Embedded finance integrates financial services directly into non-financial platforms, streamlining processes for businesses and enhancing customer experiences. Merchant acquiring involves payment processing services that enable businesses to accept and manage electronic transactions efficiently. Explore the distinctions and benefits of embedded finance versus merchant acquiring to optimize your entrepreneurial financial strategies.

Why it is important

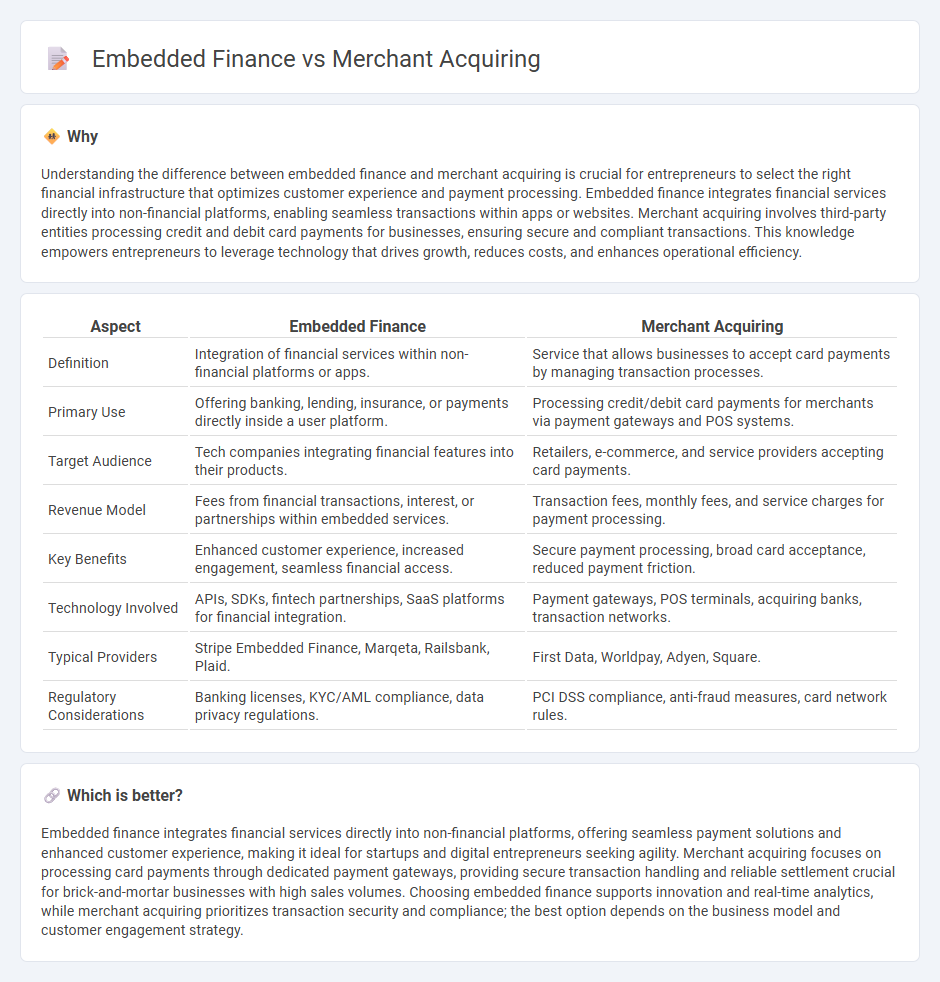

Understanding the difference between embedded finance and merchant acquiring is crucial for entrepreneurs to select the right financial infrastructure that optimizes customer experience and payment processing. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions within apps or websites. Merchant acquiring involves third-party entities processing credit and debit card payments for businesses, ensuring secure and compliant transactions. This knowledge empowers entrepreneurs to leverage technology that drives growth, reduces costs, and enhances operational efficiency.

Comparison Table

| Aspect | Embedded Finance | Merchant Acquiring |

|---|---|---|

| Definition | Integration of financial services within non-financial platforms or apps. | Service that allows businesses to accept card payments by managing transaction processes. |

| Primary Use | Offering banking, lending, insurance, or payments directly inside a user platform. | Processing credit/debit card payments for merchants via payment gateways and POS systems. |

| Target Audience | Tech companies integrating financial features into their products. | Retailers, e-commerce, and service providers accepting card payments. |

| Revenue Model | Fees from financial transactions, interest, or partnerships within embedded services. | Transaction fees, monthly fees, and service charges for payment processing. |

| Key Benefits | Enhanced customer experience, increased engagement, seamless financial access. | Secure payment processing, broad card acceptance, reduced payment friction. |

| Technology Involved | APIs, SDKs, fintech partnerships, SaaS platforms for financial integration. | Payment gateways, POS terminals, acquiring banks, transaction networks. |

| Typical Providers | Stripe Embedded Finance, Marqeta, Railsbank, Plaid. | First Data, Worldpay, Adyen, Square. |

| Regulatory Considerations | Banking licenses, KYC/AML compliance, data privacy regulations. | PCI DSS compliance, anti-fraud measures, card network rules. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, offering seamless payment solutions and enhanced customer experience, making it ideal for startups and digital entrepreneurs seeking agility. Merchant acquiring focuses on processing card payments through dedicated payment gateways, providing secure transaction handling and reliable settlement crucial for brick-and-mortar businesses with high sales volumes. Choosing embedded finance supports innovation and real-time analytics, while merchant acquiring prioritizes transaction security and compliance; the best option depends on the business model and customer engagement strategy.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless payment processing for merchants. Merchant acquiring facilitates transactions by providing businesses with the infrastructure to accept card payments, essential for embedded finance ecosystems. Together, they empower entrepreneurs to streamline payment solutions, reduce friction, and enhance customer experience.

Key Terms

Payment Processing

Merchant acquiring involves banks or financial institutions processing card payments and settling funds directly from customers to merchants, enabling seamless transaction acceptance. Embedded finance integrates payment processing within non-financial platforms, allowing businesses to offer payment solutions without traditional intermediaries, optimizing customer experiences and operational efficiency. Discover more about how these models transform payment processing and business growth opportunities.

API Integration

Merchant acquiring involves traditional payment processing systems where businesses connect to payment networks via APIs that facilitate transaction authorization and settlement. Embedded finance integrates financial services directly into non-financial platforms through seamless API integration, enhancing customer experience by enabling payments, lending, or insurance without leaving the app. Explore how API-driven solutions transform payment ecosystems and customer engagement in both models.

Revenue Streams

Merchant acquiring generates revenue primarily through transaction fees, interchange fees, and service charges imposed on merchants for processing payments. Embedded finance drives income by integrating financial services such as lending, insurance, or payments directly within non-financial platforms, creating new monetization opportunities through commissions, subscription fees, or interest spreads. Explore the detailed differences and revenue potential of merchant acquiring versus embedded finance to optimize your business strategy.

Source and External Links

Merchant acquiring - Merchant acquirers, or acquiring banks, collect card payments accepted from retailers and route them through card schemes to issuing banks, completing the settlement cycle by funding the retailer's bank account, typically within 3 to 4 days.

Acquiring bank - An acquiring bank processes credit or debit card payments on behalf of merchants, maintaining a merchant account that enables them to accept card transactions while exchanging funds with issuing banks after deducting relevant fees.

What is a merchant acquirer? - A merchant acquirer is a financial institution that processes card payments for businesses by connecting to card networks, authorizing transactions with issuing banks, settling payments, and often providing additional services such as risk management and data analytics.

dowidth.com

dowidth.com