Exit-ready startups focus on rapid growth and scalable business models designed to attract investors for profitable acquisitions or public offerings. Social enterprises prioritize mission-driven impact, balancing financial sustainability with solving social or environmental challenges. Explore how these distinct approaches shape entrepreneurial strategies and outcomes.

Why it is important

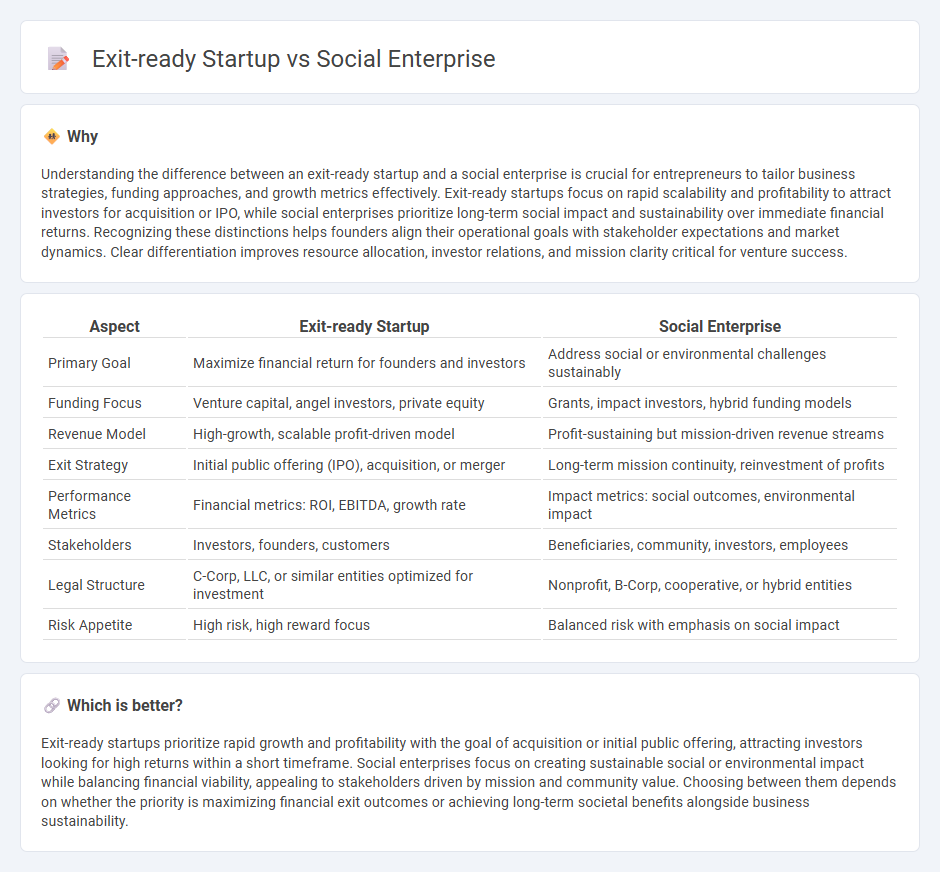

Understanding the difference between an exit-ready startup and a social enterprise is crucial for entrepreneurs to tailor business strategies, funding approaches, and growth metrics effectively. Exit-ready startups focus on rapid scalability and profitability to attract investors for acquisition or IPO, while social enterprises prioritize long-term social impact and sustainability over immediate financial returns. Recognizing these distinctions helps founders align their operational goals with stakeholder expectations and market dynamics. Clear differentiation improves resource allocation, investor relations, and mission clarity critical for venture success.

Comparison Table

| Aspect | Exit-ready Startup | Social Enterprise |

|---|---|---|

| Primary Goal | Maximize financial return for founders and investors | Address social or environmental challenges sustainably |

| Funding Focus | Venture capital, angel investors, private equity | Grants, impact investors, hybrid funding models |

| Revenue Model | High-growth, scalable profit-driven model | Profit-sustaining but mission-driven revenue streams |

| Exit Strategy | Initial public offering (IPO), acquisition, or merger | Long-term mission continuity, reinvestment of profits |

| Performance Metrics | Financial metrics: ROI, EBITDA, growth rate | Impact metrics: social outcomes, environmental impact |

| Stakeholders | Investors, founders, customers | Beneficiaries, community, investors, employees |

| Legal Structure | C-Corp, LLC, or similar entities optimized for investment | Nonprofit, B-Corp, cooperative, or hybrid entities |

| Risk Appetite | High risk, high reward focus | Balanced risk with emphasis on social impact |

Which is better?

Exit-ready startups prioritize rapid growth and profitability with the goal of acquisition or initial public offering, attracting investors looking for high returns within a short timeframe. Social enterprises focus on creating sustainable social or environmental impact while balancing financial viability, appealing to stakeholders driven by mission and community value. Choosing between them depends on whether the priority is maximizing financial exit outcomes or achieving long-term societal benefits alongside business sustainability.

Connection

Exit-ready startups focus on scalable business models with clear paths to profitability and market expansion, attracting investors seeking lucrative exit opportunities. Social enterprises integrate mission-driven goals with sustainable revenue streams, often appealing to impact investors interested in both financial return and social value. The connection lies in aligning growth strategies and exit planning that balance financial exit potential with ongoing social impact, creating attractive propositions for impact-focused acquisitions or mergers.

Key Terms

Mission-driven

Social enterprises prioritize mission-driven goals by addressing social or environmental challenges while generating sustainable revenue. Exit-ready startups primarily focus on rapid growth and high returns for investors, often gearing towards acquisition or IPO. Discover the key differences to align your business model with your long-term impact goals.

Scalability

Social enterprises prioritize sustainable impact and community benefit, often reinvesting profits to address social issues rather than maximizing financial returns. Exit-ready startups emphasize rapid scalability and high growth potential to attract investors and achieve lucrative exits, such as acquisitions or IPOs. Explore detailed strategies and examples to understand how scalability differs between these models.

Profit orientation

Social enterprises prioritize mission-driven goals that address societal issues while maintaining sustainable revenue models, often balancing profit with social impact. Exit-ready startups emphasize rapid growth and scalability with the primary goal of maximizing financial returns for investors through acquisitions or IPOs. Explore detailed comparisons to understand strategic approaches in profit orientation between these business models.

Source and External Links

Social enterprise - A social enterprise is an organization that uses commercial strategies to achieve social, financial, and environmental well-being by integrating social goals into business operations while remaining financially sustainable and reinvesting profits into their mission rather than relying on philanthropy.

What is a Social Enterprise? - Definition & Examples - Social enterprises are businesses focused on creating positive social or environmental impact, operating financially self-sufficiently by reinvesting profits and often addressing social needs unmet by traditional markets, such as affordable housing and food security.

14 Social Enterprises & Examples: How They Impact the ... - Social enterprises intentionally tackle social problems by using business models that reinvest earnings into social or environmental objectives, often structured as for-profit or non-profit entities aiming to improve communities or support marginalized groups.

dowidth.com

dowidth.com