Exit-ready startups focus on achieving rapid growth and preparing for acquisition or initial public offering (IPO), emphasizing strong market positioning, revenue generation, and streamlined operations. Scale-ups prioritize sustainable expansion, optimizing business models to increase market share, improve product offerings, and enhance customer retention over time. Discover more about the key differences that shape successful entrepreneurial strategies.

Why it is important

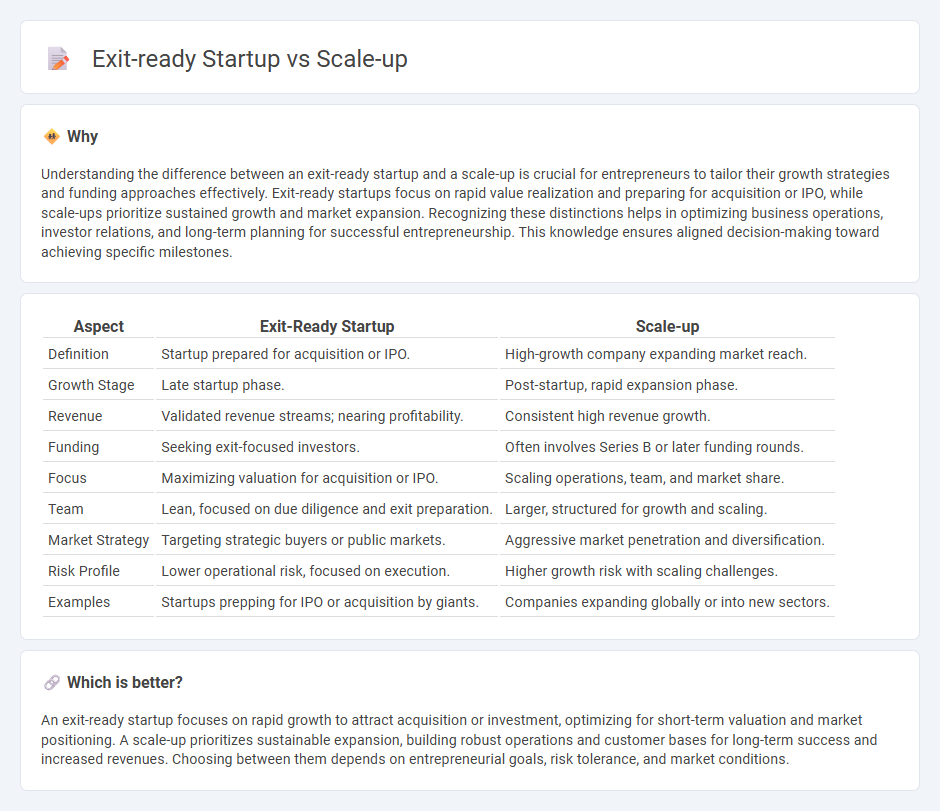

Understanding the difference between an exit-ready startup and a scale-up is crucial for entrepreneurs to tailor their growth strategies and funding approaches effectively. Exit-ready startups focus on rapid value realization and preparing for acquisition or IPO, while scale-ups prioritize sustained growth and market expansion. Recognizing these distinctions helps in optimizing business operations, investor relations, and long-term planning for successful entrepreneurship. This knowledge ensures aligned decision-making toward achieving specific milestones.

Comparison Table

| Aspect | Exit-Ready Startup | Scale-up |

|---|---|---|

| Definition | Startup prepared for acquisition or IPO. | High-growth company expanding market reach. |

| Growth Stage | Late startup phase. | Post-startup, rapid expansion phase. |

| Revenue | Validated revenue streams; nearing profitability. | Consistent high revenue growth. |

| Funding | Seeking exit-focused investors. | Often involves Series B or later funding rounds. |

| Focus | Maximizing valuation for acquisition or IPO. | Scaling operations, team, and market share. |

| Team | Lean, focused on due diligence and exit preparation. | Larger, structured for growth and scaling. |

| Market Strategy | Targeting strategic buyers or public markets. | Aggressive market penetration and diversification. |

| Risk Profile | Lower operational risk, focused on execution. | Higher growth risk with scaling challenges. |

| Examples | Startups prepping for IPO or acquisition by giants. | Companies expanding globally or into new sectors. |

Which is better?

An exit-ready startup focuses on rapid growth to attract acquisition or investment, optimizing for short-term valuation and market positioning. A scale-up prioritizes sustainable expansion, building robust operations and customer bases for long-term success and increased revenues. Choosing between them depends on entrepreneurial goals, risk tolerance, and market conditions.

Connection

Exit-ready startups and scale-ups share a critical connection through their focus on sustainable growth and market validation, which attract potential investors or buyers. As scale-ups demonstrate consistent revenue growth and operational efficiency, they position themselves as attractive exit opportunities by reducing perceived risks. This alignment ensures that startups progressing to scale-up stages are strategically prepared for successful exits, whether through acquisitions, mergers, or public offerings.

Key Terms

Growth Strategy

Scale-up startups prioritize aggressive growth strategies, emphasizing market expansion, customer acquisition, and scaling operations to capture larger market share rapidly. Exit-ready startups concentrate on building sustainable value through profitability, operational efficiency, and strong financial metrics to attract potential buyers or investors. Explore tailored growth strategies to effectively navigate your startup's path from scaling to successful exit.

Liquidity Event

Scale-up startups prioritize rapid growth and market expansion to increase valuation before pursuing a liquidity event such as an IPO or acquisition. Exit-ready startups concentrate on optimizing financial metrics and operational stability to attract potential buyers or public market investors. Explore more insights on preparing your startup for a successful liquidity event.

Operational Efficiency

Scale-up startups prioritize streamlining processes, enhancing automation, and optimizing resource allocation to drive rapid growth and scalability in operational efficiency. Exit-ready startups focus on stabilizing operations, implementing robust governance frameworks, and ensuring compliance to maximize valuation and appeal to potential acquirers. Explore in-depth strategies to transition from scaling up to preparing for a successful exit.

Source and External Links

What's the difference between a startup, a scale-up, and ... - A scale-up is a startup that has grown by stabilizing its business model, showing viability, and typically achieves over 20% annual team growth, generates between $1 million and $3 million in turnover, and has raised at least $1 million, positioning it beyond the startup phase.

What is a Scaleup, the evolution of Startups - The OECD defines a scaleup as a company growing at over 20% annually in employees or turnover for at least three consecutive years, starting with a minimum of 10 employees, marking a crucial transition from startup to a mature, sustainable business.

scale up | Scale your business with plan & made to measure ... - The scale up framework helps companies accelerate growth by improving four key areas: people, strategy, execution, and cash, turning scaling into a craft supported by proven methods that drive sustainable success.

dowidth.com

dowidth.com