Entrepreneurship in both Link in Bio startups and Fintech startups focuses on innovative digital solutions, yet they target different market needs; Link in Bio startups streamline social media traffic management, enhancing online presence for creators, while Fintech startups revolutionize financial services with technology-driven products like mobile payments and lending platforms. Both sectors require strong technical expertise, customer-centric design, and scalability for success in competitive digital landscapes. Explore more about the distinct opportunities and challenges faced by Link in Bio and Fintech startups.

Why it is important

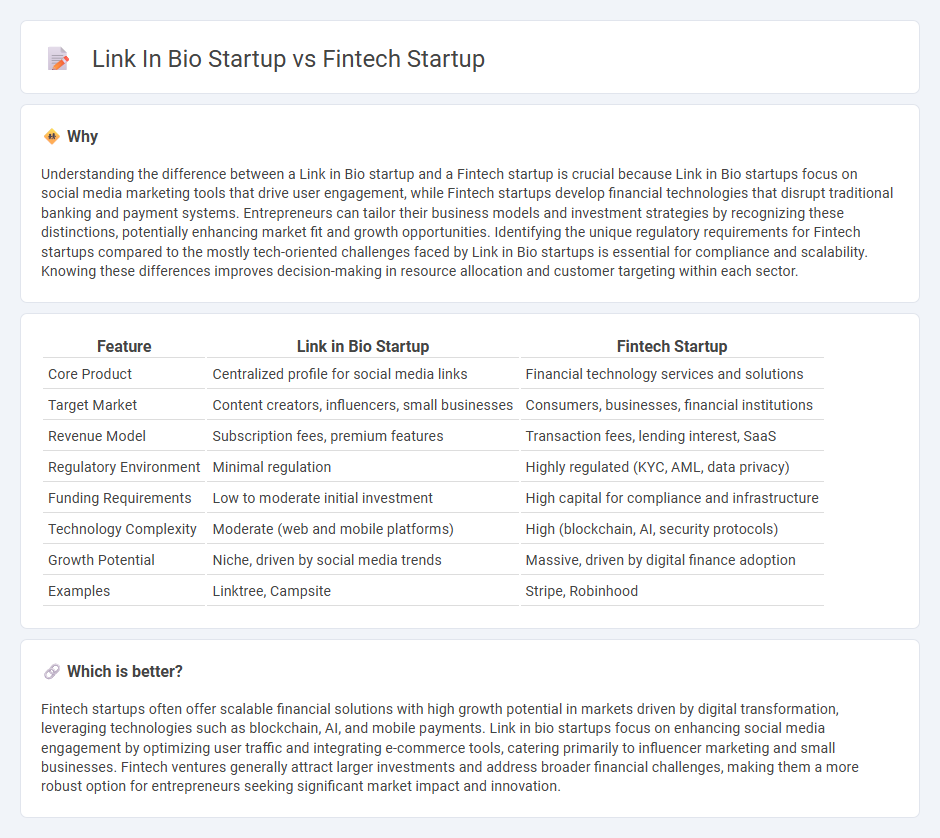

Understanding the difference between a Link in Bio startup and a Fintech startup is crucial because Link in Bio startups focus on social media marketing tools that drive user engagement, while Fintech startups develop financial technologies that disrupt traditional banking and payment systems. Entrepreneurs can tailor their business models and investment strategies by recognizing these distinctions, potentially enhancing market fit and growth opportunities. Identifying the unique regulatory requirements for Fintech startups compared to the mostly tech-oriented challenges faced by Link in Bio startups is essential for compliance and scalability. Knowing these differences improves decision-making in resource allocation and customer targeting within each sector.

Comparison Table

| Feature | Link in Bio Startup | Fintech Startup |

|---|---|---|

| Core Product | Centralized profile for social media links | Financial technology services and solutions |

| Target Market | Content creators, influencers, small businesses | Consumers, businesses, financial institutions |

| Revenue Model | Subscription fees, premium features | Transaction fees, lending interest, SaaS |

| Regulatory Environment | Minimal regulation | Highly regulated (KYC, AML, data privacy) |

| Funding Requirements | Low to moderate initial investment | High capital for compliance and infrastructure |

| Technology Complexity | Moderate (web and mobile platforms) | High (blockchain, AI, security protocols) |

| Growth Potential | Niche, driven by social media trends | Massive, driven by digital finance adoption |

| Examples | Linktree, Campsite | Stripe, Robinhood |

Which is better?

Fintech startups often offer scalable financial solutions with high growth potential in markets driven by digital transformation, leveraging technologies such as blockchain, AI, and mobile payments. Link in bio startups focus on enhancing social media engagement by optimizing user traffic and integrating e-commerce tools, catering primarily to influencer marketing and small businesses. Fintech ventures generally attract larger investments and address broader financial challenges, making them a more robust option for entrepreneurs seeking significant market impact and innovation.

Connection

Link in bio startups and fintech startups intersect through their mutual focus on digital innovation and user engagement. Link in bio platforms increasingly integrate fintech solutions such as payment processing and microtransactions to monetize social media traffic effectively. This synergy drives entrepreneurship by enabling seamless financial interactions within content-sharing ecosystems.

Key Terms

**Fintech startup:**

Fintech startups leverage advanced technologies such as blockchain, AI, and machine learning to revolutionize financial services, providing innovative solutions for payments, lending, and wealth management. They prioritize regulatory compliance, data security, and seamless user experiences to build trust and scalability in competitive markets. Explore more about how fintech startups are transforming global finance and driving digital innovation.

Regulatory Compliance

Fintech startups face stringent regulatory compliance requirements, including adherence to Anti-Money Laundering (AML), Know Your Customer (KYC), and Payment Card Industry Data Security Standards (PCI DSS), making their operational landscape complex. In contrast, link in bio startups deal predominantly with data privacy regulations like GDPR and CCPA, focusing on user data protection more than financial conduct oversight. Explore further to understand the distinct compliance challenges each startup type must navigate.

Digital Payments

Fintech startups specializing in digital payments revolutionize the way transactions are processed, offering secure, seamless, and instant payment solutions tailored for e-commerce, mobile platforms, and peer-to-peer transfers. Link in bio startups integrate payment gateways directly within social media bios, facilitating frictionless sales and monetization for influencers and small businesses by converting social engagement into direct revenue streams. Explore the distinct advantages and technological innovations driving these sectors to understand their impact on digital commerce.

Source and External Links

Top Fintech Startups in 2025 - StartupBlink - Lists leading fintech startups such as PolicyBazaar, PayPay, and Cash App, highlighting their funding, employee size, and core services like insurance comparison, digital payments, and investing platforms.

13 Fintech Startup App Ideas to Consider in 2025 - Eastern Peak - Discusses high-potential fintech startup app ideas including lending, mortgage, insurtech, and mobile banking apps, emphasizing growing market demand and innovation with AI and blockchain technologies.

Top Fintech Companies in 2025 - Purpose Jobs - Profiles innovative fintech companies like Bankjoy, Lifeworks, Ascent, and Upstart, focusing on digital banking, financial planning, RegTech, and AI-driven lending solutions reshaping financial services.

dowidth.com

dowidth.com