Exit-ready startups focus on rapid growth, external funding, and scalability to attract investors for a lucrative acquisition or IPO. Bootstrapped startups rely on personal funds and organic growth, emphasizing sustainability and control without external influence. Discover more about their distinct paths to success and strategic advantages.

Why it is important

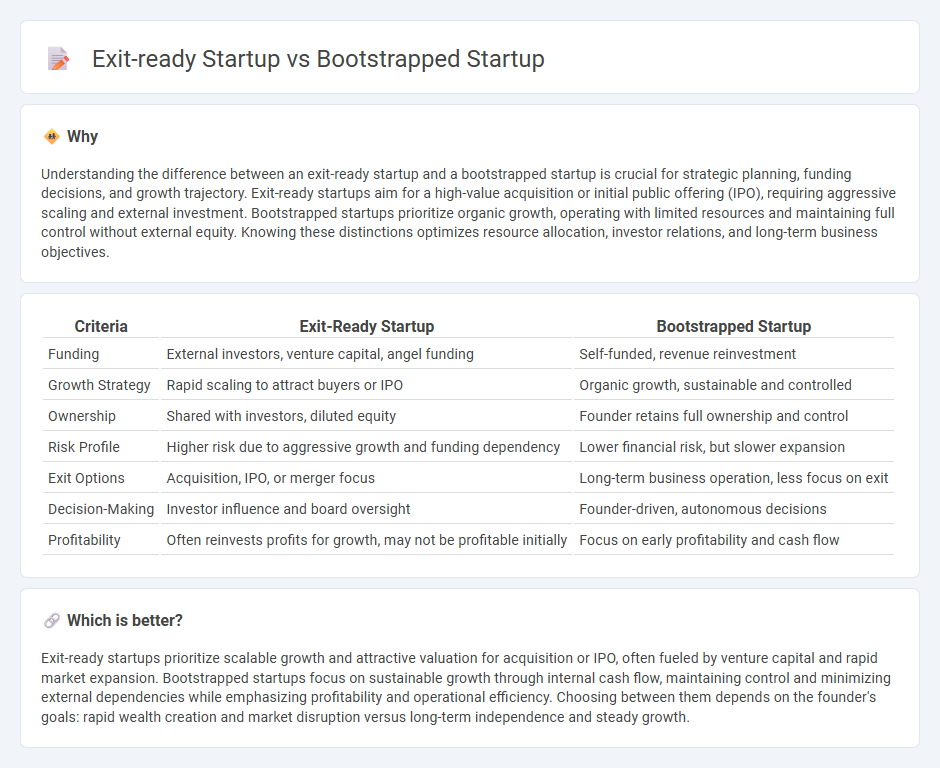

Understanding the difference between an exit-ready startup and a bootstrapped startup is crucial for strategic planning, funding decisions, and growth trajectory. Exit-ready startups aim for a high-value acquisition or initial public offering (IPO), requiring aggressive scaling and external investment. Bootstrapped startups prioritize organic growth, operating with limited resources and maintaining full control without external equity. Knowing these distinctions optimizes resource allocation, investor relations, and long-term business objectives.

Comparison Table

| Criteria | Exit-Ready Startup | Bootstrapped Startup |

|---|---|---|

| Funding | External investors, venture capital, angel funding | Self-funded, revenue reinvestment |

| Growth Strategy | Rapid scaling to attract buyers or IPO | Organic growth, sustainable and controlled |

| Ownership | Shared with investors, diluted equity | Founder retains full ownership and control |

| Risk Profile | Higher risk due to aggressive growth and funding dependency | Lower financial risk, but slower expansion |

| Exit Options | Acquisition, IPO, or merger focus | Long-term business operation, less focus on exit |

| Decision-Making | Investor influence and board oversight | Founder-driven, autonomous decisions |

| Profitability | Often reinvests profits for growth, may not be profitable initially | Focus on early profitability and cash flow |

Which is better?

Exit-ready startups prioritize scalable growth and attractive valuation for acquisition or IPO, often fueled by venture capital and rapid market expansion. Bootstrapped startups focus on sustainable growth through internal cash flow, maintaining control and minimizing external dependencies while emphasizing profitability and operational efficiency. Choosing between them depends on the founder's goals: rapid wealth creation and market disruption versus long-term independence and steady growth.

Connection

Exit-ready startups prioritize scalable business models and strong financial metrics to attract acquisitions or IPO opportunities, which bootstrapped startups often develop through disciplined cash flow management and organic growth. Both rely on sustainable revenue streams and market validation to increase valuation and appeal to investors or buyers. Mastering these elements enhances the startup's ability to execute a successful exit strategy while maintaining operational independence.

Key Terms

Funding Source

Bootstrapped startups rely primarily on personal savings, revenue, and minimal external funding, maintaining full ownership and control while emphasizing sustainability through organic growth. Exit-ready startups seek significant external investment from venture capital or private equity to accelerate scaling, often prioritizing rapid growth and market capture with an aim for a lucrative acquisition or IPO. Explore detailed strategies to optimize funding approaches for your startup's stage and goals.

Growth Strategy

Bootstrapped startups prioritize organic growth through reinvested earnings and lean operations, maintaining full control without external funding pressures. Exit-ready startups often pursue aggressive growth strategies fueled by venture capital, aiming for rapid scalability and market capture to attract potential buyers or prepare for IPOs. Discover detailed growth strategies tailored for each startup type to optimize your business trajectory.

Exit Plan

Bootstrapped startups prioritize organic growth and self-funding, minimizing external equity dilution while maintaining full control over business decisions; exit plans often emphasize sustainability or acquisition by strategic buyers familiar with the niche market. Exit-ready startups strategically position themselves for acquisitions or IPOs, implementing robust financial reporting, scalable operations, and market traction to attract venture capital and maximize valuation. Explore comprehensive strategies to align your startup's funding model with a tailored exit plan.

Source and External Links

Bootstrapping - Overview, Stages, and Advantages - Bootstrapping is building a business from scratch with minimal external capital, relying on internal financing like personal savings, credit cards, and loans to avoid sharing equity or large loans, often progressing through stages from initial savings to credit for expansion.

Bootstrapping: How to Bootstrap Your Startup - Carta - Bootstrapping is starting and growing a startup using personal resources without outside capital, allowing founders to maintain full control and focusing on customer validation and low-cost tools before seeking external funding.

The bootstrapping guide for startups - Stripe - Bootstrapping means using one's own resources to start and grow a business, emphasizing minimizing expenses, reinvesting profits, and achieving self-sustainability without relying on venture capital or loans.

dowidth.com

dowidth.com