Alternative funding platforms, such as crowdfunding and venture capital, offer entrepreneurs diverse financing options beyond traditional loans, enabling access to capital through investors interested in innovative projects. Peer-to-peer lending connects borrowers directly with individual lenders via online platforms, often providing faster approval and competitive interest rates compared to banks. Explore how these funding methods can transform your entrepreneurial journey.

Why it is important

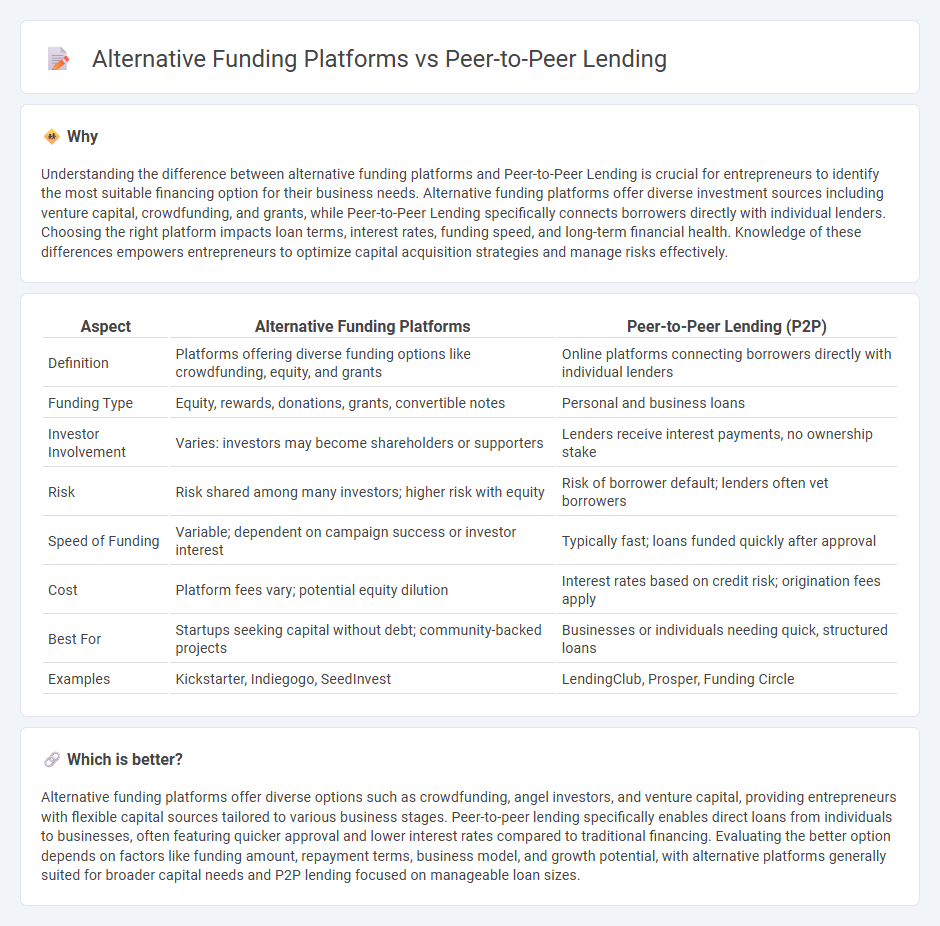

Understanding the difference between alternative funding platforms and Peer-to-Peer Lending is crucial for entrepreneurs to identify the most suitable financing option for their business needs. Alternative funding platforms offer diverse investment sources including venture capital, crowdfunding, and grants, while Peer-to-Peer Lending specifically connects borrowers directly with individual lenders. Choosing the right platform impacts loan terms, interest rates, funding speed, and long-term financial health. Knowledge of these differences empowers entrepreneurs to optimize capital acquisition strategies and manage risks effectively.

Comparison Table

| Aspect | Alternative Funding Platforms | Peer-to-Peer Lending (P2P) |

|---|---|---|

| Definition | Platforms offering diverse funding options like crowdfunding, equity, and grants | Online platforms connecting borrowers directly with individual lenders |

| Funding Type | Equity, rewards, donations, grants, convertible notes | Personal and business loans |

| Investor Involvement | Varies: investors may become shareholders or supporters | Lenders receive interest payments, no ownership stake |

| Risk | Risk shared among many investors; higher risk with equity | Risk of borrower default; lenders often vet borrowers |

| Speed of Funding | Variable; dependent on campaign success or investor interest | Typically fast; loans funded quickly after approval |

| Cost | Platform fees vary; potential equity dilution | Interest rates based on credit risk; origination fees apply |

| Best For | Startups seeking capital without debt; community-backed projects | Businesses or individuals needing quick, structured loans |

| Examples | Kickstarter, Indiegogo, SeedInvest | LendingClub, Prosper, Funding Circle |

Which is better?

Alternative funding platforms offer diverse options such as crowdfunding, angel investors, and venture capital, providing entrepreneurs with flexible capital sources tailored to various business stages. Peer-to-peer lending specifically enables direct loans from individuals to businesses, often featuring quicker approval and lower interest rates compared to traditional financing. Evaluating the better option depends on factors like funding amount, repayment terms, business model, and growth potential, with alternative platforms generally suited for broader capital needs and P2P lending focused on manageable loan sizes.

Connection

Alternative funding platforms and Peer-to-Peer (P2P) lending are intrinsically connected as they both facilitate direct financial transactions between entrepreneurs and individual investors without traditional financial institutions. This connection empowers startups and small businesses to access capital through online marketplaces, where P2P lending serves as a key mechanism for matching borrowers with lenders. These platforms leverage technology to streamline funding, improve transparency, and expand access to early-stage capital in the entrepreneurship ecosystem.

Key Terms

Crowdfunding

Peer-to-peer lending connects individual borrowers directly with investors, offering lower interest rates and faster approval times compared to traditional loans. Crowdfunding platforms gather small contributions from a large audience, providing businesses and projects with flexible funding without requiring repayment or equity relinquishment. Explore the key differences and benefits of crowdfunding versus peer-to-peer lending to find the best alternative funding solution.

Angel Investment

Peer-to-peer lending platforms connect borrowers directly with individual lenders, offering quick access to funds with lower interest rates compared to traditional loans. Angel investment involves affluent individuals investing equity capital into startups, providing mentorship and strategic guidance beyond just funding. Explore the key differences and advantages of angel investment versus peer-to-peer lending for innovative financing opportunities.

Venture Capital

Venture capital provides startups with substantial funding in exchange for equity, offering not just capital but also strategic guidance and industry connections. Peer-to-peer lending platforms deliver quick access to debt financing through individual lenders, typically without diluting ownership equity. Discover the unique advantages and risks of each funding option to determine the best fit for your startup's growth strategy.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending is a method for borrowing and lending money without banks, connecting borrowers and individual investors through specialized websites, offering flexible terms and potentially competitive rates with some extra risks due to lack of institutional protections.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an alternative financial service where online platforms match lenders and borrowers, often allowing lenders to select loans, with services including credit checks, payment processing, and loan servicing, typically without government insurance protection.

PEER-TO-PEER LENDING | NASAA - P2P lending connects individuals or small businesses creating loan requests with investors who fund them via online platforms acting as intermediaries, but investors should be aware of risks such as platform inexperience and regulatory considerations.

dowidth.com

dowidth.com