Alternative funding platforms such as crowdfunding and peer-to-peer lending offer entrepreneurs diverse sources of capital beyond traditional angel investors, enabling access to a broader pool of individual contributors and institutional backers. These platforms leverage technology to provide scalable funding options with varying requirements for equity stakes or repayment terms, often fostering community engagement and marketing benefits. Explore how alternative funding platforms compare to angel investors to determine the optimal strategy for your venture's financial growth.

Why it is important

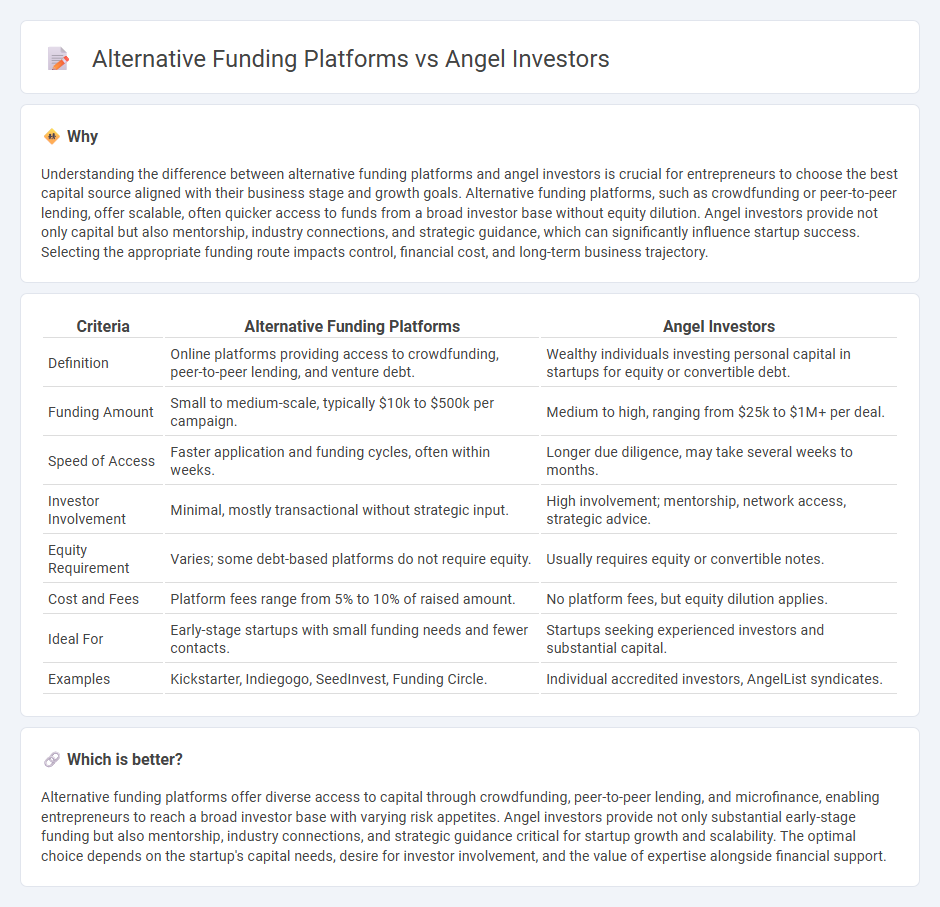

Understanding the difference between alternative funding platforms and angel investors is crucial for entrepreneurs to choose the best capital source aligned with their business stage and growth goals. Alternative funding platforms, such as crowdfunding or peer-to-peer lending, offer scalable, often quicker access to funds from a broad investor base without equity dilution. Angel investors provide not only capital but also mentorship, industry connections, and strategic guidance, which can significantly influence startup success. Selecting the appropriate funding route impacts control, financial cost, and long-term business trajectory.

Comparison Table

| Criteria | Alternative Funding Platforms | Angel Investors |

|---|---|---|

| Definition | Online platforms providing access to crowdfunding, peer-to-peer lending, and venture debt. | Wealthy individuals investing personal capital in startups for equity or convertible debt. |

| Funding Amount | Small to medium-scale, typically $10k to $500k per campaign. | Medium to high, ranging from $25k to $1M+ per deal. |

| Speed of Access | Faster application and funding cycles, often within weeks. | Longer due diligence, may take several weeks to months. |

| Investor Involvement | Minimal, mostly transactional without strategic input. | High involvement; mentorship, network access, strategic advice. |

| Equity Requirement | Varies; some debt-based platforms do not require equity. | Usually requires equity or convertible notes. |

| Cost and Fees | Platform fees range from 5% to 10% of raised amount. | No platform fees, but equity dilution applies. |

| Ideal For | Early-stage startups with small funding needs and fewer contacts. | Startups seeking experienced investors and substantial capital. |

| Examples | Kickstarter, Indiegogo, SeedInvest, Funding Circle. | Individual accredited investors, AngelList syndicates. |

Which is better?

Alternative funding platforms offer diverse access to capital through crowdfunding, peer-to-peer lending, and microfinance, enabling entrepreneurs to reach a broad investor base with varying risk appetites. Angel investors provide not only substantial early-stage funding but also mentorship, industry connections, and strategic guidance critical for startup growth and scalability. The optimal choice depends on the startup's capital needs, desire for investor involvement, and the value of expertise alongside financial support.

Connection

Alternative funding platforms leverage technology to connect startups with a broad network of Angel Investors seeking early-stage investment opportunities. These platforms facilitate streamlined deal flow, due diligence, and communication, increasing accessibility and efficiency for both entrepreneurs and investors. The synergy between alternative funding platforms and Angel Investors accelerates capital deployment, fostering innovation and business growth in competitive markets.

Key Terms

Equity

Angel investors provide early-stage equity funding, offering not only capital but also mentorship and industry connections valuable for startup growth. Alternative funding platforms, such as crowdfunding and venture capital, offer diversified equity investment options with varying levels of involvement and risk exposure. Explore the benefits and nuances of equity funding through angel investors versus alternative platforms to find the best fit for your startup.

Crowdfunding

Angel investors provide early-stage capital and valuable mentorship to startups, typically contributing between $25,000 and $100,000 per investment round. Crowdfunding platforms, such as Kickstarter and Indiegogo, enable businesses to raise smaller amounts of money from a large pool of backers, often in exchange for product pre-orders or rewards, bypassing traditional equity stakes. Explore how combining angel investment with crowdfunding strategies can optimize your startup's funding opportunities.

Venture Capital

Angel investors provide early-stage capital through personal funds, offering not only financial support but also valuable mentorship and industry connections critical for startup growth. Alternative funding platforms like crowdfunding and online venture capital networks democratize access to resources, enabling startups to reach a broader base of investors and accelerate fundraising. Explore the evolving landscape of venture capital to understand how these funding sources impact startup success and growth potential.

Source and External Links

Angel Investors - The Hartford Insurance - Angel investors are wealthy private individuals who invest their own money into small business ventures in exchange for equity, often expecting around a 30% return and aiming for an eventual exit through acquisition or public offering.

100 Top Angel Investors List for Startups (2025) - Eqvista - Angel investors provide not only funding but also mentorship, valuable expertise, and access to professional networks, helping startups grow and increase their chances of success while accepting the high risk of early-stage ventures.

Angel investor - Wikipedia - Angel investors are individual private investors who typically invest smaller amounts than venture capitalists, acquiring equity stakes and generating average returns of around 2.2 times their investment over roughly 3.6 years, with a notable presence and growth in the UK market.

dowidth.com

dowidth.com