Embedded finance integrates financial services directly into non-financial platforms, streamlining transactions and enhancing user experience through APIs and banking partnerships. Crypto payments leverage blockchain technology to enable secure, decentralized, and borderless transactions with lower fees and increased transparency. Explore how these innovations reshape the future of entrepreneurship and payment ecosystems.

Why it is important

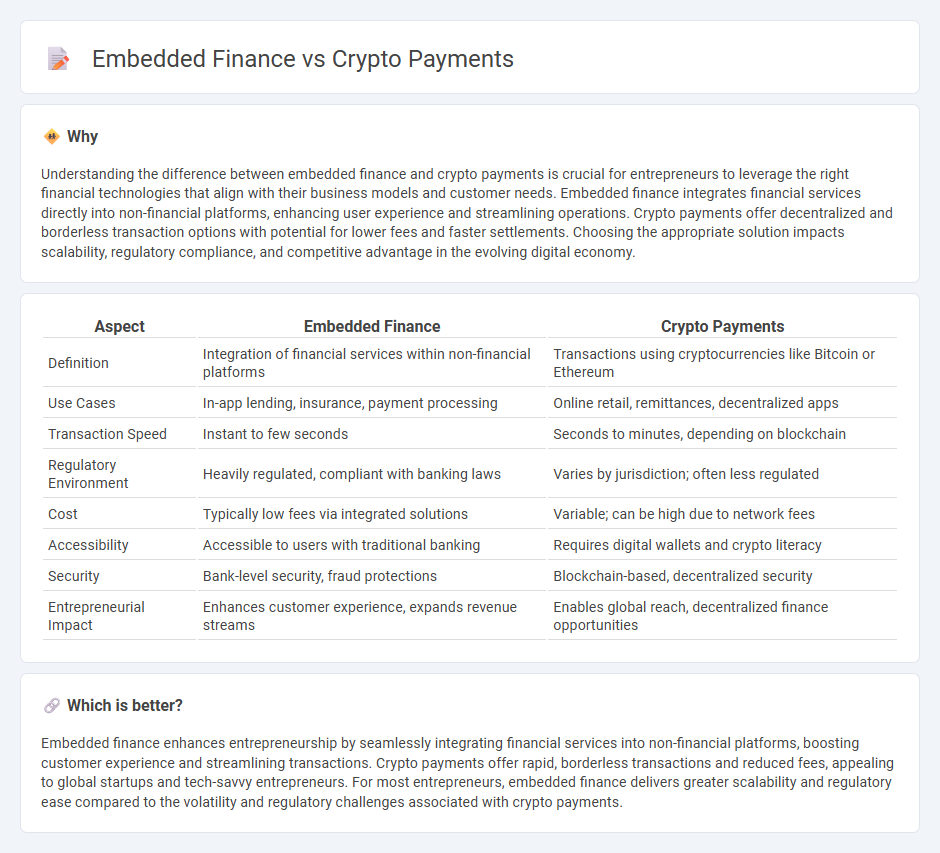

Understanding the difference between embedded finance and crypto payments is crucial for entrepreneurs to leverage the right financial technologies that align with their business models and customer needs. Embedded finance integrates financial services directly into non-financial platforms, enhancing user experience and streamlining operations. Crypto payments offer decentralized and borderless transaction options with potential for lower fees and faster settlements. Choosing the appropriate solution impacts scalability, regulatory compliance, and competitive advantage in the evolving digital economy.

Comparison Table

| Aspect | Embedded Finance | Crypto Payments |

|---|---|---|

| Definition | Integration of financial services within non-financial platforms | Transactions using cryptocurrencies like Bitcoin or Ethereum |

| Use Cases | In-app lending, insurance, payment processing | Online retail, remittances, decentralized apps |

| Transaction Speed | Instant to few seconds | Seconds to minutes, depending on blockchain |

| Regulatory Environment | Heavily regulated, compliant with banking laws | Varies by jurisdiction; often less regulated |

| Cost | Typically low fees via integrated solutions | Variable; can be high due to network fees |

| Accessibility | Accessible to users with traditional banking | Requires digital wallets and crypto literacy |

| Security | Bank-level security, fraud protections | Blockchain-based, decentralized security |

| Entrepreneurial Impact | Enhances customer experience, expands revenue streams | Enables global reach, decentralized finance opportunities |

Which is better?

Embedded finance enhances entrepreneurship by seamlessly integrating financial services into non-financial platforms, boosting customer experience and streamlining transactions. Crypto payments offer rapid, borderless transactions and reduced fees, appealing to global startups and tech-savvy entrepreneurs. For most entrepreneurs, embedded finance delivers greater scalability and regulatory ease compared to the volatility and regulatory challenges associated with crypto payments.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless crypto payment options within entrepreneurial ecosystems. This connection enhances liquidity and accessibility for startups by facilitating instant, borderless transactions and reducing dependence on traditional banking infrastructure. As a result, entrepreneurs can streamline operations, attract global customers, and innovate with decentralized financial tools.

Key Terms

Decentralization

Crypto payments leverage blockchain technology to enable decentralized transactions without intermediaries, ensuring transparency and enhanced security. Embedded finance integrates financial services directly into non-financial platforms but often remains reliant on centralized institutions and traditional payment rails. Explore how decentralization differentiates these models and shapes the future of digital finance.

API Integration

API integration in crypto payments streamlines transactions by enabling secure, real-time transfers on blockchain networks, reducing costs and settlement times compared to traditional systems. Embedded finance leverages APIs to integrate financial services directly within non-financial platforms, enhancing user experience through seamless access to payments, lending, or insurance without leaving the app. Discover how API integration shapes the future of digital transactions by exploring in-depth use cases and technological advancements.

Smart Contracts

Smart contracts revolutionize crypto payments by automating trustless, transparent transactions without intermediaries, enhancing security and reducing costs. In embedded finance, smart contracts streamline integration of financial services directly into non-financial platforms, enabling real-time execution and compliance with programmable rules. Explore how smart contracts transform payment ecosystems and drive innovation in fintech.

Source and External Links

Best Crypto Payment Gateway & Processor | Accept Crypto Payments - CoinGate offers a comprehensive crypto payment gateway that allows businesses to accept Bitcoin, stablecoins, and other cryptocurrencies with easy integration via API, plugins, or payment buttons, featuring instant conversion and settlement to bank accounts.

CoinPayments: Secure & Trusted Cryptocurrency Payment Gateway - CoinPayments, established in 2013, supports over 100 cryptocurrencies and provides secure, flexible crypto payments with easy integration options, custodial wallets, automated conversions, and point-of-sale features for businesses.

A new standard in global crypto payments | Coinbase Commerce - Coinbase Commerce enables merchants to accept global crypto payments quickly and securely with automatic volatility-free conversions, instant settlement to wallets, and integrations with popular e-commerce platforms, supporting multiple currencies and wallets.

dowidth.com

dowidth.com