Alternative funding platforms such as crowdfunding, angel investors, and venture capital provide entrepreneurs with diversified financial resources that can accelerate business growth and reduce personal financial risk compared to bootstrapping. Bootstrapping involves self-funding early-stage projects relying on personal savings and revenue reinvestment, fostering lean operations and full ownership but possibly limiting scalability. Explore more insights on how these funding strategies impact startup success and decision-making.

Why it is important

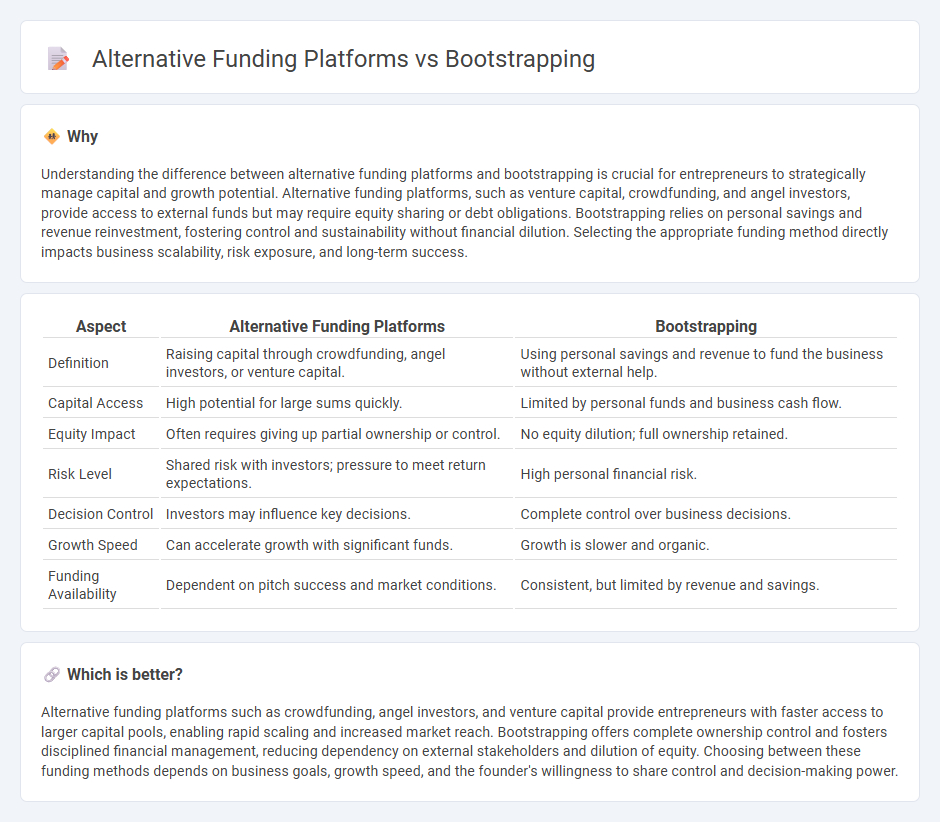

Understanding the difference between alternative funding platforms and bootstrapping is crucial for entrepreneurs to strategically manage capital and growth potential. Alternative funding platforms, such as venture capital, crowdfunding, and angel investors, provide access to external funds but may require equity sharing or debt obligations. Bootstrapping relies on personal savings and revenue reinvestment, fostering control and sustainability without financial dilution. Selecting the appropriate funding method directly impacts business scalability, risk exposure, and long-term success.

Comparison Table

| Aspect | Alternative Funding Platforms | Bootstrapping |

|---|---|---|

| Definition | Raising capital through crowdfunding, angel investors, or venture capital. | Using personal savings and revenue to fund the business without external help. |

| Capital Access | High potential for large sums quickly. | Limited by personal funds and business cash flow. |

| Equity Impact | Often requires giving up partial ownership or control. | No equity dilution; full ownership retained. |

| Risk Level | Shared risk with investors; pressure to meet return expectations. | High personal financial risk. |

| Decision Control | Investors may influence key decisions. | Complete control over business decisions. |

| Growth Speed | Can accelerate growth with significant funds. | Growth is slower and organic. |

| Funding Availability | Dependent on pitch success and market conditions. | Consistent, but limited by revenue and savings. |

Which is better?

Alternative funding platforms such as crowdfunding, angel investors, and venture capital provide entrepreneurs with faster access to larger capital pools, enabling rapid scaling and increased market reach. Bootstrapping offers complete ownership control and fosters disciplined financial management, reducing dependency on external stakeholders and dilution of equity. Choosing between these funding methods depends on business goals, growth speed, and the founder's willingness to share control and decision-making power.

Connection

Alternative funding platforms and bootstrapping are interconnected as both provide entrepreneurs with essential financial resources outside traditional venture capital or bank loans. Bootstrapping relies on personal savings and revenue reinvestment, while alternative funding platforms, such as crowdfunding and peer-to-peer lending, offer accessible capital by leveraging community support and digital technology. This synergy enables startups to maintain control while scaling operations efficiently through diverse, innovative financing methods.

Key Terms

Self-financing

Self-financing, a core bootstrapping method, allows entrepreneurs to maintain full control over their business without external debt or equity dilution, fostering organic growth through personal savings or reinvested profits. Alternative funding platforms like crowdfunding, angel investors, or venture capital provide rapid capital influx but often require equity sharing or influence on business decisions. Explore the advantages and challenges of self-financing to determine its suitability for your startup growth strategy.

Venture Capital

Bootstrapping involves self-funding a startup using personal savings or operational revenue, offering full control but limited capital growth potential. Venture capital provides substantial funding in exchange for equity, accelerating expansion with expert guidance from investors specialized in scaling startups. Explore the advantages and challenges of venture capital versus alternative funding to determine the optimal path for your business growth.

Crowdfunding

Crowdfunding provides startups with access to capital by raising small amounts of money from a large number of people, offering an alternative to traditional bootstrapping or venture capital. Platforms like Kickstarter and Indiegogo enable entrepreneurs to validate their ideas and gain market exposure while minimizing personal financial risk. Explore how crowdfunding can accelerate your business growth and compare its benefits with other funding options.

Source and External Links

Bootstrapping - Overview, Stages, and Advantages - Bootstrapping is the process of building a business from scratch without attracting external investment or with minimal capital, relying mostly on internal financing and gradual growth stages such as using savings, customer funds, and eventually credit or loans for expansion.

Bootstrapping (statistics) - In statistics, bootstrapping is a resampling technique used to estimate the distribution and accuracy of a sample statistic by repeatedly sampling with replacement from the original data, allowing calculation of bias, variance, and confidence intervals without relying on parametric assumptions.

Bootstrapping - Bootstrapping broadly refers to a self-starting process requiring no external input; in business, it means growing a company with internal cash flow and minimal outside funding, progressing through stages from initial savings and loans to customer funding and possibly later seeking external loans or venture capital for expansion.

dowidth.com

dowidth.com