Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions and improved customer experiences. POS financing offers point-of-sale credit options, allowing consumers to finance purchases instantly at checkout. Explore how these innovative financing solutions drive entrepreneurial growth and customer engagement.

Why it is important

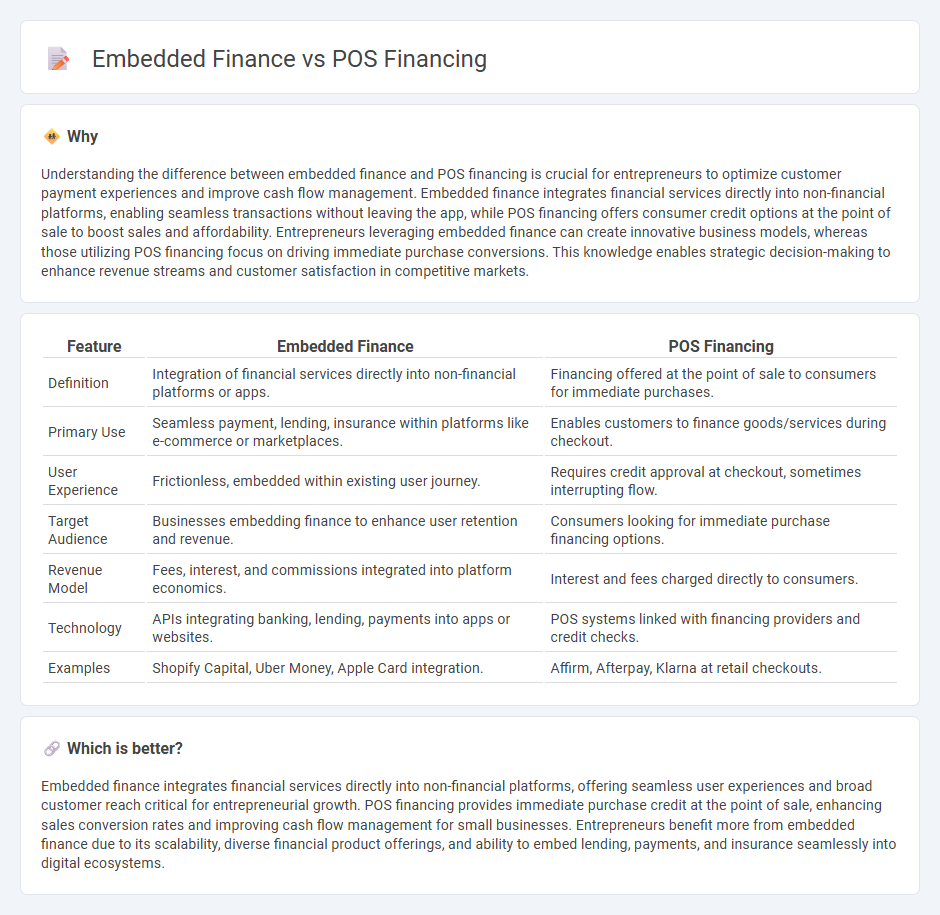

Understanding the difference between embedded finance and POS financing is crucial for entrepreneurs to optimize customer payment experiences and improve cash flow management. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions without leaving the app, while POS financing offers consumer credit options at the point of sale to boost sales and affordability. Entrepreneurs leveraging embedded finance can create innovative business models, whereas those utilizing POS financing focus on driving immediate purchase conversions. This knowledge enables strategic decision-making to enhance revenue streams and customer satisfaction in competitive markets.

Comparison Table

| Feature | Embedded Finance | POS Financing |

|---|---|---|

| Definition | Integration of financial services directly into non-financial platforms or apps. | Financing offered at the point of sale to consumers for immediate purchases. |

| Primary Use | Seamless payment, lending, insurance within platforms like e-commerce or marketplaces. | Enables customers to finance goods/services during checkout. |

| User Experience | Frictionless, embedded within existing user journey. | Requires credit approval at checkout, sometimes interrupting flow. |

| Target Audience | Businesses embedding finance to enhance user retention and revenue. | Consumers looking for immediate purchase financing options. |

| Revenue Model | Fees, interest, and commissions integrated into platform economics. | Interest and fees charged directly to consumers. |

| Technology | APIs integrating banking, lending, payments into apps or websites. | POS systems linked with financing providers and credit checks. |

| Examples | Shopify Capital, Uber Money, Apple Card integration. | Affirm, Afterpay, Klarna at retail checkouts. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, offering seamless user experiences and broad customer reach critical for entrepreneurial growth. POS financing provides immediate purchase credit at the point of sale, enhancing sales conversion rates and improving cash flow management for small businesses. Entrepreneurs benefit more from embedded finance due to its scalability, diverse financial product offerings, and ability to embed lending, payments, and insurance seamlessly into digital ecosystems.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions at the point of sale (POS). POS financing leverages this integration by offering instant credit options during checkout, boosting customer purchasing power and merchant sales. This connection drives entrepreneurship by facilitating smoother payment experiences and enhancing access to flexible capital.

Key Terms

Point-of-Sale (POS) Lending

Point-of-Sale (POS) lending offers consumers immediate credit options at checkout, enabling smoother transactions and increased purchasing power. Embedded finance integrates POS lending directly within retail platforms or payment systems, enhancing user experience by simplifying access to credit without redirecting consumers to third-party lenders. Explore the advancements in POS lending and embedded finance to understand their impact on modern retail ecosystems.

API Integration

POS financing leverages APIs to connect payment platforms with external lenders, enabling seamless installment options directly at checkout. Embedded finance integrates financial services like lending, payments, or insurance within non-financial platforms via APIs, creating a unified user experience without redirecting customers. Explore the differences in API integration approaches to optimize your financial service offerings.

Customer Experience

POS financing offers customers flexible payment options at checkout, enhancing purchasing power and satisfaction by spreading costs over time. Embedded finance seamlessly integrates financial services within the customer journey, reducing friction and streamlining transactions for a more intuitive shopping experience. Explore how these financing methods transform customer engagement and boost loyalty by learning more about their unique impact on user experience.

Source and External Links

What is POS financing? - Jifiti - POS financing allows customers to buy now and pay later by offering credit cards, store cards, or installment loans right at checkout, making it easier for consumers to afford large purchases and for merchants to attract more sales.

What Is POS Financing? - GoCardless - POS financing is a short-term loan option at checkout, letting customers split payments into installments with flexible plans and quick approval, often with interest rates and terms that vary by provider.

What is point-of-sale financing? - Affirm - Point-of-sale financing includes credit cards, lines of credit, or unsecured loans offered during checkout, enabling customers to pay over time and helping businesses drive higher sales through flexible payment options.

dowidth.com

dowidth.com