Bootstrapper communities consist of self-funded entrepreneurs who rely on personal savings and reinvested profits to grow their businesses, fostering complete ownership and control. Angel investor networks provide startups with external capital and mentorship from experienced investors seeking equity stakes, accelerating growth but diluting ownership. Explore the advantages and challenges of both approaches to determine the optimal funding strategy for your entrepreneurial journey.

Why it is important

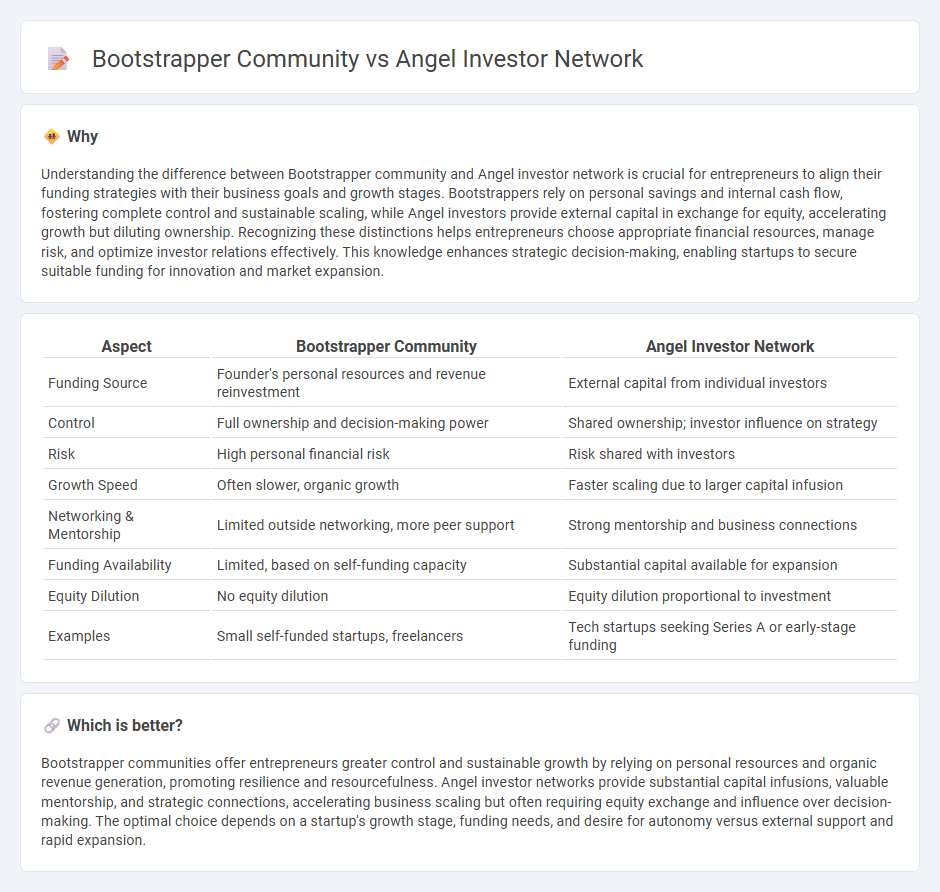

Understanding the difference between Bootstrapper community and Angel investor network is crucial for entrepreneurs to align their funding strategies with their business goals and growth stages. Bootstrappers rely on personal savings and internal cash flow, fostering complete control and sustainable scaling, while Angel investors provide external capital in exchange for equity, accelerating growth but diluting ownership. Recognizing these distinctions helps entrepreneurs choose appropriate financial resources, manage risk, and optimize investor relations effectively. This knowledge enhances strategic decision-making, enabling startups to secure suitable funding for innovation and market expansion.

Comparison Table

| Aspect | Bootstrapper Community | Angel Investor Network |

|---|---|---|

| Funding Source | Founder's personal resources and revenue reinvestment | External capital from individual investors |

| Control | Full ownership and decision-making power | Shared ownership; investor influence on strategy |

| Risk | High personal financial risk | Risk shared with investors |

| Growth Speed | Often slower, organic growth | Faster scaling due to larger capital infusion |

| Networking & Mentorship | Limited outside networking, more peer support | Strong mentorship and business connections |

| Funding Availability | Limited, based on self-funding capacity | Substantial capital available for expansion |

| Equity Dilution | No equity dilution | Equity dilution proportional to investment |

| Examples | Small self-funded startups, freelancers | Tech startups seeking Series A or early-stage funding |

Which is better?

Bootstrapper communities offer entrepreneurs greater control and sustainable growth by relying on personal resources and organic revenue generation, promoting resilience and resourcefulness. Angel investor networks provide substantial capital infusions, valuable mentorship, and strategic connections, accelerating business scaling but often requiring equity exchange and influence over decision-making. The optimal choice depends on a startup's growth stage, funding needs, and desire for autonomy versus external support and rapid expansion.

Connection

Bootstrapper communities thrive on self-funded startups emphasizing resourcefulness and organic growth, while angel investor networks provide critical early-stage capital and mentorship. Entrepreneurs within the bootstrapper community often seek connections to angel investors to accelerate scaling and expand market reach. This synergy fosters a dynamic ecosystem where innovation is funded and nurtured through both independent efforts and strategic investment.

Key Terms

**Angel investor network:**

Angel investor networks consist of high-net-worth individuals who provide early-stage funding, mentorship, and strategic guidance to startups in exchange for equity. These networks offer access to significant capital, industry connections, and expertise, accelerating business growth and increasing chances of successful scaling. Discover how joining an angel investor network can transform your startup's funding and development trajectory.

Capital infusion

Angel investor networks provide early-stage startups with crucial capital infusion, often accompanied by mentorship and strategic guidance from experienced investors. Bootstrapper communities emphasize self-funding and resourcefulness, relying less on external capital and more on revenue generation and cost management. Explore the unique advantages of each funding approach to determine the best fit for your startup's growth trajectory.

Equity stake

Angel investor networks typically provide funding in exchange for an equity stake, offering capital along with strategic guidance to fuel startup growth and accelerate market entry. Bootstrapper communities rely on self-funding and organic growth, prioritizing control retention and minimizing external ownership dilution. Discover how choosing between these funding strategies impacts your startup's equity and long-term success.

Source and External Links

What Is an Angel Network and How Does It Work? - Angel investor networks are groups of investors who pool resources to invest in startups, offering early-stage funding typically between $200,000 and $500,000, along with mentorship, networking, and higher startup success rates.

Angel Networks - Angel networks often connect investors with early-stage startups, including some focused on niche causes such as faith-driven entrepreneurship, providing both capital and guidance to mission-aligned ventures.

Berkeley Angel Network - This is an example of a university-affiliated angel network comprising UC Berkeley alumni and faculty, aiming to foster entrepreneurship by supporting startups through combined expertise and investment.

dowidth.com

dowidth.com