Micro private equity firms focus on acquiring and growing small to mid-sized businesses, delivering hands-on operational expertise and targeted capital to boost value. Family office investing involves managing wealth for high-net-worth families through a diversified portfolio, prioritizing long-term preservation and growth with a personalized investment approach. Explore how these distinct strategies shape investment outcomes and entrepreneurial success.

Why it is important

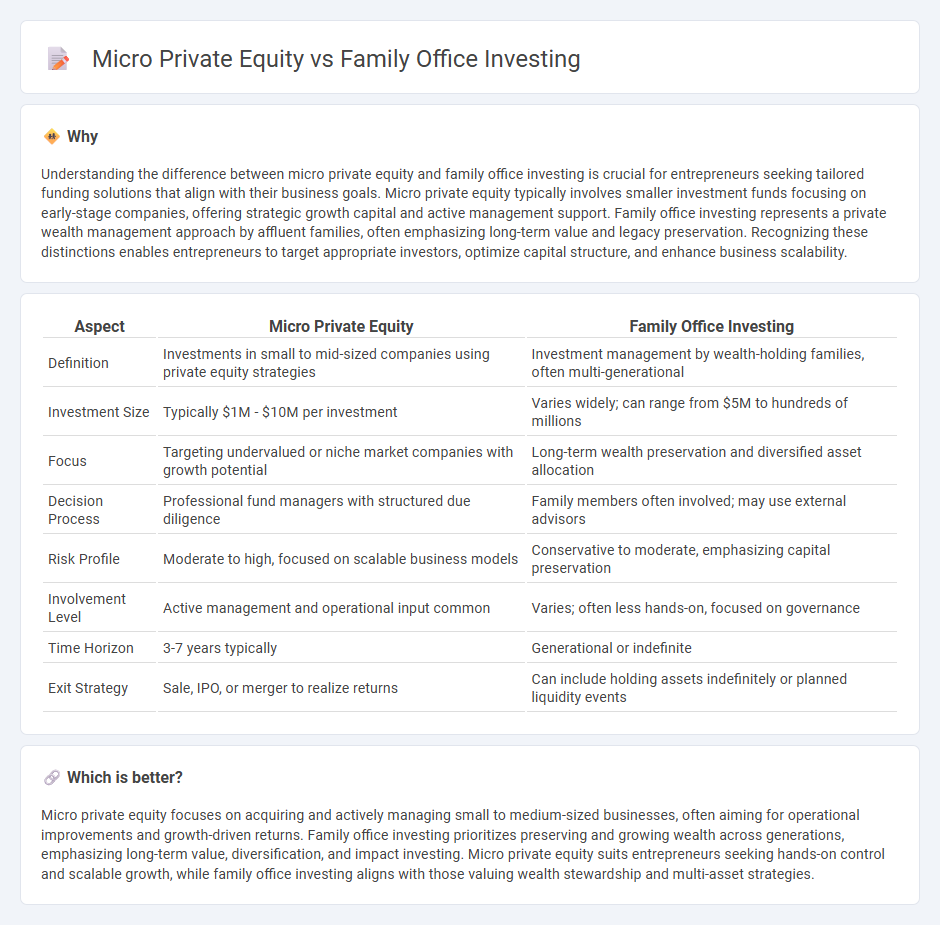

Understanding the difference between micro private equity and family office investing is crucial for entrepreneurs seeking tailored funding solutions that align with their business goals. Micro private equity typically involves smaller investment funds focusing on early-stage companies, offering strategic growth capital and active management support. Family office investing represents a private wealth management approach by affluent families, often emphasizing long-term value and legacy preservation. Recognizing these distinctions enables entrepreneurs to target appropriate investors, optimize capital structure, and enhance business scalability.

Comparison Table

| Aspect | Micro Private Equity | Family Office Investing |

|---|---|---|

| Definition | Investments in small to mid-sized companies using private equity strategies | Investment management by wealth-holding families, often multi-generational |

| Investment Size | Typically $1M - $10M per investment | Varies widely; can range from $5M to hundreds of millions |

| Focus | Targeting undervalued or niche market companies with growth potential | Long-term wealth preservation and diversified asset allocation |

| Decision Process | Professional fund managers with structured due diligence | Family members often involved; may use external advisors |

| Risk Profile | Moderate to high, focused on scalable business models | Conservative to moderate, emphasizing capital preservation |

| Involvement Level | Active management and operational input common | Varies; often less hands-on, focused on governance |

| Time Horizon | 3-7 years typically | Generational or indefinite |

| Exit Strategy | Sale, IPO, or merger to realize returns | Can include holding assets indefinitely or planned liquidity events |

Which is better?

Micro private equity focuses on acquiring and actively managing small to medium-sized businesses, often aiming for operational improvements and growth-driven returns. Family office investing prioritizes preserving and growing wealth across generations, emphasizing long-term value, diversification, and impact investing. Micro private equity suits entrepreneurs seeking hands-on control and scalable growth, while family office investing aligns with those valuing wealth stewardship and multi-asset strategies.

Connection

Micro private equity and family office investing both focus on acquiring and managing privately held businesses, aiming for long-term value creation through active involvement and tailored growth strategies. Family offices leverage micro private equity funds to diversify their investment portfolios while maintaining control and minimizing risk in niche markets. This synergy allows family offices to capitalize on specialized expertise and operational improvements offered by micro private equity firms, enhancing wealth preservation and growth.

Key Terms

Succession Planning

Family offices prioritize succession planning by maintaining long-term wealth preservation and ensuring smooth generational transfers through personalized investment strategies. Micro private equity firms emphasize structured governance and liquidity events to facilitate business continuity and exit planning for family-owned enterprises. Explore detailed approaches and best practices in succession planning to optimize family wealth and business legacy.

Deal Sourcing

Family offices leverage extensive personal networks and trusted advisor relationships for deal sourcing, often gaining early access to unique investment opportunities. Micro private equity firms deploy systematic screening and proprietary databases to identify high-potential small and medium-sized enterprises (SMEs). Discover more about how these approaches impact investment outcomes and strategic growth.

Value Creation

Family offices invest with a long-term perspective, leveraging personalized wealth management and deep industry expertise to create sustainable value by nurturing portfolio companies' growth and innovation. Micro private equity firms focus on acquiring smaller businesses, executing hands-on operational improvements and strategic guidance to drive rapid value creation and profitable exits. Explore detailed strategies and success stories to understand how each approach maximizes value creation.

Source and External Links

The Family Office: What Is It, Purpose, Strategies - Family offices manage diverse assets through customized investment policies and may include direct investments in real estate or private businesses related to the family's expertise, offering personalized control but also facing complexity and risk.

What is a Family Office? A Complete Family Office Guide - Family offices adopt integrated, personalized investment strategies centered on long-term wealth growth across generations, featuring diversified portfolios and often direct private market investments to enhance returns and control.

A Simple guide to family offices - Family offices provide ultra-high-net-worth families access to exclusive asset classes like private equity and real estate, offering either single or multi-family office structures tailored to clients' focus and wealth thresholds.

dowidth.com

dowidth.com