies to balance effort and earnings for sustainable financial growth.

Scalability

Side hustles often require active involvement, limiting scalability due to time constraints and effort dependence. Passive income streams, such as investments or automated digital products, offer higher scalability by generating revenue with minimal ongoing input. Explore effective strategies to maximize scalable income opportunities and grow your financial portfolio.

Automation

Side hustles often require active involvement and time investment, whereas passive income streams leverage automation to generate revenue with minimal ongoing effort. Automation tools such as AI-driven marketing, automated sales funnels, and subscription billing systems enable scaling of passive income effectively. Discover strategies to automate your income streams and maximize financial freedom.

Source and External Links

30 Side Hustle Ideas That Don't Need Experience (2025) - Shopify - Offers 30 diverse side hustle ideas that require no prior experience, including monetizing a YouTube channel, starting a blog, affiliate marketing, and offering virtual services, suitable for generating extra income with just a few hours weekly.

48 Side Hustle Ideas to Get You Started - Provides creative and practical side hustle examples such as starting a tour guide service, becoming an Amazon affiliate, and offering consulting on adult life skills, highlighting minimal startup costs and potential passive income streams.

26 Ways to Make Money Online, Offline and at Home in 2025 - NerdWallet - Details ways to make money including freelance jobs and private tutoring, specifying that tutoring can be profitable and flexible either online or in-person, depending on expertise and demand.

dowidth.com

dowidth.com