Passive income streams generate continuous revenue with minimal effort by leveraging assets such as rental properties, dividend stocks, or online businesses. Peer-to-peer lending involves directly lending money to individuals or small businesses through online platforms, earning interest as borrowers repay their loans. Explore the advantages and risks of each method to discover the most suitable passive income strategy for your entrepreneurial goals.

Why it is important

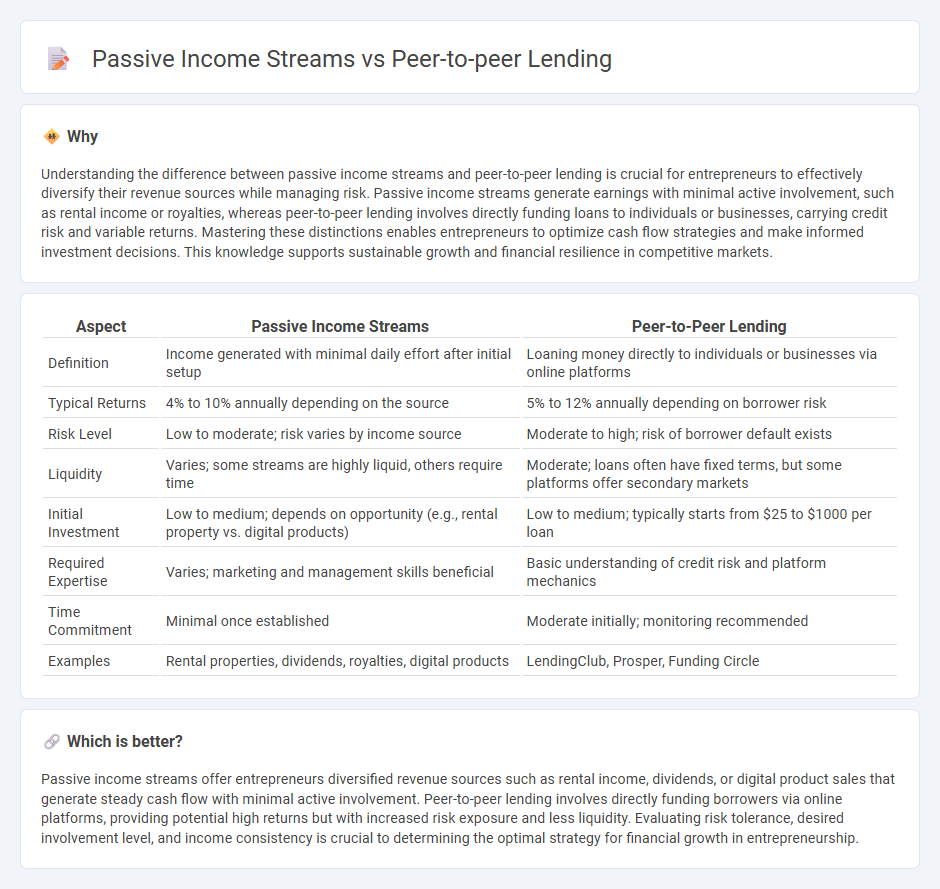

Understanding the difference between passive income streams and peer-to-peer lending is crucial for entrepreneurs to effectively diversify their revenue sources while managing risk. Passive income streams generate earnings with minimal active involvement, such as rental income or royalties, whereas peer-to-peer lending involves directly funding loans to individuals or businesses, carrying credit risk and variable returns. Mastering these distinctions enables entrepreneurs to optimize cash flow strategies and make informed investment decisions. This knowledge supports sustainable growth and financial resilience in competitive markets.

Comparison Table

| Aspect | Passive Income Streams | Peer-to-Peer Lending |

|---|---|---|

| Definition | Income generated with minimal daily effort after initial setup | Loaning money directly to individuals or businesses via online platforms |

| Typical Returns | 4% to 10% annually depending on the source | 5% to 12% annually depending on borrower risk |

| Risk Level | Low to moderate; risk varies by income source | Moderate to high; risk of borrower default exists |

| Liquidity | Varies; some streams are highly liquid, others require time | Moderate; loans often have fixed terms, but some platforms offer secondary markets |

| Initial Investment | Low to medium; depends on opportunity (e.g., rental property vs. digital products) | Low to medium; typically starts from $25 to $1000 per loan |

| Required Expertise | Varies; marketing and management skills beneficial | Basic understanding of credit risk and platform mechanics |

| Time Commitment | Minimal once established | Moderate initially; monitoring recommended |

| Examples | Rental properties, dividends, royalties, digital products | LendingClub, Prosper, Funding Circle |

Which is better?

Passive income streams offer entrepreneurs diversified revenue sources such as rental income, dividends, or digital product sales that generate steady cash flow with minimal active involvement. Peer-to-peer lending involves directly funding borrowers via online platforms, providing potential high returns but with increased risk exposure and less liquidity. Evaluating risk tolerance, desired involvement level, and income consistency is crucial to determining the optimal strategy for financial growth in entrepreneurship.

Connection

Passive income streams and peer-to-peer lending are interconnected through the ability of investors to earn recurring returns by lending capital directly to borrowers via online platforms, bypassing traditional financial institutions. Entrepreneurs utilize peer-to-peer lending as a strategic avenue to diversify income sources while generating steady cash flow from interest payments and loan repayments. This synergy enhances financial independence by leveraging technology-driven lending markets to build sustainable, automated revenue streams.

Key Terms

Crowdfunding

Peer-to-peer lending platforms facilitate direct loans between individuals or businesses, often yielding higher returns compared to traditional passive income streams like dividends or rental income. Crowdfunding leverages collective investment, enabling investors to participate in diverse projects with relatively low capital, optimizing risk distribution and potential earnings. Explore how crowdfunding can diversify your passive income portfolio and enhance financial growth opportunities.

Residual Income

Peer-to-peer lending offers residual income through interest payments generated by loans, providing consistent cash flow with varying risk levels based on borrower creditworthiness. Passive income streams such as dividends, rental income, or royalties also create residual income by allowing money to grow or assets to produce returns without continuous active involvement. Explore more about maximizing residual income with diverse passive revenue strategies and lending opportunities.

Marketplace Platform

Peer-to-peer lending platforms such as LendingClub and Prosper enable investors to directly fund loans, often yielding higher returns than traditional savings accounts while assuming moderate risk. Passive income streams like dividend-paying stocks, rental properties, and affiliate marketing generate consistent cash flow but often require upfront capital and ongoing management. Explore the nuances of marketplace platforms to optimize your passive income strategy effectively.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer lending allows individuals to borrow and lend money directly through online platforms, bypassing traditional banks, and offers flexible terms with potentially lower eligibility barriers for borrowers.

Peer-to-peer lending - P2P lending connects individual lenders with borrowers via specialized online services, operates outside traditional financial institutions, and often provides more choice to lenders in selecting loans, though loans carry risks as they are not typically government-insured.

PEER-TO-PEER LENDING - Unlike traditional bank loans, peer-to-peer lending uses the internet as a marketplace to match borrowers seeking unsecured loans (often $1,000-$25,000) directly with individual investors.

dowidth.com

dowidth.com