Alternative funding platforms provide startups with diverse sources such as crowdfunding, peer-to-peer lending, and angel investors, bypassing traditional bank loans. Revenue-based financing allows businesses to repay capital through a fixed percentage of their ongoing gross revenues, aligning repayment with cash flow fluctuations. Explore the advantages and suitability of these funding options to empower your entrepreneurial journey.

Why it is important

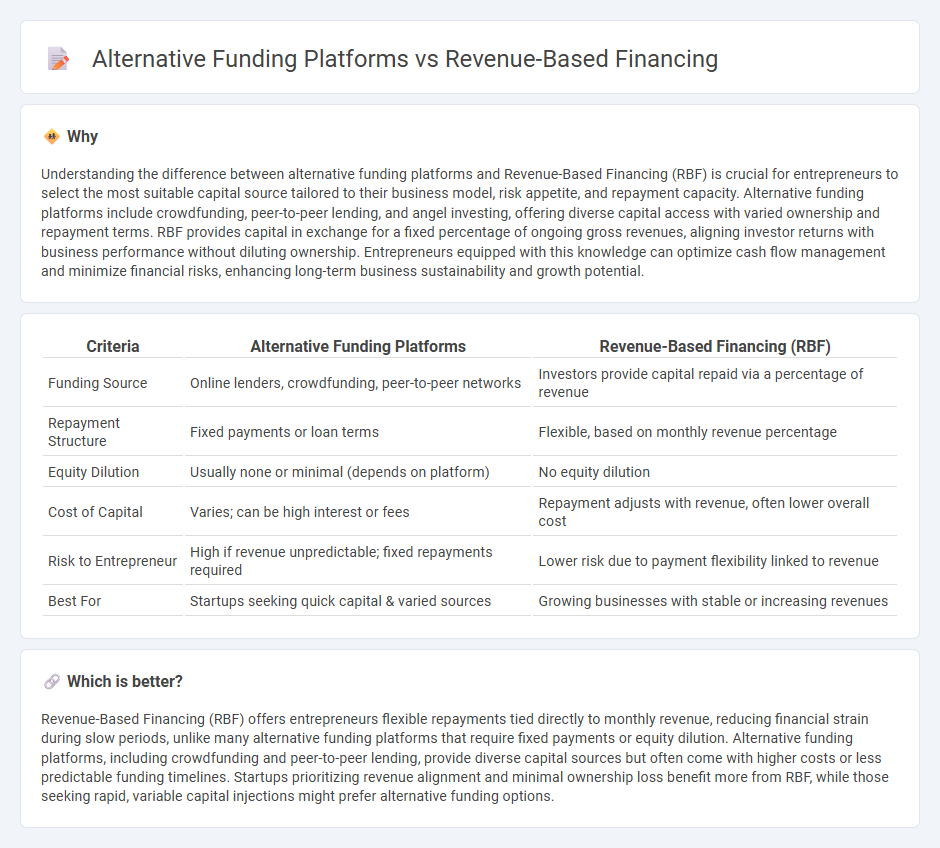

Understanding the difference between alternative funding platforms and Revenue-Based Financing (RBF) is crucial for entrepreneurs to select the most suitable capital source tailored to their business model, risk appetite, and repayment capacity. Alternative funding platforms include crowdfunding, peer-to-peer lending, and angel investing, offering diverse capital access with varied ownership and repayment terms. RBF provides capital in exchange for a fixed percentage of ongoing gross revenues, aligning investor returns with business performance without diluting ownership. Entrepreneurs equipped with this knowledge can optimize cash flow management and minimize financial risks, enhancing long-term business sustainability and growth potential.

Comparison Table

| Criteria | Alternative Funding Platforms | Revenue-Based Financing (RBF) |

|---|---|---|

| Funding Source | Online lenders, crowdfunding, peer-to-peer networks | Investors provide capital repaid via a percentage of revenue |

| Repayment Structure | Fixed payments or loan terms | Flexible, based on monthly revenue percentage |

| Equity Dilution | Usually none or minimal (depends on platform) | No equity dilution |

| Cost of Capital | Varies; can be high interest or fees | Repayment adjusts with revenue, often lower overall cost |

| Risk to Entrepreneur | High if revenue unpredictable; fixed repayments required | Lower risk due to payment flexibility linked to revenue |

| Best For | Startups seeking quick capital & varied sources | Growing businesses with stable or increasing revenues |

Which is better?

Revenue-Based Financing (RBF) offers entrepreneurs flexible repayments tied directly to monthly revenue, reducing financial strain during slow periods, unlike many alternative funding platforms that require fixed payments or equity dilution. Alternative funding platforms, including crowdfunding and peer-to-peer lending, provide diverse capital sources but often come with higher costs or less predictable funding timelines. Startups prioritizing revenue alignment and minimal ownership loss benefit more from RBF, while those seeking rapid, variable capital injections might prefer alternative funding options.

Connection

Alternative funding platforms expand access to capital for entrepreneurs by leveraging diverse sources like crowdfunding, peer-to-peer lending, and online investment networks. Revenue-Based Financing (RBF) integrates seamlessly with these platforms by offering flexible repayment terms tied to a company's revenue performance, aligning investor returns with actual business growth. This connection provides startups with scalable funding options that reduce equity dilution and enhance financial agility.

Key Terms

Recurring Revenue

Revenue-Based Financing (RBF) offers flexible repayment tied directly to a business's recurring revenue streams, making it an attractive alternative to equity financing or traditional loans for companies with consistent monthly income. Unlike crowdfunding or peer-to-peer lending platforms, RBF aligns investor returns with actual business performance without diluting ownership or imposing fixed repayment schedules. Explore how revenue-based financing can optimize cash flow management and fuel growth by learning more about its advantages over other funding options.

Equity Dilution

Revenue-Based Financing (RBF) allows businesses to raise capital without equity dilution, unlike venture capital and angel investments where founders often give up ownership stakes. This funding model ties repayments directly to revenue, aligning investor returns with company performance while maintaining full control for entrepreneurs. Explore more about how RBF compares with other financing options to protect your equity.

Crowdfunding

Revenue-Based Financing (RBF) offers startups flexible repayment tied to revenue percentages, avoiding equity dilution typical in equity crowdfunding. Crowdfunding platforms, including reward-based and equity crowdfunding, rely heavily on community engagement and investor backing, often requiring significant marketing efforts to reach funding goals. Explore the key differences and advantages of each funding method to determine the best fit for your business needs.

Source and External Links

Revenue-based financing - Wikipedia - A financing method where investors provide capital to a business in exchange for a fixed percentage of ongoing gross revenues until the initial capital plus a multiple is repaid, allowing the company to retain control and avoid equity dilution.

Revenue-Based Financing - Overview, How It Works - Investors receive a percentage of a company's gross revenues in exchange for capital, with repayments linked to revenues rather than fixed interest, and the company retains ownership without pledging collateral or equity stakes.

What is Revenue-Based Financing? Pros and Cons (2025) - Shopify - An investor gives a loan in exchange for a set percentage of monthly revenues until a repayment cap multiplies the initial loan amount, offering flexible repayment tied directly to revenue performance.

dowidth.com

dowidth.com