Bootstrapped SaaS startups rely on personal savings and revenue reinvestment to grow, allowing founders to maintain full control and equity while managing limited resources. Crowdfunding startups leverage platforms like Kickstarter or Indiegogo to raise capital from a broad audience, gaining early market validation and community support but often sacrificing some control and equity. Explore the pros and cons of each funding strategy to determine the best path for your entrepreneurial journey.

Why it is important

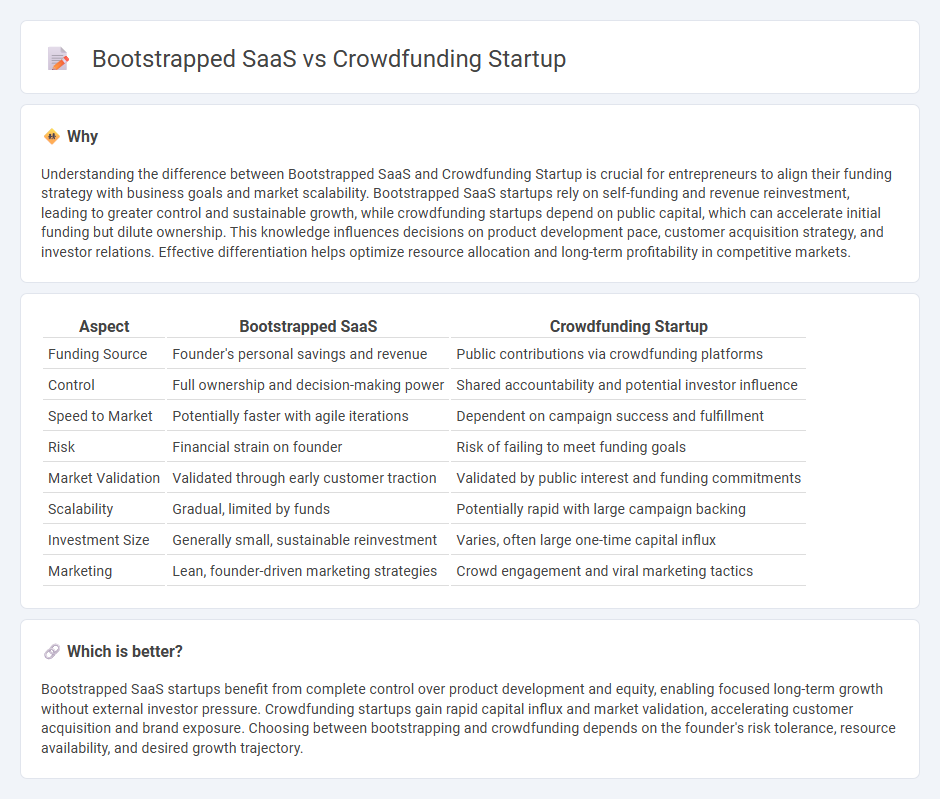

Understanding the difference between Bootstrapped SaaS and Crowdfunding Startup is crucial for entrepreneurs to align their funding strategy with business goals and market scalability. Bootstrapped SaaS startups rely on self-funding and revenue reinvestment, leading to greater control and sustainable growth, while crowdfunding startups depend on public capital, which can accelerate initial funding but dilute ownership. This knowledge influences decisions on product development pace, customer acquisition strategy, and investor relations. Effective differentiation helps optimize resource allocation and long-term profitability in competitive markets.

Comparison Table

| Aspect | Bootstrapped SaaS | Crowdfunding Startup |

|---|---|---|

| Funding Source | Founder's personal savings and revenue | Public contributions via crowdfunding platforms |

| Control | Full ownership and decision-making power | Shared accountability and potential investor influence |

| Speed to Market | Potentially faster with agile iterations | Dependent on campaign success and fulfillment |

| Risk | Financial strain on founder | Risk of failing to meet funding goals |

| Market Validation | Validated through early customer traction | Validated by public interest and funding commitments |

| Scalability | Gradual, limited by funds | Potentially rapid with large campaign backing |

| Investment Size | Generally small, sustainable reinvestment | Varies, often large one-time capital influx |

| Marketing | Lean, founder-driven marketing strategies | Crowd engagement and viral marketing tactics |

Which is better?

Bootstrapped SaaS startups benefit from complete control over product development and equity, enabling focused long-term growth without external investor pressure. Crowdfunding startups gain rapid capital influx and market validation, accelerating customer acquisition and brand exposure. Choosing between bootstrapping and crowdfunding depends on the founder's risk tolerance, resource availability, and desired growth trajectory.

Connection

Bootstrapped SaaS startups and crowdfunding ventures share a strong connection through their reliance on self-sustained funding models that prioritize early customer validation and market testing. Both approaches emphasize agile product development and community engagement to minimize external investment risks while maximizing user-driven growth and feedback loops. Leveraging crowdfunding platforms helps bootstrapped SaaS businesses attract initial capital and brand advocates, enabling scalable and organic revenue expansion.

Key Terms

Capital Acquisition

Crowdfunding startups secure capital by attracting numerous small investors, leveraging platforms like Kickstarter or Indiegogo to validate market demand and gain early user engagement. Bootstrapped SaaS companies rely on founder resources and revenue reinvestment, ensuring operational control and sustainable growth without external debt or equity dilution. Explore detailed strategies and case studies to understand which capital acquisition model best suits your SaaS venture.

Equity Dilution

Crowdfunding startups often face significant equity dilution due to multiple funding rounds involving numerous investors, which can reduce founders' ownership percentages substantially. Bootstrapped SaaS companies maintain full control and ownership by relying on internal cash flow and avoiding external equity financing, preserving founder equity. Explore detailed strategies to balance growth and ownership in SaaS startups.

Revenue Model

Crowdfunding startups often rely on pre-launch customer funding and one-time contributions, creating early revenue streams through backer investments and product pre-sales. Bootstrapped SaaS companies prioritize sustainable recurring revenue models, focusing on subscription-based payments and customer retention to drive consistent cash flow. Explore detailed comparisons to understand which revenue model best supports your business growth strategy.

Source and External Links

12 Best Crowdfunding Sites for Startups 2025 - Crowdfunding platforms like StartEngine, Indiegogo, Kickstarter, and Wefunder are popular ways for startups to raise capital from many small investors, often in exchange for equity or rewards.

What is crowdfunding? Here are four types to know - Crowdfunding helps startups access capital, validate their markets, build audiences, receive feedback, and reduce funding risks by sourcing many small contributions through the internet and social media.

5 Best Crowdfunding Platforms For Investing In Startups - Crowdfunding types include reward-based (product rewards), equity (shares of ownership), and debt (loans with interest), making investing accessible to everyday people through platforms like Wefunder and StartEngine.

dowidth.com

dowidth.com