Passive income streams generate revenue with minimal ongoing effort, often through investments, royalties, or online businesses, while earned income requires active work and time commitment, such as salaries or freelance gigs. Entrepreneurs leverage passive income to diversify cash flow and build financial independence, contrasting traditional earned income reliant on continuous labor. Discover effective strategies to balance both for sustainable wealth creation.

Why it is important

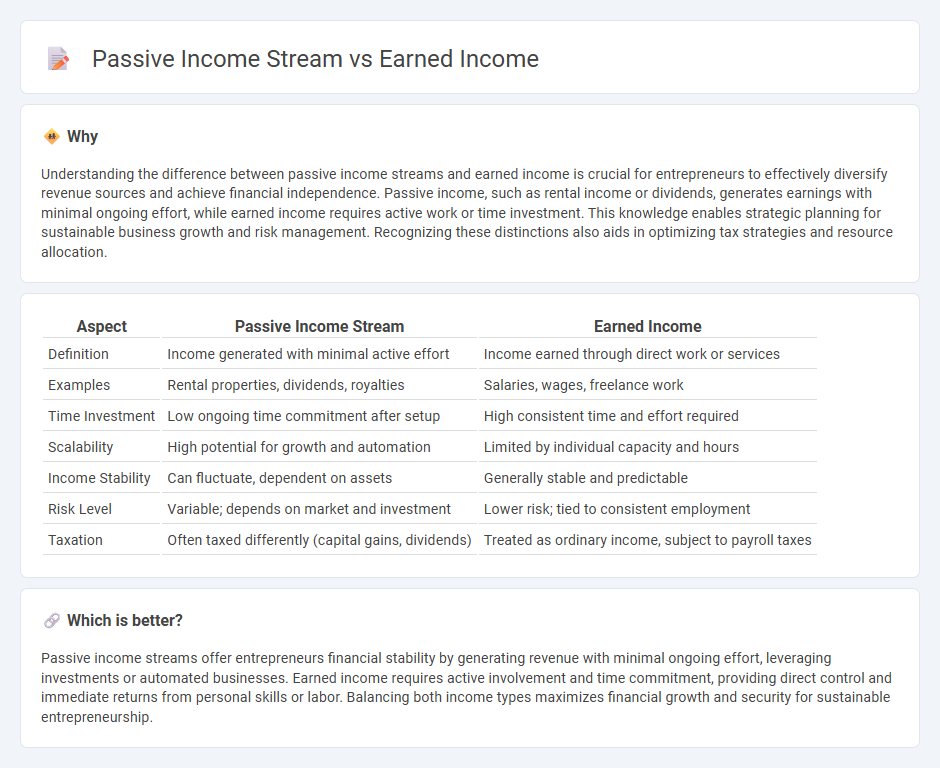

Understanding the difference between passive income streams and earned income is crucial for entrepreneurs to effectively diversify revenue sources and achieve financial independence. Passive income, such as rental income or dividends, generates earnings with minimal ongoing effort, while earned income requires active work or time investment. This knowledge enables strategic planning for sustainable business growth and risk management. Recognizing these distinctions also aids in optimizing tax strategies and resource allocation.

Comparison Table

| Aspect | Passive Income Stream | Earned Income |

|---|---|---|

| Definition | Income generated with minimal active effort | Income earned through direct work or services |

| Examples | Rental properties, dividends, royalties | Salaries, wages, freelance work |

| Time Investment | Low ongoing time commitment after setup | High consistent time and effort required |

| Scalability | High potential for growth and automation | Limited by individual capacity and hours |

| Income Stability | Can fluctuate, dependent on assets | Generally stable and predictable |

| Risk Level | Variable; depends on market and investment | Lower risk; tied to consistent employment |

| Taxation | Often taxed differently (capital gains, dividends) | Treated as ordinary income, subject to payroll taxes |

Which is better?

Passive income streams offer entrepreneurs financial stability by generating revenue with minimal ongoing effort, leveraging investments or automated businesses. Earned income requires active involvement and time commitment, providing direct control and immediate returns from personal skills or labor. Balancing both income types maximizes financial growth and security for sustainable entrepreneurship.

Connection

Passive income streams complement earned income by providing ongoing revenue without active daily involvement, enhancing overall financial stability and wealth building. Entrepreneurs often leverage earned income from their primary jobs or businesses to invest in passive income opportunities such as rental properties, dividends, or online ventures. This strategic combination reduces financial risk and accelerates the path to financial independence by diversifying income sources.

Key Terms

Active Participation

Earned income requires active participation through work, such as salaries, wages, or freelance services, making time and effort key factors in generating revenue. Passive income streams like royalties, rental income, or investments generally require minimal ongoing involvement but may initially demand strategic setup. Explore detailed comparisons to understand how active involvement influences income sustainability and growth potential.

Recurring Revenue

Earned income stems from active work such as salaries, while passive income streams generate recurring revenue through investments, royalties, or rental properties, requiring minimal ongoing effort. Recurring revenue models, like subscriptions or membership fees, offer predictable cash flow and financial stability over time. Explore effective strategies to build resilient passive income streams and enhance your financial independence.

Scalability

Earned income refers to active earnings from work or services, typically limited by hours invested, whereas passive income streams like rental properties or dividends offer scalability through ongoing revenue without direct daily effort. Scalability in passive income allows for exponential growth potential by leveraging systems or investments that generate income autonomously. Explore strategies to maximize scalable passive income and optimize financial freedom.

Source and External Links

Earned income and Earned Income Tax Credit (EITC) tables - IRS - Earned income includes taxable wages, salaries, tips, income from self-employment, and certain other payments, but excludes income like interest, pensions, Social Security, and unemployment benefits, important for qualifying for the Earned Income Tax Credit (EITC).

Earned Income - IRS - Earned income encompasses taxable employee pay such as wages, salaries, net earnings from self-employment, strike benefits, and certain disability benefits received before minimum retirement age, with specifics outlined for ministers and statutory employees.

Understanding Supplemental Security Income SSI Income - SSA - For SSI purposes, earned income includes wages, net self-employment earnings, certain royalties, honoraria, and sheltered workshop payments as opposed to unearned income such as Social Security and pensions.

dowidth.com

dowidth.com