Side hustle stacks enable entrepreneurs to diversify income streams by managing multiple small businesses or freelance gigs simultaneously, maximizing cash flow without relinquishing control. Equity partnerships involve sharing ownership and profits in a venture, pooling resources and expertise to scale faster and mitigate risks. Explore the advantages and challenges of both approaches to determine the best fit for your entrepreneurial goals.

Why it is important

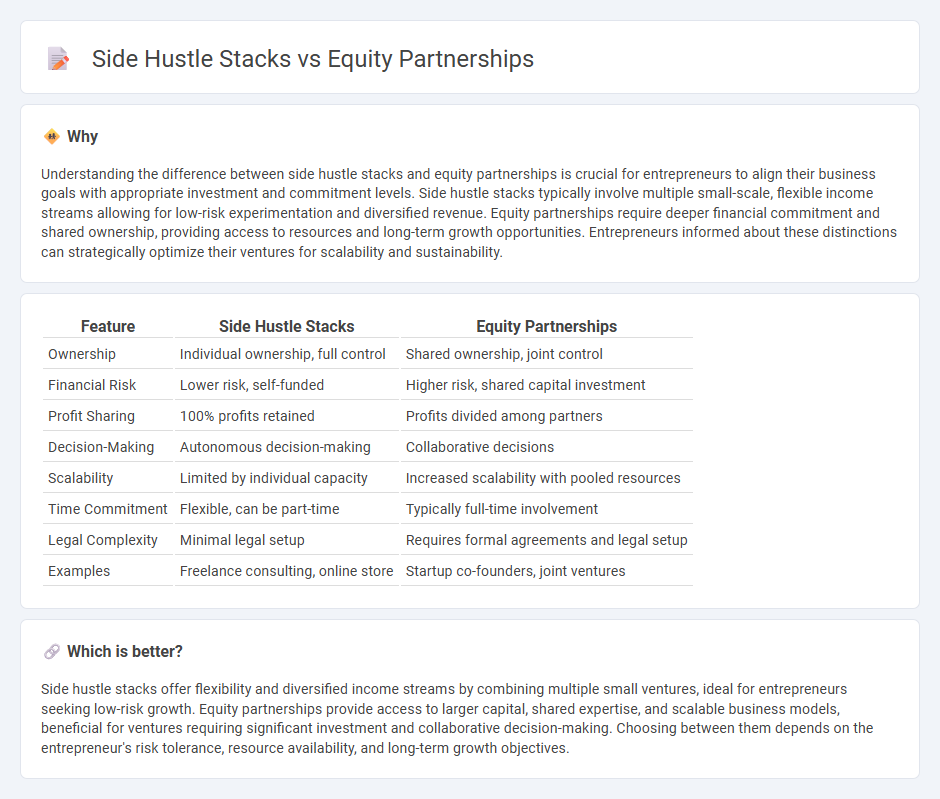

Understanding the difference between side hustle stacks and equity partnerships is crucial for entrepreneurs to align their business goals with appropriate investment and commitment levels. Side hustle stacks typically involve multiple small-scale, flexible income streams allowing for low-risk experimentation and diversified revenue. Equity partnerships require deeper financial commitment and shared ownership, providing access to resources and long-term growth opportunities. Entrepreneurs informed about these distinctions can strategically optimize their ventures for scalability and sustainability.

Comparison Table

| Feature | Side Hustle Stacks | Equity Partnerships |

|---|---|---|

| Ownership | Individual ownership, full control | Shared ownership, joint control |

| Financial Risk | Lower risk, self-funded | Higher risk, shared capital investment |

| Profit Sharing | 100% profits retained | Profits divided among partners |

| Decision-Making | Autonomous decision-making | Collaborative decisions |

| Scalability | Limited by individual capacity | Increased scalability with pooled resources |

| Time Commitment | Flexible, can be part-time | Typically full-time involvement |

| Legal Complexity | Minimal legal setup | Requires formal agreements and legal setup |

| Examples | Freelance consulting, online store | Startup co-founders, joint ventures |

Which is better?

Side hustle stacks offer flexibility and diversified income streams by combining multiple small ventures, ideal for entrepreneurs seeking low-risk growth. Equity partnerships provide access to larger capital, shared expertise, and scalable business models, beneficial for ventures requiring significant investment and collaborative decision-making. Choosing between them depends on the entrepreneur's risk tolerance, resource availability, and long-term growth objectives.

Connection

Side hustle stacks enable entrepreneurs to generate multiple income streams simultaneously, creating a financial foundation that attracts equity partnerships. Equity partnerships often arise when side hustles demonstrate consistent revenue and scalability, making the business more appealing for investment. Combining side hustle stacks with equity partnerships accelerates business growth by leveraging shared resources, expertise, and capital infusion.

Key Terms

Ownership Structure

Equity partnerships involve shared ownership rights, where each partner holds a percentage of the business equity based on their contribution or agreement, influencing control and profit distribution. Side hustle stacks typically consist of multiple independent income streams, each with separate ownership and operational control, minimizing shared liability but often limiting long-term equity growth. Explore detailed comparisons to determine which ownership structure aligns with your financial goals and risk tolerance.

Resource Allocation

Equity partnerships demand strategic resource allocation involving shared capital investment, operational responsibilities, and profit distribution, leading to long-term growth potential. Side hustle stacks prioritize flexible time management and diverse income streams, allowing individuals to optimize personal effort across multiple projects without significant financial commitment. Explore in-depth strategies to balance these models and maximize your resource efficiency.

Risk Sharing

Equity partnerships distribute financial risk among collaborators, aligning incentives through shared ownership and long-term commitment. Side hustle stacks involve multiple independent income streams, balancing risk by diversifying efforts without shared liability. Explore how these approaches impact your financial strategy and risk management.

Source and External Links

What Defines Being an Equity Partner? (2024) - An equity partner owns a partial share of a business, has significant decision-making power, and is compensated based on ownership percentage, sharing both the risks and rewards of the business's success.

A Return to Equity Partnerships? | Fairfax Associates - Equity partnerships involve partners contributing capital and sharing risks and rewards, with voting rights often weighted by ownership, aligning partner compensation closely with firm performance.

What Does It Mean To Be An Equity Partner? - Lawpath - Equity partners invest capital to buy ownership, share profits and losses, and have personal and financial stakes in the business's success, but are also responsible for partnership debts.

dowidth.com

dowidth.com