Acquihire involves one company purchasing another primarily to acquire its talented workforce, optimizing talent integration and accelerating innovation. Joint ventures establish a new business entity through partnership between companies, sharing resources, risks, and profits to achieve common strategic objectives. Explore the advantages and strategic implications of acquihires versus joint ventures to determine the best growth strategy for your business.

Why it is important

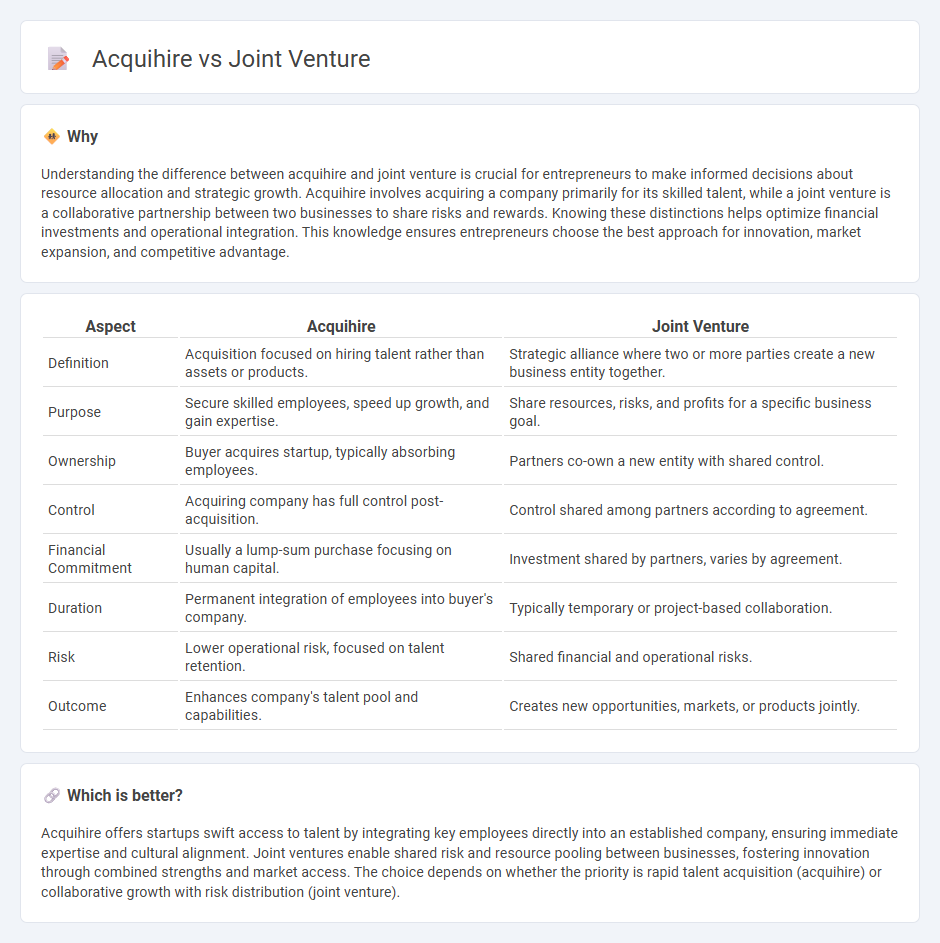

Understanding the difference between acquihire and joint venture is crucial for entrepreneurs to make informed decisions about resource allocation and strategic growth. Acquihire involves acquiring a company primarily for its skilled talent, while a joint venture is a collaborative partnership between two businesses to share risks and rewards. Knowing these distinctions helps optimize financial investments and operational integration. This knowledge ensures entrepreneurs choose the best approach for innovation, market expansion, and competitive advantage.

Comparison Table

| Aspect | Acquihire | Joint Venture |

|---|---|---|

| Definition | Acquisition focused on hiring talent rather than assets or products. | Strategic alliance where two or more parties create a new business entity together. |

| Purpose | Secure skilled employees, speed up growth, and gain expertise. | Share resources, risks, and profits for a specific business goal. |

| Ownership | Buyer acquires startup, typically absorbing employees. | Partners co-own a new entity with shared control. |

| Control | Acquiring company has full control post-acquisition. | Control shared among partners according to agreement. |

| Financial Commitment | Usually a lump-sum purchase focusing on human capital. | Investment shared by partners, varies by agreement. |

| Duration | Permanent integration of employees into buyer's company. | Typically temporary or project-based collaboration. |

| Risk | Lower operational risk, focused on talent retention. | Shared financial and operational risks. |

| Outcome | Enhances company's talent pool and capabilities. | Creates new opportunities, markets, or products jointly. |

Which is better?

Acquihire offers startups swift access to talent by integrating key employees directly into an established company, ensuring immediate expertise and cultural alignment. Joint ventures enable shared risk and resource pooling between businesses, fostering innovation through combined strengths and market access. The choice depends on whether the priority is rapid talent acquisition (acquihire) or collaborative growth with risk distribution (joint venture).

Connection

Acquihire and joint ventures are connected through their strategic focus on combining resources and expertise to accelerate business growth. Both approaches enable companies to access talent, technology, or market presence by forming collaborative relationships, either through acquiring a startup for its skilled team or partnering with another firm to share risks and rewards. Entrepreneurs often leverage acquihires to quickly integrate innovative capabilities, while joint ventures facilitate long-term cooperation and market expansion in entrepreneurial ventures.

Key Terms

Ownership structure

Joint ventures involve shared ownership where two or more companies collaboratively create a new entity, splitting equity and control based on agreed terms. Acquihires typically result in full ownership transfer, as a company acquires a startup primarily for its talent, integrating employees into the existing structure without creating a new business. Explore further insights on ownership structures in mergers and acquisitions to make informed strategic decisions.

Talent acquisition

Joint ventures enable companies to collaborate on shared projects while retaining independent operations, fostering talent development through combined expertise and resource exchange. Acquihires focus on acquiring skilled employees by purchasing startups primarily for their talent, integrating key personnel into the acquirer's organizational structure. Explore the strategic benefits and implications of each approach to optimize your talent acquisition efforts.

Strategic partnership

A joint venture involves two or more companies creating a new business entity to share resources, risks, and profits for mutual strategic goals, often fostering long-term collaboration and market expansion. In contrast, an acquihire focuses on acquiring a company primarily to obtain its talent, integrating key employees into the buyer's team rather than forming a partnership or shared business. Explore further to understand which approach aligns best with your strategic partnership objectives.

Source and External Links

What Is a Joint Venture and How Does It Work? - NerdWallet - A joint venture is an agreement by two or more people or companies to accomplish a specific business goal together, often to access new markets or complementary resources, formed through steps including finding a trustworthy partner and signing agreements.

Joint Venture (JV) - Corporate Finance Institute - A joint venture is a commercial enterprise where two or more organizations combine resources to gain strategic advantages, sharing profits and losses while potentially enabling quick market entry through local partners.

joint venture | Wex | US Law | LII / Legal Information Institute - A joint venture is a combination of two or more parties who agree to develop a single enterprise or project for profit, sharing risks, contributions, control, and profits, distinct legally from partnerships or corporations.

dowidth.com

dowidth.com