Exit-ready startups focus on rapid innovation and scalable growth to attract investors and enable lucrative acquisitions, often emphasizing unique value propositions and disruptive technologies. Franchise businesses prioritize proven operational models and brand consistency, offering lower risk through established market presence and replicable systems. Explore the distinctions to determine the best entrepreneurial path for your goals.

Why it is important

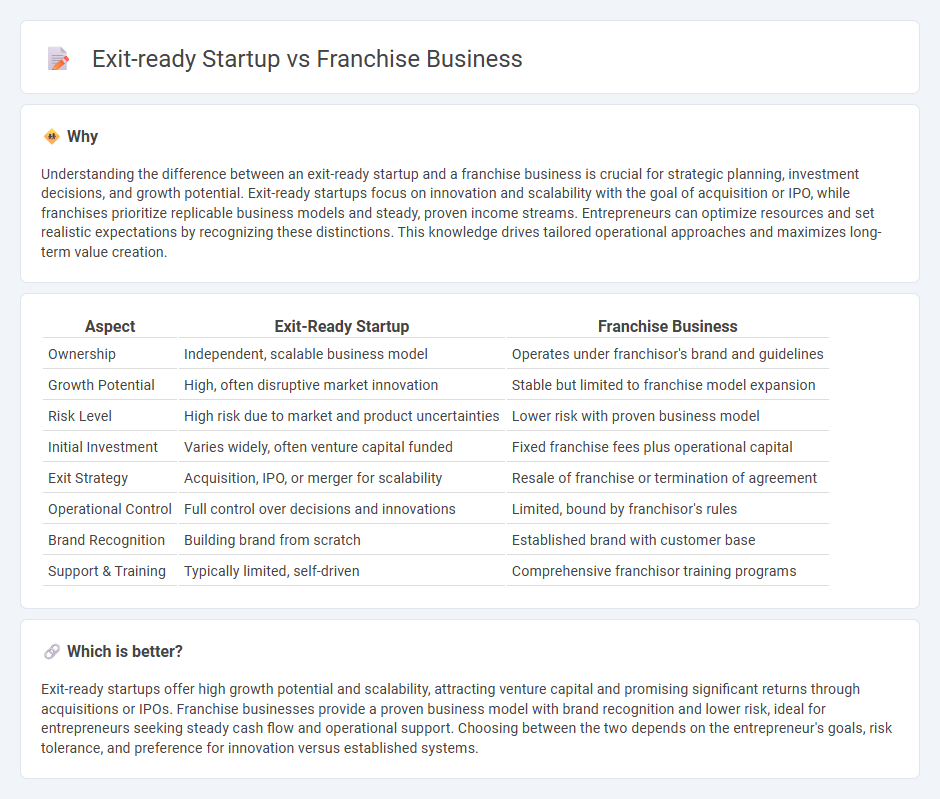

Understanding the difference between an exit-ready startup and a franchise business is crucial for strategic planning, investment decisions, and growth potential. Exit-ready startups focus on innovation and scalability with the goal of acquisition or IPO, while franchises prioritize replicable business models and steady, proven income streams. Entrepreneurs can optimize resources and set realistic expectations by recognizing these distinctions. This knowledge drives tailored operational approaches and maximizes long-term value creation.

Comparison Table

| Aspect | Exit-Ready Startup | Franchise Business |

|---|---|---|

| Ownership | Independent, scalable business model | Operates under franchisor's brand and guidelines |

| Growth Potential | High, often disruptive market innovation | Stable but limited to franchise model expansion |

| Risk Level | High risk due to market and product uncertainties | Lower risk with proven business model |

| Initial Investment | Varies widely, often venture capital funded | Fixed franchise fees plus operational capital |

| Exit Strategy | Acquisition, IPO, or merger for scalability | Resale of franchise or termination of agreement |

| Operational Control | Full control over decisions and innovations | Limited, bound by franchisor's rules |

| Brand Recognition | Building brand from scratch | Established brand with customer base |

| Support & Training | Typically limited, self-driven | Comprehensive franchisor training programs |

Which is better?

Exit-ready startups offer high growth potential and scalability, attracting venture capital and promising significant returns through acquisitions or IPOs. Franchise businesses provide a proven business model with brand recognition and lower risk, ideal for entrepreneurs seeking steady cash flow and operational support. Choosing between the two depends on the entrepreneur's goals, risk tolerance, and preference for innovation versus established systems.

Connection

Exit-ready startups and franchise businesses both focus on scalable, repeatable models that attract investors by demonstrating potential for rapid growth and market penetration. Exit-ready startups prepare for acquisition or IPO by optimizing operational efficiencies and solidifying brand value, which aligns with franchise businesses' emphasis on standardized processes and replicable success. This connection enhances valuation and eases transition during exit events, benefiting founders and franchisees alike.

Key Terms

Business Model

Franchise businesses operate on proven, replicable models with established brand recognition and standardized processes, ensuring predictable revenue streams and lower market entry risks. Exit-ready startups emphasize scalable, innovative business models designed for rapid growth and high return on investment, often prioritizing disruption over immediate profitability. Explore the key differences in business models to determine the best strategic fit for your entrepreneurial goals.

Scalability

Franchise businesses offer proven models with established brand recognition, enabling rapid scalability through replication and standardized operations. Exit-ready startups emphasize innovative products or technologies with high-growth potential, attracting investors by demonstrating scalability via disruptive market solutions. Explore the scalability advantages of each to determine which aligns best with your entrepreneurial goals.

Ownership Structure

Franchise businesses feature a proven ownership structure with franchisees operating under a parent company's established brand, ensuring standardized processes and revenue models. Exit-ready startups, by contrast, offer flexible ownership frameworks typically focused on equity distribution to attract investors and facilitate eventual acquisition or public offering. Explore the nuanced differences in ownership that influence scalability and investment appeal.

Source and External Links

A Consumer's Guide to Buying a Franchise - A franchise business allows an investor to operate using a franchisor's brand and system in exchange for initial fees, ongoing royalties, and adherence to contractual obligations, with franchisors providing support such as training, marketing, and operational advice.

What is a Franchise - International Franchise Association - Franchising is a business expansion method where franchisors license franchisees to operate under their trademark with support including training, brand standards, and marketing, with two main types: business format franchising and product distribution franchising.

Pros & Cons of Buying a Franchise Business - Buying a franchise allows business ownership with significant support from the franchisor such as site selection, training, advertising, and operational assistance, but requires upfront franchise fees, substantial startup costs, and ongoing royalty payments.

dowidth.com

dowidth.com