Entrepreneurship often contrasts the relentless drive of hustle culture with the strategic approach of passive income generation. Hustle culture emphasizes constant effort, long hours, and immediate results, while passive income focuses on building systems or investments that generate revenue over time with minimal ongoing work. Explore the nuances between these mindsets to find the balance that suits your entrepreneurial journey.

Why it is important

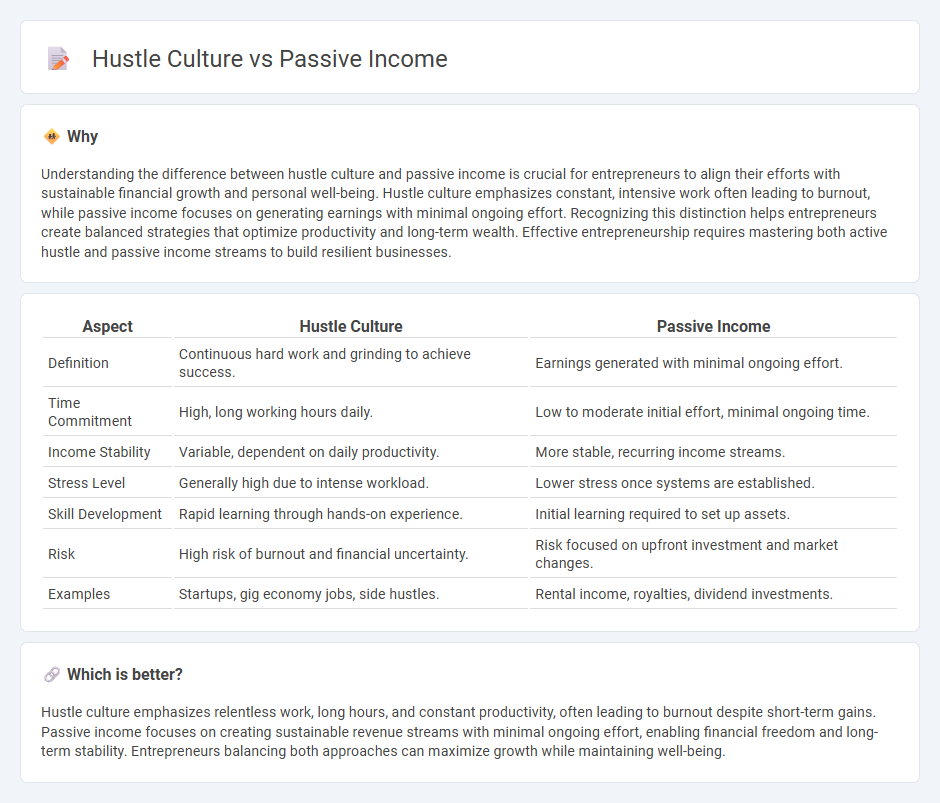

Understanding the difference between hustle culture and passive income is crucial for entrepreneurs to align their efforts with sustainable financial growth and personal well-being. Hustle culture emphasizes constant, intensive work often leading to burnout, while passive income focuses on generating earnings with minimal ongoing effort. Recognizing this distinction helps entrepreneurs create balanced strategies that optimize productivity and long-term wealth. Effective entrepreneurship requires mastering both active hustle and passive income streams to build resilient businesses.

Comparison Table

| Aspect | Hustle Culture | Passive Income |

|---|---|---|

| Definition | Continuous hard work and grinding to achieve success. | Earnings generated with minimal ongoing effort. |

| Time Commitment | High, long working hours daily. | Low to moderate initial effort, minimal ongoing time. |

| Income Stability | Variable, dependent on daily productivity. | More stable, recurring income streams. |

| Stress Level | Generally high due to intense workload. | Lower stress once systems are established. |

| Skill Development | Rapid learning through hands-on experience. | Initial learning required to set up assets. |

| Risk | High risk of burnout and financial uncertainty. | Risk focused on upfront investment and market changes. |

| Examples | Startups, gig economy jobs, side hustles. | Rental income, royalties, dividend investments. |

Which is better?

Hustle culture emphasizes relentless work, long hours, and constant productivity, often leading to burnout despite short-term gains. Passive income focuses on creating sustainable revenue streams with minimal ongoing effort, enabling financial freedom and long-term stability. Entrepreneurs balancing both approaches can maximize growth while maintaining well-being.

Connection

Hustle culture drives entrepreneurs to relentlessly pursue multiple income streams, often prioritizing constant activity and productivity. Passive income serves as the ultimate goal within this mindset, enabling financial growth without continuous effort. Understanding this connection reveals how entrepreneurs balance active work with strategic investment to achieve long-term wealth.

Key Terms

Residual Income

Residual income provides a sustainable financial foundation by generating earnings continuously from previous efforts, contrasting with hustle culture's constant, high-intensity work demand. This passive income model allows individuals to build long-term wealth without the need for ongoing active involvement, enhancing financial freedom. Discover more about leveraging residual income to break free from hustle culture and achieve lasting prosperity.

Active Income

Active income requires continuous effort and time investment, such as working a full-time job or running a side business, differing fundamentally from passive income streams like dividends or rental property earnings. Hustle culture emphasizes maximizing active income by taking on multiple jobs or gigs, promoting constant productivity and self-driven financial growth. Explore the benefits and challenges of active income within hustle culture to optimize your financial strategy.

Time Leverage

Passive income offers significant time leverage by generating earnings with minimal ongoing effort, enabling individuals to focus on personal growth or new ventures. Hustle culture demands continuous active engagement, often sacrificing leisure and long-term sustainability for immediate financial gains. Discover strategies to balance time leverage and productivity effectively for sustainable wealth creation.

Source and External Links

Passive income - Wikipedia - Passive income is unearned income obtained with little to no labor to earn or maintain, often from rental income or business activities without material participation, and can provide financial independence or early retirement benefits.

36 Passive Income Ideas To Make Money in 2025 - Shopify - Examples of passive income include dividend stocks, bonds, and buying income-generating websites, each requiring some initial investment and potentially yielding steady returns over time.

18 Passive Income Ideas: How Much Can You Make? - NerdWallet - Passive income can be earned through investments like dividend stocks, bonds, rental properties, or business models generating income without active involvement after an initial investment of time or money.

dowidth.com

dowidth.com