Sweat equity marketplaces enable entrepreneurs to trade time and skills for ownership stakes, fostering collaborative business growth without immediate capital investment. Initial Coin Offerings (ICOs) provide startups a method to raise funds by issuing digital tokens, leveraging blockchain technology for liquidity and investor access. Explore the advantages and challenges of both models to understand their impact on modern entrepreneurship.

Why it is important

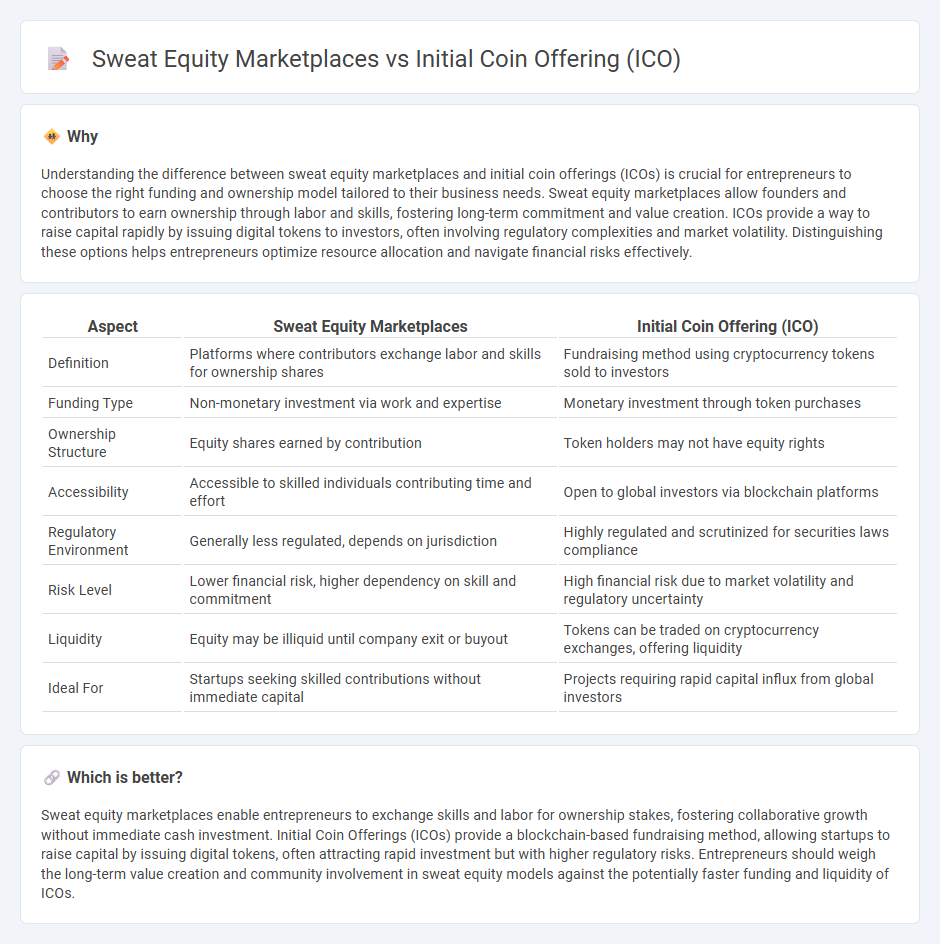

Understanding the difference between sweat equity marketplaces and initial coin offerings (ICOs) is crucial for entrepreneurs to choose the right funding and ownership model tailored to their business needs. Sweat equity marketplaces allow founders and contributors to earn ownership through labor and skills, fostering long-term commitment and value creation. ICOs provide a way to raise capital rapidly by issuing digital tokens to investors, often involving regulatory complexities and market volatility. Distinguishing these options helps entrepreneurs optimize resource allocation and navigate financial risks effectively.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Initial Coin Offering (ICO) |

|---|---|---|

| Definition | Platforms where contributors exchange labor and skills for ownership shares | Fundraising method using cryptocurrency tokens sold to investors |

| Funding Type | Non-monetary investment via work and expertise | Monetary investment through token purchases |

| Ownership Structure | Equity shares earned by contribution | Token holders may not have equity rights |

| Accessibility | Accessible to skilled individuals contributing time and effort | Open to global investors via blockchain platforms |

| Regulatory Environment | Generally less regulated, depends on jurisdiction | Highly regulated and scrutinized for securities laws compliance |

| Risk Level | Lower financial risk, higher dependency on skill and commitment | High financial risk due to market volatility and regulatory uncertainty |

| Liquidity | Equity may be illiquid until company exit or buyout | Tokens can be traded on cryptocurrency exchanges, offering liquidity |

| Ideal For | Startups seeking skilled contributions without immediate capital | Projects requiring rapid capital influx from global investors |

Which is better?

Sweat equity marketplaces enable entrepreneurs to exchange skills and labor for ownership stakes, fostering collaborative growth without immediate cash investment. Initial Coin Offerings (ICOs) provide a blockchain-based fundraising method, allowing startups to raise capital by issuing digital tokens, often attracting rapid investment but with higher regulatory risks. Entrepreneurs should weigh the long-term value creation and community involvement in sweat equity models against the potentially faster funding and liquidity of ICOs.

Connection

Sweat equity marketplaces enable entrepreneurs to invest time and expertise in startups in exchange for ownership shares, aligning incentives without immediate capital outlay. Initial Coin Offerings (ICOs) offer a blockchain-based fundraising model where tokens represent value or equity, facilitating liquidity and wider investor access. Both mechanisms innovate traditional funding by leveraging non-cash assets and decentralized finance to democratize entrepreneurship and capital formation.

Key Terms

Tokenization

Initial Coin Offerings (ICOs) enable startups to raise capital by issuing digital tokens that represent assets or utility on a blockchain, allowing investors to trade these tokens globally. Sweat equity marketplaces tokenize contributions of time and effort, transforming intangible input into tradable digital shares, thereby monetizing skills and labor through blockchain. Explore how tokenization is revolutionizing funding and workforce participation models.

Equity Allocation

Initial Coin Offerings (ICOs) involve raising capital by issuing digital tokens, often leading to diluted equity among numerous investors. Sweat equity marketplaces allocate ownership based on contributions of time, skills, and effort rather than capital investment, preserving equity for active participants. Explore how these models impact startup growth and equitable ownership distribution.

Fundraising Mechanism

Initial Coin Offerings (ICOs) enable startups to raise capital by issuing digital tokens to investors in exchange for cryptocurrency, providing immediate liquidity and broad access to global investors. Sweat equity marketplaces facilitate fundraising through contributions of labor or expertise, allowing participants to earn ownership stakes without upfront financial investment. Explore the differences in fundraising mechanisms to determine the best option for your project's growth strategy.

Source and External Links

What are Initial Coin Offerings (ICOs) and how do they work? - Initial Coin Offerings (ICOs) are cryptocurrency fundraising methods where new tokens are distributed to participants in exchange for capital, similar to IPOs, but they vary in structure and carry regulatory risks due to lack of oversight.

Initial coin offering - ICOs are a form of crowdfunding using cryptocurrency tokens to raise capital for projects, often bypassing traditional regulations, but they have high failure rates and risks of scams due to limited regulatory enforcement.

Initial Coin Offering (ICO) - Definition, Examples, Types - ICOs involve companies creating tradeable tokens on blockchain platforms to raise funds, promoting the tokens as utility or rights related to a project, often relying on broad online marketing despite some platform bans on ICO ads.

dowidth.com

dowidth.com