Micro private equity involves direct investment in small businesses by specialized firms or individuals seeking significant ownership and control, often focusing on long-term growth and value creation. Crowdfunding raises capital from a large pool of small investors through online platforms, enabling entrepreneurs to access funds with minimal equity dilution and increased market exposure. Explore the differences between these financing methods to identify the best strategy for your entrepreneurial venture.

Why it is important

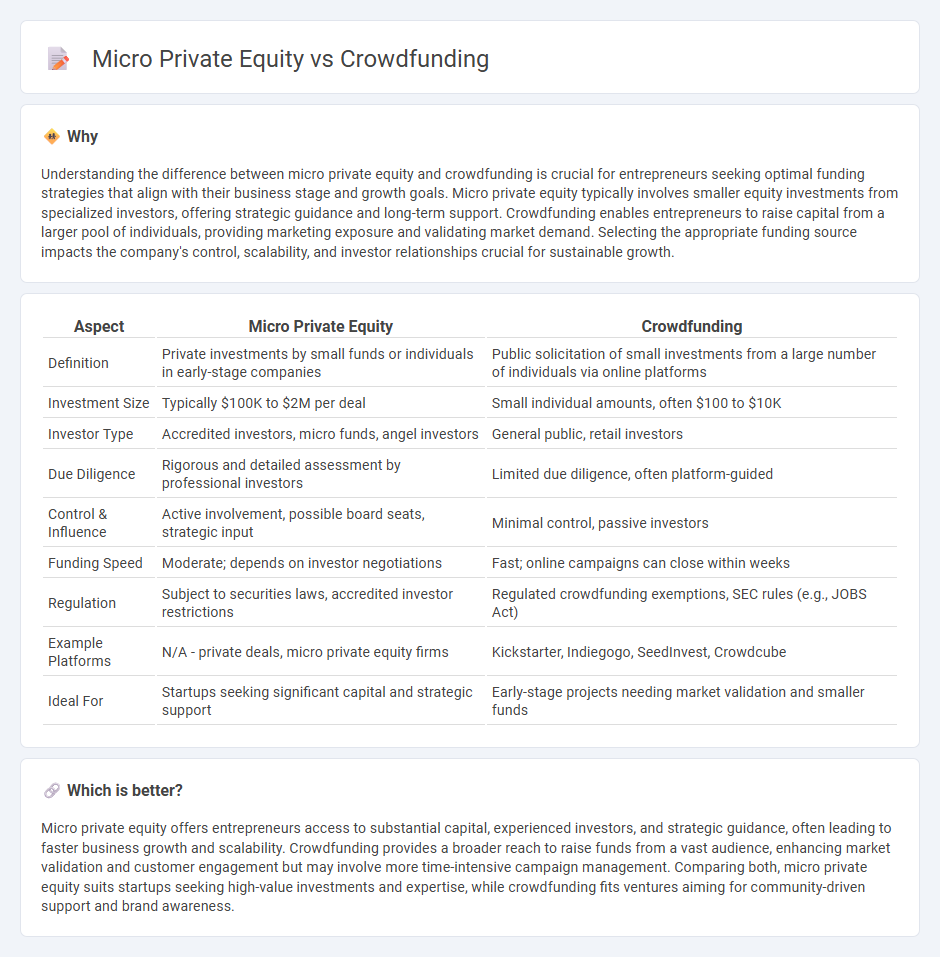

Understanding the difference between micro private equity and crowdfunding is crucial for entrepreneurs seeking optimal funding strategies that align with their business stage and growth goals. Micro private equity typically involves smaller equity investments from specialized investors, offering strategic guidance and long-term support. Crowdfunding enables entrepreneurs to raise capital from a larger pool of individuals, providing marketing exposure and validating market demand. Selecting the appropriate funding source impacts the company's control, scalability, and investor relationships crucial for sustainable growth.

Comparison Table

| Aspect | Micro Private Equity | Crowdfunding |

|---|---|---|

| Definition | Private investments by small funds or individuals in early-stage companies | Public solicitation of small investments from a large number of individuals via online platforms |

| Investment Size | Typically $100K to $2M per deal | Small individual amounts, often $100 to $10K |

| Investor Type | Accredited investors, micro funds, angel investors | General public, retail investors |

| Due Diligence | Rigorous and detailed assessment by professional investors | Limited due diligence, often platform-guided |

| Control & Influence | Active involvement, possible board seats, strategic input | Minimal control, passive investors |

| Funding Speed | Moderate; depends on investor negotiations | Fast; online campaigns can close within weeks |

| Regulation | Subject to securities laws, accredited investor restrictions | Regulated crowdfunding exemptions, SEC rules (e.g., JOBS Act) |

| Example Platforms | N/A - private deals, micro private equity firms | Kickstarter, Indiegogo, SeedInvest, Crowdcube |

| Ideal For | Startups seeking significant capital and strategic support | Early-stage projects needing market validation and smaller funds |

Which is better?

Micro private equity offers entrepreneurs access to substantial capital, experienced investors, and strategic guidance, often leading to faster business growth and scalability. Crowdfunding provides a broader reach to raise funds from a vast audience, enhancing market validation and customer engagement but may involve more time-intensive campaign management. Comparing both, micro private equity suits startups seeking high-value investments and expertise, while crowdfunding fits ventures aiming for community-driven support and brand awareness.

Connection

Micro private equity and crowdfunding intersect by enabling access to capital for early-stage entrepreneurs and small businesses through alternative funding sources. Crowdfunding platforms aggregate numerous small investments from individuals, while micro private equity pools modest sums from specialized investors to support business growth. Both approaches democratize investment opportunities, reduce reliance on traditional venture capital, and stimulate innovation by funding diverse entrepreneurial ventures.

Key Terms

Capital Sourcing

Crowdfunding platforms aggregate capital from numerous individual investors to fund projects or startups, enabling broad access to capital without traditional financial intermediaries. Micro private equity involves smaller-scale private equity funds that source capital from accredited investors or institutions, focusing on niche markets or early-stage ventures with potential for high returns. Explore the distinct advantages of each capital sourcing method to determine the best fit for your funding strategy.

Ownership Structure

Crowdfunding involves pooling small investments from a large number of individuals, typically resulting in dispersed ownership with limited control for each investor. Micro private equity targets a smaller group of investors, often leading to concentrated ownership and greater influence over business decisions. Explore more to understand how ownership structures impact investor rights and company governance.

Investor Involvement

Crowdfunding allows a broad base of investors to contribute smaller amounts with limited influence on company decisions, making it accessible but less involved. Micro private equity involves fewer investors who commit larger funds and often expect significant involvement in governance and strategic direction. Explore the key differences in investor roles to decide which approach aligns best with your investment goals.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of raising money for projects or ventures from many people, usually via the internet, involving project initiators, supporters, and a platform to connect them.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding raises funds through collective effort from a broad group including friends, family, and individual investors via online platforms and social media, differing from traditional financing reliant on few investors.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small contributions from many individuals and can be donation-based, rewards-based, or equity-based, with equity crowdfunding allowing investors partial ownership in companies.

dowidth.com

dowidth.com