Entrepreneurship offers diverse income models, with passive income streams generating revenue through automated systems or investments requiring minimal ongoing effort. Commission-based income rewards direct sales or performance, linking earnings to individual productivity and client acquisition. Explore detailed strategies to optimize your entrepreneurial income and achieve financial independence.

Why it is important

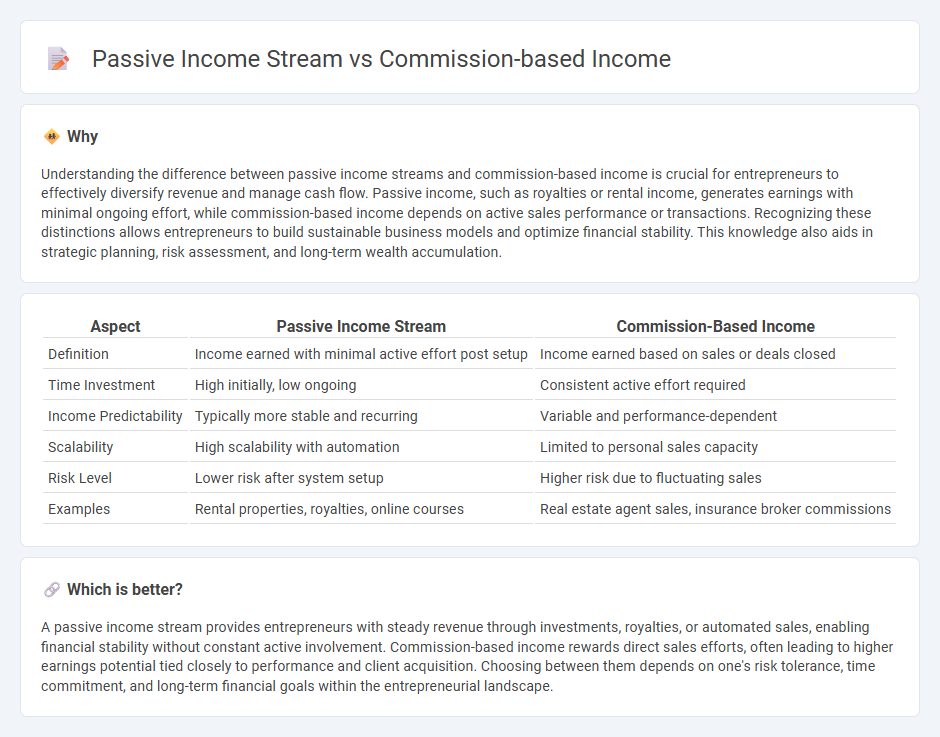

Understanding the difference between passive income streams and commission-based income is crucial for entrepreneurs to effectively diversify revenue and manage cash flow. Passive income, such as royalties or rental income, generates earnings with minimal ongoing effort, while commission-based income depends on active sales performance or transactions. Recognizing these distinctions allows entrepreneurs to build sustainable business models and optimize financial stability. This knowledge also aids in strategic planning, risk assessment, and long-term wealth accumulation.

Comparison Table

| Aspect | Passive Income Stream | Commission-Based Income |

|---|---|---|

| Definition | Income earned with minimal active effort post setup | Income earned based on sales or deals closed |

| Time Investment | High initially, low ongoing | Consistent active effort required |

| Income Predictability | Typically more stable and recurring | Variable and performance-dependent |

| Scalability | High scalability with automation | Limited to personal sales capacity |

| Risk Level | Lower risk after system setup | Higher risk due to fluctuating sales |

| Examples | Rental properties, royalties, online courses | Real estate agent sales, insurance broker commissions |

Which is better?

A passive income stream provides entrepreneurs with steady revenue through investments, royalties, or automated sales, enabling financial stability without constant active involvement. Commission-based income rewards direct sales efforts, often leading to higher earnings potential tied closely to performance and client acquisition. Choosing between them depends on one's risk tolerance, time commitment, and long-term financial goals within the entrepreneurial landscape.

Connection

Passive income streams often include commission-based income as a key component, where entrepreneurs earn revenues without continuous active involvement. Affiliate marketing and sales commissions generate recurring payments from initial efforts, linking commission-based earnings directly to sustained passive income. Leveraging commission structures enables entrepreneurs to scale income while minimizing ongoing work, optimizing overall financial growth.

Key Terms

Active Participation

Commission-based income requires active participation, as earnings depend on continuous sales or services rendered, directly linking effort to compensation. Passive income streams, such as rental properties or investments, generate revenue with minimal ongoing involvement, allowing more financial freedom. Explore detailed comparisons to determine which income model aligns best with your financial goals and lifestyle.

Residual Earnings

Commission-based income relies on active sales efforts, generating earnings only when transactions occur, whereas passive income streams, particularly residual earnings, continue to produce revenue over time with minimal ongoing effort. Residual earnings, common in subscription services or royalties, accumulate as repeated payments from an initial sale or investment, creating sustainable financial growth. Explore strategies to maximize residual income and build long-term wealth.

Scalability

Commission-based income relies on direct sales efforts, limiting scalability due to time and resource constraints tied to each transaction. Passive income streams, such as royalties, rental income, or digital products, offer exponential scalability by generating revenue without continuous active involvement. Discover effective strategies to transform your earnings and maximize scalable income opportunities.

Source and External Links

The pros and cons of commission-based pay for your employees - Commission-based income is typically a percentage of goods or services sold and can be structured as straight commission, base pay plus commission, variable commission, or draw against commission, common in sales-related roles like real estate agents, insurance agents, and travel agents.

Everything you need to know about commission based pay - Primeum - Commission-based pay is incentive compensation calculated as a percentage of sales or gross profit generated, which can be fixed or variable, sometimes with progressive rates where higher sales yield higher commissions.

A comprehensive guide to commission-based pay [With examples] - Common commission structures include straight commission (only earning via sales) and base salary plus commission, with examples showing how commissions add to a guaranteed base salary to increase total earnings.

dowidth.com

dowidth.com