Sweat equity marketplaces empower entrepreneurs by offering access to funding through active participation and skill contribution, fostering collaboration and shared ownership in startups. Corporate venture arms provide strategic investments by established companies, leveraging industry expertise and resources to scale innovative ventures. Explore how these models reshape startup funding dynamics and create diverse growth opportunities.

Why it is important

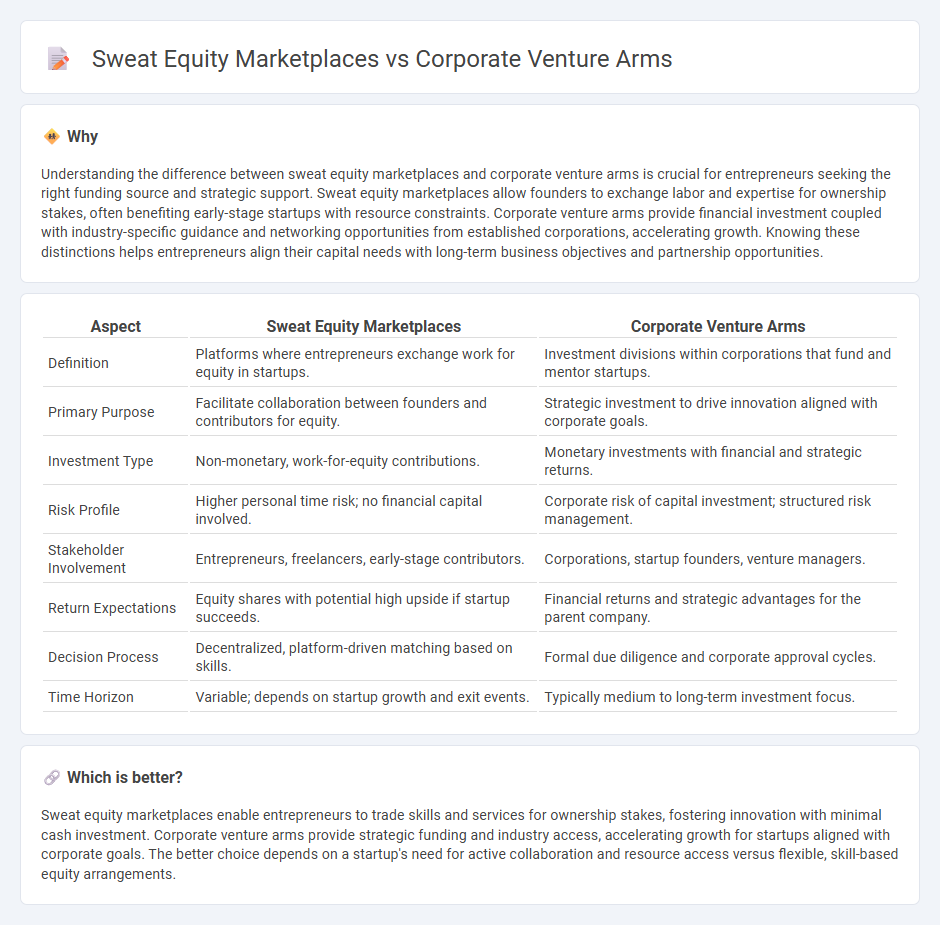

Understanding the difference between sweat equity marketplaces and corporate venture arms is crucial for entrepreneurs seeking the right funding source and strategic support. Sweat equity marketplaces allow founders to exchange labor and expertise for ownership stakes, often benefiting early-stage startups with resource constraints. Corporate venture arms provide financial investment coupled with industry-specific guidance and networking opportunities from established corporations, accelerating growth. Knowing these distinctions helps entrepreneurs align their capital needs with long-term business objectives and partnership opportunities.

Comparison Table

| Aspect | Sweat Equity Marketplaces | Corporate Venture Arms |

|---|---|---|

| Definition | Platforms where entrepreneurs exchange work for equity in startups. | Investment divisions within corporations that fund and mentor startups. |

| Primary Purpose | Facilitate collaboration between founders and contributors for equity. | Strategic investment to drive innovation aligned with corporate goals. |

| Investment Type | Non-monetary, work-for-equity contributions. | Monetary investments with financial and strategic returns. |

| Risk Profile | Higher personal time risk; no financial capital involved. | Corporate risk of capital investment; structured risk management. |

| Stakeholder Involvement | Entrepreneurs, freelancers, early-stage contributors. | Corporations, startup founders, venture managers. |

| Return Expectations | Equity shares with potential high upside if startup succeeds. | Financial returns and strategic advantages for the parent company. |

| Decision Process | Decentralized, platform-driven matching based on skills. | Formal due diligence and corporate approval cycles. |

| Time Horizon | Variable; depends on startup growth and exit events. | Typically medium to long-term investment focus. |

Which is better?

Sweat equity marketplaces enable entrepreneurs to trade skills and services for ownership stakes, fostering innovation with minimal cash investment. Corporate venture arms provide strategic funding and industry access, accelerating growth for startups aligned with corporate goals. The better choice depends on a startup's need for active collaboration and resource access versus flexible, skill-based equity arrangements.

Connection

Sweat equity marketplaces enable entrepreneurs to exchange skills and effort for ownership stakes, fostering startup growth without immediate cash investment. Corporate venture arms often collaborate with these platforms to identify innovative startups and acquire minority equity positions while leveraging strategic partnerships. This synergy accelerates innovation by combining resource-rich corporations with agile, skill-driven entrepreneurial ventures.

Key Terms

Corporate Venture Arms:

Corporate venture arms serve as strategic investment vehicles for established companies to fund startups aligned with their innovation goals, leveraging financial resources and industry expertise. These arms provide startups not only funding but also access to valuable corporate networks, market channels, and mentorship, accelerating growth and market penetration. Explore how corporate venture arms drive innovation through strategic partnerships and investment.

Strategic Investment

Corporate venture arms specialize in strategic investments to align startups with a parent company's innovation goals, leveraging financial backing and industry resources to accelerate growth. Sweat equity marketplaces, in contrast, facilitate collaboration by exchanging expertise and time for ownership stakes, prioritizing operational support over direct capital infusion. Explore how these distinct models drive innovation and value creation in evolving entrepreneurial ecosystems.

Corporate Innovation

Corporate venture arms invest capital into startups to drive strategic innovation and access emerging technologies, fostering growth within their corporate ecosystem. Sweat equity marketplaces enable employees and collaborators to contribute skills in exchange for ownership stakes, promoting internal innovation through shared value creation. Explore how these models transform corporate innovation strategies and unlock new growth opportunities.

Source and External Links

10 Corporate Venture Program Examples You Should Know About - Corporate venture arms are vehicles used by companies like Unilever, Porsche, and BMW to invest in startups across various stages, gaining access to cutting-edge technologies and emerging market insights to fuel innovation and maintain competitive advantage.

Corporate venture capital - Corporate venture capital is the investment of corporate funds directly into external startups often linked operationally to the parent company, serving both strategic innovation and potential acquisition opportunities while keeping new capabilities insulated.

Understanding Corporate Venture Capital: The Ultimate Guide - Corporate venture capital not only provides financial returns but also builds the parent company's intellectual capital by engaging with startups using novel technologies, thus helping to de-risk future mergers and acquisitions.

dowidth.com

dowidth.com