Exit as a service offers entrepreneurs a streamlined process for selling their business through a third-party platform, maximizing value while minimizing time and complexity. Employee buyouts empower the current workforce to take ownership, fostering continuity and preserving company culture. Explore how these exit strategies can align with your entrepreneurial goals and unlock future opportunities.

Why it is important

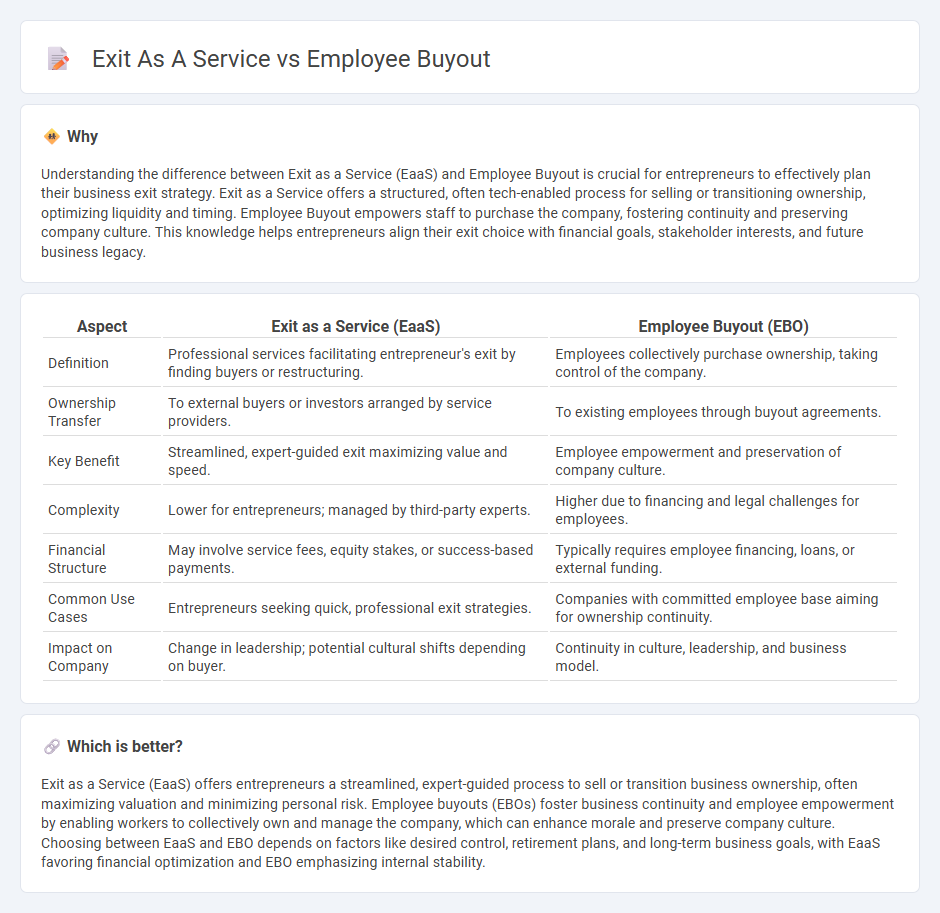

Understanding the difference between Exit as a Service (EaaS) and Employee Buyout is crucial for entrepreneurs to effectively plan their business exit strategy. Exit as a Service offers a structured, often tech-enabled process for selling or transitioning ownership, optimizing liquidity and timing. Employee Buyout empowers staff to purchase the company, fostering continuity and preserving company culture. This knowledge helps entrepreneurs align their exit choice with financial goals, stakeholder interests, and future business legacy.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Employee Buyout (EBO) |

|---|---|---|

| Definition | Professional services facilitating entrepreneur's exit by finding buyers or restructuring. | Employees collectively purchase ownership, taking control of the company. |

| Ownership Transfer | To external buyers or investors arranged by service providers. | To existing employees through buyout agreements. |

| Key Benefit | Streamlined, expert-guided exit maximizing value and speed. | Employee empowerment and preservation of company culture. |

| Complexity | Lower for entrepreneurs; managed by third-party experts. | Higher due to financing and legal challenges for employees. |

| Financial Structure | May involve service fees, equity stakes, or success-based payments. | Typically requires employee financing, loans, or external funding. |

| Common Use Cases | Entrepreneurs seeking quick, professional exit strategies. | Companies with committed employee base aiming for ownership continuity. |

| Impact on Company | Change in leadership; potential cultural shifts depending on buyer. | Continuity in culture, leadership, and business model. |

Which is better?

Exit as a Service (EaaS) offers entrepreneurs a streamlined, expert-guided process to sell or transition business ownership, often maximizing valuation and minimizing personal risk. Employee buyouts (EBOs) foster business continuity and employee empowerment by enabling workers to collectively own and manage the company, which can enhance morale and preserve company culture. Choosing between EaaS and EBO depends on factors like desired control, retirement plans, and long-term business goals, with EaaS favoring financial optimization and EBO emphasizing internal stability.

Connection

Exit as a service (EaaS) offers structured solutions for business founders seeking to transition ownership smoothly, often facilitating employee buyouts as a viable exit strategy. Employee buyouts empower staff to acquire ownership stakes, ensuring continuity and preserving company culture during the founder's exit. Both concepts align in promoting sustainable business succession through accessible, well-planned ownership transfers.

Key Terms

Ownership Transfer

Employee buyouts involve transferring ownership directly to the current employees, empowering them with control and decision-making authority in the company. Exit as a Service, on the other hand, facilitates ownership transfer through external platforms or intermediaries that streamline the sale process and provide flexible exit options for business owners. Discover how these models compare in optimizing ownership transition strategies and ensuring smooth business continuity.

Valuation

Employee buyouts involve valuing the business based on cash flow, asset appraisal, and market multiples to determine a fair price for employee ownership. Exit as a Service models often prioritize scalable valuation methods using digital tools and predictive analytics for timely, data-driven exit decisions. Explore how nuanced valuation approaches impact your strategic choice between employee buyout and Exit as a Service.

Transition Management

Employee buyout enables internal teams to take ownership, fostering continuity and preserving company culture during transition management. Exit as a Service provides structured support for leadership changes, minimizing disruption and ensuring operational stability. Discover detailed strategies to optimize your transition management process effectively.

Source and External Links

Employee Buyout: When Employees Become Owners - An employee buyout is when employees acquire all or most of the company's shares, transferring control from the owner to employees, usually involving a business valuation and price negotiation similar to other business sales.

Voluntary Buyouts: The Pros and Cons - Voluntary buyouts are incentives offered to employees to voluntarily resign in exchange for severance payments, used to reduce workforce size without involuntary layoffs, often including releases to reduce legal risks.

Employee ownership - Business Gateway - Employee buyouts involve employees collectively owning significant shares with engagement in company decisions, serving as an effective succession plan and promoting business continuity and motivation.

dowidth.com

dowidth.com