Side hustle stacks involve building multiple income streams simultaneously by leveraging skills, gig platforms, and digital products to maximize revenue potential. Crowdfunding harnesses the power of online communities to raise capital for innovative projects, enabling entrepreneurs to validate ideas and access funds without traditional financial barriers. Discover more about how these strategies can accelerate your entrepreneurial journey.

Why it is important

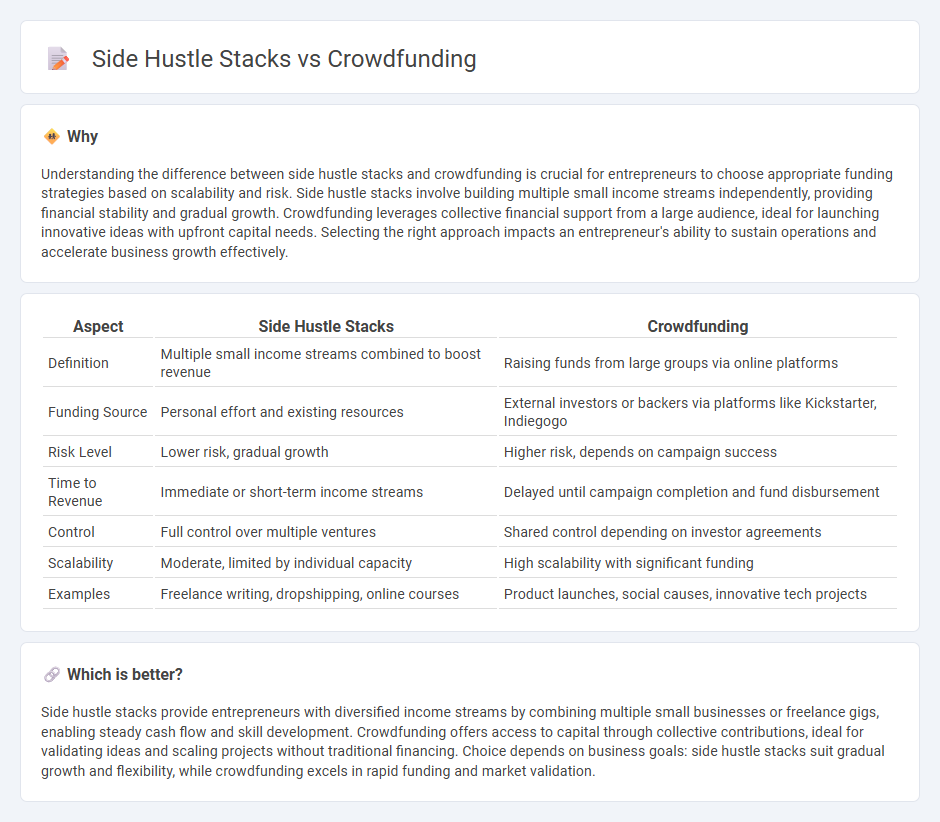

Understanding the difference between side hustle stacks and crowdfunding is crucial for entrepreneurs to choose appropriate funding strategies based on scalability and risk. Side hustle stacks involve building multiple small income streams independently, providing financial stability and gradual growth. Crowdfunding leverages collective financial support from a large audience, ideal for launching innovative ideas with upfront capital needs. Selecting the right approach impacts an entrepreneur's ability to sustain operations and accelerate business growth effectively.

Comparison Table

| Aspect | Side Hustle Stacks | Crowdfunding |

|---|---|---|

| Definition | Multiple small income streams combined to boost revenue | Raising funds from large groups via online platforms |

| Funding Source | Personal effort and existing resources | External investors or backers via platforms like Kickstarter, Indiegogo |

| Risk Level | Lower risk, gradual growth | Higher risk, depends on campaign success |

| Time to Revenue | Immediate or short-term income streams | Delayed until campaign completion and fund disbursement |

| Control | Full control over multiple ventures | Shared control depending on investor agreements |

| Scalability | Moderate, limited by individual capacity | High scalability with significant funding |

| Examples | Freelance writing, dropshipping, online courses | Product launches, social causes, innovative tech projects |

Which is better?

Side hustle stacks provide entrepreneurs with diversified income streams by combining multiple small businesses or freelance gigs, enabling steady cash flow and skill development. Crowdfunding offers access to capital through collective contributions, ideal for validating ideas and scaling projects without traditional financing. Choice depends on business goals: side hustle stacks suit gradual growth and flexibility, while crowdfunding excels in rapid funding and market validation.

Connection

Side hustle stacks provide a diverse portfolio of income streams for entrepreneurs, enabling financial stability and growth opportunities. Crowdfunding platforms offer essential capital by engaging a broad audience to invest in or support innovative side projects within these stacks. This synergy accelerates product development and market validation, enhancing entrepreneurial success rates.

Key Terms

Capital acquisition

Crowdfunding leverages a broad online audience to raise capital rapidly, ideal for startups seeking substantial initial funding without incurring debt. Side hustle stacks combine multiple small income streams, maximizing personal cash flow and minimizing financial risk but often requiring more time to accumulate significant capital. Explore detailed strategies to choose the best capital acquisition method tailored to your entrepreneurial goals.

Multiple income streams

Multiple income streams, including crowdfunding and side hustle stacks, significantly enhance financial stability and growth potential by diversifying revenue sources. Crowdfunding leverages community support and pre-sales for project funding, while side hustle stacks combine various part-time ventures to maximize earnings and skill development. Explore in-depth strategies for balancing these approaches to optimize your financial portfolio.

Resource leveraging

Resource leveraging in crowdfunding harnesses collective financial support and community engagement to fuel projects without large upfront capital. Side hustle stacks combine multiple income streams and skills, maximizing personal time and assets for diversified revenue generation. Explore strategies to optimize your resource leveraging for sustainable growth.

Source and External Links

Crowdfunding (Wikipedia) - Crowdfunding is the practice of raising money from a large number of people, typically via the internet, to fund projects or ventures without standard financial intermediaries.

Four Types of Crowdfunding for Startups - Crowdfunding allows entrepreneurs to finance projects or businesses through small contributions from a large pool of individuals, primarily via online platforms and social media.

Small Business Financing: Crowdfunding - Crowdfunding collects small amounts from many people using online platforms, operating through models like donation, reward, or equity-based funding.

dowidth.com

dowidth.com