Thrift flipping involves buying undervalued secondhand items, refurbishing them, and reselling for profit, requiring minimal initial capital and quick turnaround. Real estate investing focuses on purchasing properties to generate long-term income through rental yields or capital appreciation, demanding significant financial commitment and market knowledge. Explore detailed strategies and benefits of both to choose the right path for your entrepreneurial goals.

Why it is important

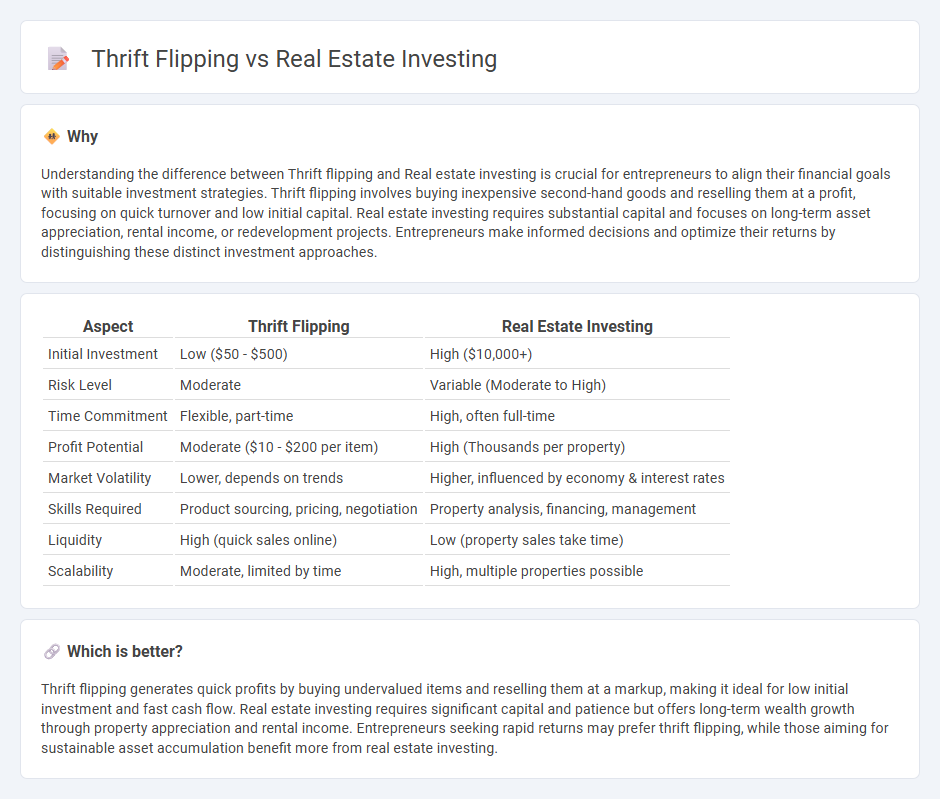

Understanding the difference between Thrift flipping and Real estate investing is crucial for entrepreneurs to align their financial goals with suitable investment strategies. Thrift flipping involves buying inexpensive second-hand goods and reselling them at a profit, focusing on quick turnover and low initial capital. Real estate investing requires substantial capital and focuses on long-term asset appreciation, rental income, or redevelopment projects. Entrepreneurs make informed decisions and optimize their returns by distinguishing these distinct investment approaches.

Comparison Table

| Aspect | Thrift Flipping | Real Estate Investing |

|---|---|---|

| Initial Investment | Low ($50 - $500) | High ($10,000+) |

| Risk Level | Moderate | Variable (Moderate to High) |

| Time Commitment | Flexible, part-time | High, often full-time |

| Profit Potential | Moderate ($10 - $200 per item) | High (Thousands per property) |

| Market Volatility | Lower, depends on trends | Higher, influenced by economy & interest rates |

| Skills Required | Product sourcing, pricing, negotiation | Property analysis, financing, management |

| Liquidity | High (quick sales online) | Low (property sales take time) |

| Scalability | Moderate, limited by time | High, multiple properties possible |

Which is better?

Thrift flipping generates quick profits by buying undervalued items and reselling them at a markup, making it ideal for low initial investment and fast cash flow. Real estate investing requires significant capital and patience but offers long-term wealth growth through property appreciation and rental income. Entrepreneurs seeking rapid returns may prefer thrift flipping, while those aiming for sustainable asset accumulation benefit more from real estate investing.

Connection

Thrift flipping and real estate investing both capitalize on identifying undervalued assets and enhancing their value for profit. Entrepreneurs use thrift flipping to develop skills in market research, negotiation, and creative improvement, which directly translate to successful real estate investing strategies. The combined expertise in asset assessment and strategic investment fosters a diversified entrepreneurial portfolio with increased financial returns.

Key Terms

Asset Appreciation

Real estate investing typically offers substantial asset appreciation through long-term property value increases and rental income generation. Thrift flipping can yield quicker returns by purchasing undervalued items and reselling them at a profit, but it lacks the enduring equity growth characteristic of real estate. Discover more about maximizing your returns by understanding the nuances of asset appreciation in both strategies.

Market Liquidity

Real estate investing offers lower market liquidity due to high entry costs, lengthy transaction processes, and limited market responsiveness compared to thrift flipping, which provides faster cash flow and quicker turnover through buying and reselling thrifted goods. Thrift flipping capitalizes on rapidly changing consumer trends and low initial investment, making it more liquid and accessible for short-term profit seekers. Explore the nuances of both strategies to understand which suits your investment goals better.

Capital Requirements

Real estate investing typically demands substantial capital upfront, including down payments, closing costs, and potential renovation expenses, often exceeding tens of thousands of dollars. Thrift flipping requires significantly lower initial investment, focusing on purchasing undervalued items at thrift stores and reselling them for profit with minimal overhead. Discover detailed strategies and capital insights to choose the best investment path for your financial goals.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - Real estate investing can be done through REITs, rental properties, flipping homes, online platforms, or rental property investments, each with varying risk and complexity.

Arrived | Easily Invest in Real Estate - Arrived offers an accessible platform to invest in pre-vetted rental properties from $100, allowing investors to earn passive income and benefit from property appreciation without managing properties directly.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Real estate is a massive asset class including residential, commercial, and land properties, requiring specific knowledge of zoning, patience, and skills to succeed in long-term investments.

dowidth.com

dowidth.com